We are in the era from a shift from Meme to Utility plays.

Utility were the top 7 days weekly gainers.

Memes were the worse 7 days weekly loser.

Let’s dive into all of that this week 👇🧵

Weekly Updates

1. BlackRock Surpasses Grayscale in Crypto ETFs

Key Highlight: BlackRock now controls $21.217 billion in Bitcoin and Ether ETFs, surpassing Grayscale. This shift indicates growing institutional interest and confidence in digital assets.

What to Watch: Continued inflows into BlackRock’s ETFs could further strengthen institutional investment in the crypto space, potentially stabilizing markets amid volatility.

2. Tether Faces $3.3 Billion Lawsuit from Celsius

Key Highlight: Tether is entangled in a $3.3 billion lawsuit from Celsius over the mishandling of Bitcoin collateral. The outcome could have significant regulatory implications for stablecoin operations.

What to Watch: The case’s developments might influence the regulatory landscape for stablecoins and impact market confidence in Tether and similar products.

3. Coinbase Launches cbBTC

Key Highlight: Coinbase introduced cbBTC, a tokenized Bitcoin derivative designed to compete with WBTC. Backed 1:1 by Bitcoin, cbBTC aims to bring transparency to DeFi markets.

What to Watch: Market adoption of cbBTC versus WBTC could shift the dynamics within DeFi, especially regarding concerns over centralization and security.

4. MetaMask and Mastercard Launch Global Crypto Debit Card

Key Highlight: MetaMask, in collaboration with Mastercard, launched a crypto debit card allowing users to spend cryptocurrencies directly at merchants worldwide.

What to Watch: The card’s adoption could drive broader crypto usage in everyday transactions, bridging the gap between blockchain technology and traditional finance.

5. Arbitrum DAO Approves Liquid Staked ARB Token Proposal

Key Highlight: The Arbitrum DAO approved the creation of a liquid staked ARB token (stARB), enhancing governance and ARB token utility.

What to Watch: This initiative could further solidify Arbitrum’s dominance as the leading Layer 2 network and drive increased activity within its ecosystem.

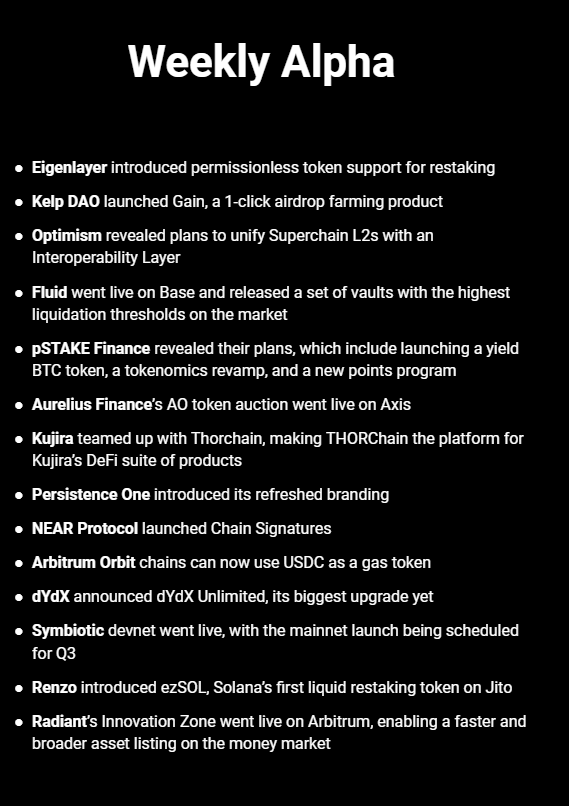

Weekly alpha by @TheDeFinvestor

Narrative Overview

The past week in crypto has been marked by mixed signals, with institutional confidence growing as Goldman Sachs and Morgan Stanley invested heavily in Bitcoin ETFs despite a price dip, signaling long-term optimism.

Meanwhile, memecoins continue to dominate the market, led by Pump.fun's profitability, though concerns about market saturation loom. DeFi shows signs of revival, with Aave reaching new highs in active borrowers, driven by Layer-2 adoption. The BTC ecosystem is buzzing with anticipation around the potential Rune layer, and TRON's milestone in stablecoin settlement underscores the rising impact of blockchain in global finance.

Institutional Adoption of Bitcoin ETFs

Despite a 12% drop in Bitcoin’s price, the significant investments made by Goldman Sachs and Morgan Stanley in U.S. spot Bitcoin ETFs signal growing institutional confidence in the crypto market.

This reflects a broader trend of increasing institutional involvement, which could stabilize and drive future growth in the market.

Pump.fun's Dominance and the Memecoin Cycle

Pump.fun became the most profitable crypto project, highlighting the enduring appeal and profitability of memecoins. The narrative here is that memecoins have become the defining feature of this market cycle, with Pump.fun's success underscoring the high interest and activity in this space. However, concerns about market saturation and value dilution are also noted.

Revival in the DeFi Sector

Aave’s achievement of a new all-time high in weekly active borrowers points to a resurgence in DeFi. The expansion of Layer-2 solutions like Base and Scroll has contributed to this growth, indicating that decentralized finance is regaining momentum after a period of decline.

BTC Ecosystem and Rune’s Potential Growth

The BTC ecosystem, particularly the potential for a new BTC layer for trading Runes, has sparked bullish sentiment among collectors. The narrative is that the Rune ecosystem could lead to a significant revival in interest and activity, potentially kicking off a new phase of growth for Bitcoin-related projects.

Stablecoin Growth and TRON's Milestone

The rapid growth of USDT on the TRON network, reaching a settlement volume comparable to one-third of Visa’s annual total, highlights the increasing influence of stablecoins in global finance. This narrative emphasizes the shift towards blockchain-based solutions in traditional finance and the potential of stablecoins to disrupt and reshape global transactions.

Other updates

Major Headlines

Grayscale Launches New Crypto Investment Trusts

Judge Approves $12.7B FTX-CFTC Settlement

Celsius Sues Tether for $2.4B

BitGo Announces WBTC Custody Move

SEC Sends Letters to a16z, Union Square Ventures, and Others

Project Updates

Ronin Network Exploited Funds Returned

y2k Rebrands to Fractality

Ethena Expands to Solana

Binance to List $TON

Canto Chain Halted Due to Consensus Issue

Cow Swap Launches CoW AMM on Balancer

Kanpai Panda Memecoin Drama

Kujira Partners with Thorchain

Hyperlane and deBridge Announce New Tools

MakerDAO Proposes WBTC Risk Mitigation

On-Chain Sleuthing Summary

A major $DMT whale, holding around 14k tokens, has been consistently buying the dips on Ethereum mainnet. This whale had previously sold some tokens after the Sanko Corp Layer 3 announcement but has resumed accumulating. $DMT presents a strong risk/reward opportunity on the EVM network.

Sanko Scape & Ecosystem Growth: The flagship game, Sanko Scape, is nearing release, and multiple builders are actively developing on Sanko's Layer 3. The upcoming integration of a Layer 0 bridge is expected to attract significant capital flow into Sanko's ecosystem.

Sanko NFT Collection: A new NFT collection on Sanko chain, created by C-l and other Miladys, is set to launch soon. Follow updates here.

BlockGraze Wallet Identified: The well-known $DMT advocate and Solana enthusiast, BlockGraze, has been tracked to a Solana wallet. You can monitor his activity here.