Governments are wrecking the charts

Upcoming ETF approvals will unlock more than $9M

While altcoins gets rekted, Bananagun is secretly raking up $15M in volume daily

Who is profiting from memes and over 50 early project funds 🧵👇

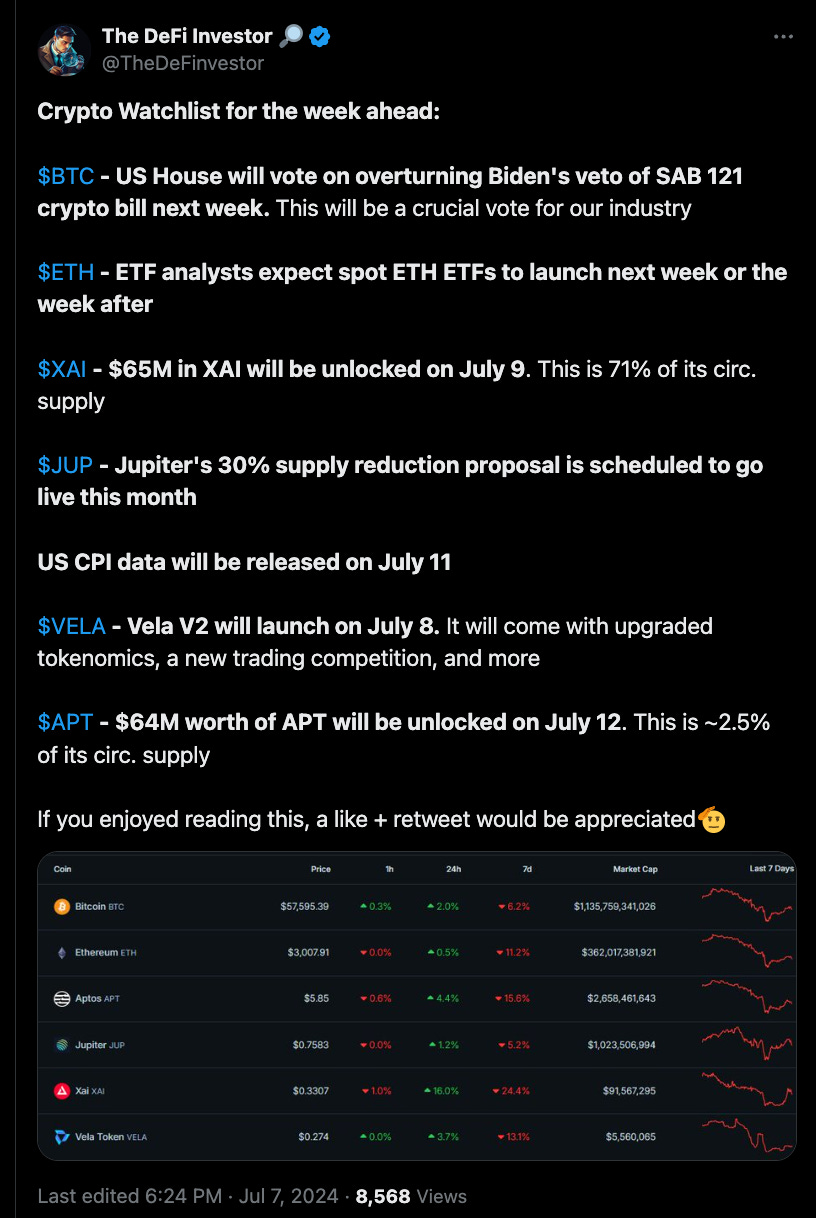

Weekly Updates

It’s been a challenging few months for crypto investors. While BTC remains relatively stable, many altcoins have seen drops of 60-70%. So, what’s causing this downturn?

Key Factors:

US & German Governments Selling BTC: Increased selling pressure.

Mt. Gox BTC Repayments: Billions of dollars in BTC distributed this month. Seasonal Trends: Historically, summer is a tough season for crypto.

Ethereum ETFs: Upcoming spot Ethereum ETFs will unlock $9 billion worth of ETH from Grayscale Ethereum Trust.

Halving Event: Historically, a sell-the-news event leading to sideways movement for months.

Despite these challenges, there are no significant short-term catalysts. However, this doesn’t mean the bull market is over. Looking ahead to Q4 2024, there are several bullish catalysts, including FED rate cuts, US presidential elections, and FTX cash repayments.

Looking Forward:

FED Rate Cuts: Potential positive impact on the market.

US Presidential Elections: Historically bullish for crypto.

FTX Repayments: $16 billion in cash distributed to former FTX users, many likely to reinvest in crypto.

While summer may remain choppy, an uptrend is expected by the end of the season or in autumn. Now might be a good time to accumulate high-conviction coins. Patience and conviction will be rewarded.

On-chain Alpha: Ethereum DeFi Leaders Reach New ATH in Revenue

DeFi leaders like Lido, MakerDAO, Uniswap, and AAVE are generating more revenue than ever, yet their market cap/revenue ratio is at a low. This may change post-US presidential elections, depending on regulatory changes.

Weekly alpha by @TheDeFinvestor

Narrative Overview

With altcoins experiencing a significant downturn on June 18, indicating possible altcoin capitulation. Since then, $BTC dropped from $65k to $58.5k on June 24, before bouncing back to $63.8k and settling around $60k. Despite bearish news, such as Mt. Gox creditors potentially receiving $9bn worth of $BTC, the German government selling seized $BTC, and weak ETF flows, $BTC has managed to stabilize.

Altcoin Performance and Outlook

June 18 marked the local bottom for OTHERS/BTC, which has since been on the rise. While $ETHBTC remains steady around 0.055, the $ETH ETF’s potential impact is yet to be fully realized. Among ETH-related coins, $ENS showed strength by breaking its $28 resistance, while $LDO suffered from regulatory challenges, dropping from $2.4 to $1.75. Other ETH-related coins like $PENDLE, $ETHFI, $DEGEN, $MAV, $AERO, and $XAI have also faced significant declines. Conversely, DeFi 1.0 coins such as $AAVE, $MKR, $LINK, $SNX, and $COMP have shown resilience, potentially benefiting from a pivot to fundamentals.

Solana and Emerging Trends

VanEck’s announcement of filing for a $SOL ETF sparked a brief rally, although its approval remains uncertain. $SOLBTC and SOLETH have both shown strength since June 24. Solana memecoins like $POPCAT are gaining traction, drawing parallels with $WIF and $PEPE. Meanwhile, $WIF experienced a capitulation but shows potential for a bullish rebound.

Notable Movements and Potential Opportunities

$ZRO, the token of LayerZero, saw a significant pump after its recent launch, indicating potential for further gains. Similarly, $ZK might follow $ZRO’s path. However, the launch of $BLAST token was disappointing, with its price dropping 33% from its ATH. The $BLAST airdrop also negatively impacted $BLUR, which is down 20% in a week.

Political Impact and Other Developments

The Trump-Biden debate led to significant declines in “PolitiFi memecoins,” with $BODEN down 96% from its top and $TRUMP down 40%. Despite this, $TRUMP might present a buying opportunity in the $4-$5 range. Other noteworthy coins include $KAS, which reached a new ATH, and $AVAX, showing strength possibly linked to $SOL’s ETF prospects. High FDV low float coins like $TIA, $SEI, $ENA, $PIXEL, and $ALT have struggled, while smaller memecoins like $BILLY, $RETARDIO, $MUMU, $SPX, and $JOE have performed well recently.

Other updates

Major Headlines

German Government Selling BTC: The German government has begun selling $BTC that was seized years ago, with over 43K BTC still in their possession, worth approximately $2.6bn at current prices.

VanEck Solana ETF Filing: VanEck has filed for the first Solana ETF, sparking interest in the crypto community despite regulatory uncertainties.

Coinbase vs. SEC and FDIC: Coinbase has filed a lawsuit against the SEC and FDIC over FOIA requests.

SEC Lawsuits: The SEC has filed lawsuits against Consensys, Lido, and RocketPool, claiming they are unregistered securities.

Sony’s Crypto Exchange: Sony is set to launch a crypto exchange in Japan after acquiring Amber.

Philippines Adopts USDT: Tether’s USDT is now being used for social security payments in the Philippines.

US Federal Judge’s Ruling on Binance: A federal judge in the U.S. has rejected main claims by the SEC against Binance.

Circle and MiCA Compliance: Circle has become the first stablecoin issuer to comply with MiCA regulations.

Project Updates

Optimism’s SuperFest: Optimism introduces SuperFest, a new community event.

Animoca Going Public: Animoca is looking to go public in 2025.

Fantom’s $S Airdrop: Details about Fantom’s $S airdrop have been revealed.

Vitalik Buterin’s MegaETH: Vitalik Buterin backs a new blockchain project, MegaETH.

Aptos x Alibaba Cloud: Aptos and Alibaba Cloud launch Alcove.

Igloo Inc’s Abstract Chain: Igloo Inc has acquired Frame and is building Abstract Chain.

Blast Governance: Blast introduces Blast Governance and Progress Council Proposal 1.

Zksync’s Elastic Chains: Zksync unveils Elastic Chains while Friendtech introduces FriendCard.

Marginfi’s mrgnswap: Marginfi plans to launch “mrgnswap.”

Chromia MVP Launch: Chromia is launching its MVP on July 16th.

On-Chain Sleuthing

A Polymarket whale has been making significant moves, focusing on political topics with substantial liquidity. This address has shown bullishness on Biden and short positions on Trump, with recent attempts to close some losing positions. Polymarket’s success this cycle highlights its product market fit and appeal to political speculators.

Memes & Tokens: Who is Profiting?

The market is experiencing constant dilution with new tokens, often launched by celebrities and political figures. This trend has created opportunities for a few lucky traders and sophisticated snipers. A standout project in this environment is BananaGun, a sniping and trading tool that consistently pulls over $15 million in volume daily, despite market conditions.

Early Projects

Powered by @arbusai