DeEdu is growing narrative first spearheaded by @cz_binance and now @balajis

With Babylon mainnet, we are seeing a hype into BTC restaking eco

Andre is now Sonic’s CTO

Tron’s meme is being led by the top $SUNDOG

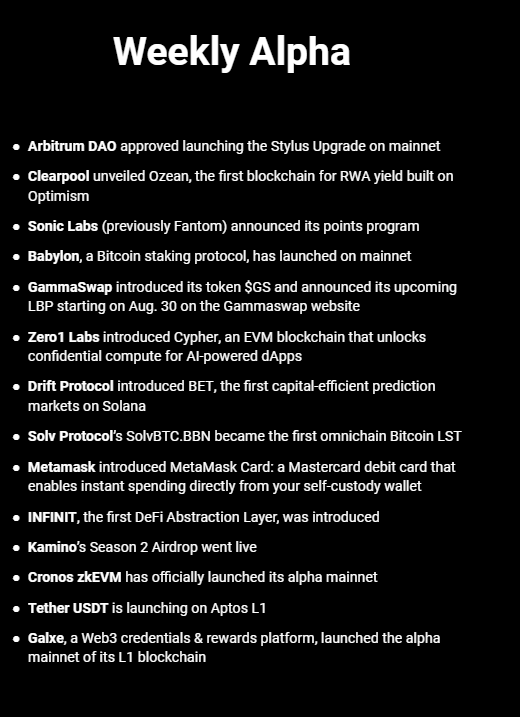

Here is all the alpha you need to know for the week 👇🧵

Weekly Updates

Babylon Goes Live on Mainnet

Despite Ethereum’s recent dip, many held ETH for high-yield farming opportunities. Today, Babylon, a Bitcoin Staking protocol, launched on mainnet, offering BTC holders a chance to stake and secure PoS blockchains for yield. With $70M raised and an active points program, Babylon echoes early Eigenlayer vibes. If successful, BTC Staking could drive demand for BTC, especially with upcoming airdrops and its rich ecosystem of DeFi applications like Solv Protocol, pSTAKE Finance, and Babypie.

Solv Protocol

Solv is establishing a decentralized Bitcoin Reserve and recently launched SolvBTC.BBN, a BTC liquid staking solution for Babylon. Supported by Blockchain Capital and Binance Labs, Solv currently holds $980M in TVL. SolvBTC.BBN can be minted and utilized across multiple chains including BNB Chain, Ethereum, Arbitrum, Mantle, Avalanche, and Merlin.

Airdrop opportunities are available by depositing FBTC or WBTC for SolvBTC, staking for SolvBTC.BBN, and leveraging it on platforms like Fuel or Mezo to farm up to three airdrops simultaneously: Babylon, Solv Protocol, and Fuel/Mezo.

Babypie

Babypie, a SubDAO from Magpie, focuses on providing liquid staking services for Bitcoin, built on Babylon. With $2.5M in TVL, Babypie’s points program is live, allocating 8% of its token supply to the first airdrop. Users can participate by registering their BTC and Ethereum addresses on the Babypie website, depositing BTC, and claiming mBTC on Ethereum. Early users also gain access to the protocol’s future token sale at a 20M FDV, providing additional incentives for engagement.

Fluid

Fluid, built by the Instadapp team, offers a standout borrowing experience in DeFi, combining features from top protocols like Uniswap, Aave, and MakerDAO. With high liquidation thresholds, low penalties, and the option to get paid to borrow, Fluid is reshaping DeFi lending. Its Refinancing feature allows seamless migration from other protocols, making it a must-try for those seeking the best rates, LTVs, and low liquidation risks.

On-chain Alpha

Since the FTX collapse, Bitcoin’s dominance in the crypto market has surged from 38% to 56%. Historically, an altseason only starts after BTC dominance declines. Given its current trajectory, the best part of this bull market might still be ahead.

Weekly updates by @TheDeFinvestor

Narrative Overview

1. The Evolution of Bitcoin Staking and DeFi Integration

The DeFi landscape is witnessing a significant evolution with the launch of Babylon’s Bitcoin Staking Protocol, enabling BTC holders to stake without losing custody. This new protocol mirrors the success of ETH restaking, allowing direct staking on any PoS system while maintaining full control.

Alongside Babylon, YieldNest has introduced its first Liquid Restaking Token (ynLSDe) to maximize rewards from staked $ETH, and pSTAKE Finance offers a growing BTC liquid staking solution built on Babylon. Moreover, Solv Protocol’s decentralized Bitcoin Reserve and liquid staking solution, SolvBTC.BBN, has been rolled out across multiple chains, driving new opportunities for BTC holders. This narrative of enhancing staking with self-custodial control and cross-chain integ–ration marks a critical shift in DeFi, setting the stage for BTC Staking as the next big trend.

2. Cross-Chain Expansion and Interoperability

As blockchain ecosystems mature, cross-chain functionality and interoperability have become key drivers of growth. The launch of $ME, a cross-chain token supporting dApps and NFT trading via MagicEden, exemplifies this trend.

Additionally, the DeFund cross-VM liquidity hub aims to address DeFi’s interoperability challenges by connecting ecosystems and reducing impermanent loss. Further expanding on this theme, Superbridge has introduced themed bridges for $ezETH and $USDC, ensuring fee-free transfers, while OKX Wallet integrates with Sonic SVM to enable seamless cross-chain interactions.

Together, these developments illustrate the increasing importance of interoperability in creating a more connected and efficient DeFi landscape.

3. Emerging Layer 1 and Layer 2 Solutions

New Layer 1 and Layer 2 solutions are gaining traction, with notable launches and updates from various projects. Gravity, a Layer 1 blockchain, has launched its Alpha Mainnet, focusing on enhancing cross-chain interactions and introducing features like onchain questing and smart savings.

Meanwhile, the Viction blockchain’s DA Network mainnet launch brings scalable and secure data management to its ecosystem. On the Layer 2 front, Aave V3’s integration with zkSync on Era Mainnet represents a significant step forward, especially with the introduction of Chainlink price feeds and zkSync ecosystem airdrops.

The narrative of emerging Layer 1 and Layer 2 solutions showcases the ongoing innovation aimed at addressing scalability, security, and cross-chain capabilities.

4. Advancements in DeFi Protocols and Applications

The DeFi space continues to innovate, with new protocols and updates enhancing user experience and expanding functionality. DeepBook’s V3 Testnet offers improved liquidity and trading fees, aiming to replicate CEX-like performance on decentralized platforms.

Diva Operator Testnet’s final version, now available on Holesky, introduces telemetry improvements and SDK integration, marking significant advancements in DeFi protocol infrastructure.

Additionally, YieldNest is expanding its liquid restaking solutions to Base, providing enhanced accessibility and security for users. These advancements highlight the ongoing refinement of DeFi protocols, ensuring they meet the growing demands of a more sophisticated user base.

5. Web3 Infrastructure and Ecosystem Growth

The Web3 ecosystem is rapidly evolving, with infrastructure projects playing a pivotal role in its expansion.

Viction’s DA Network mainnet launch marks a crucial milestone in scalable data management within its ecosystem. Similarly, the launch of Puffer UniFi, a Based Rollup, is set to unify the fragmented Ethereum Layer 2 experience, while DubdotSocial launches on Solana to create a fairer space for memecoin traders.

In a related development, Eden Network’s “So Extra” decentralized auction app, now live on the SUAVE Toliman testnet, enhances the capability of Ethereum blocks by allowing users to publish custom messages.

Collectively, these developments illustrate the growth and diversification of Web3 infrastructure, paving the way for a more inclusive and efficient ecosystem.

6. Updates and Strategic Moves in Blockchain and DeFi

Key players in blockchain and DeFi are making strategic moves to strengthen their ecosystems.

Astar Network’s transition to Soneium L2 aims to broaden ASTR token utility and enhance Web3 integration. Grayscale’s introduction of the Grayscale Avalanche Trust and Franklin Templeton’s expansion of FOBXX to Avalanche highlight the growing institutional interest in blockchain investments.

Additionally, Arbitrum’s vote on ARB staking could redefine its utility and governance, while Stargate DAO’s proposed changes to its staking system seek to enhance user engagement. These updates reflect the dynamic nature of the blockchain space as projects adapt and evolve to meet emerging challenges and opportunities.

7. Security Alerts and Project Issues

Security remains a critical concern, with several projects facing challenges.

Kresko is shutting down due to significant health issues faced by the founder, advising users to withdraw or migrate assets by September 10, 2024. Seif Wallet has issued a critical security alert following a breach that exposed private keys in certain versions, urging users to update and secure their assets immediately.

Additionally, AshPerp experienced an oracle error causing a $26,000 loss, and Parcl’s official website was compromised, draining tokens from Solana wallets. These incidents underscore the importance of security vigilance in the rapidly evolving crypto landscape.

8. Exciting Airdrop Opportunities and Reward Programs

The crypto space is buzzing with airdrop opportunities and reward programs.

Orderly Network has surpassed 1 million messages with LayerZero Labs, distributing $ZRO rewards through The Big O Campaign.

Bedrock’s Merlin Mega Campaign offers rewards for minting, swapping, and restaking $uniBTC, while Origami Finance provides early access to deposit stables and bond USD0 for rewards.

Stride’s stTIA airdrop is in its final days, and Hemi Network’s incentivized testnet offers rewards for user engagement.

Additionally, Sonic Labs, Grass, and Leap have launched various airdrop campaigns and reward programs, adding to the excitement for crypto enthusiasts seeking new opportunities.

9. Upcoming Developments and Launches to Watch

Gearbox is proposing a fundamental oracle for stETH and wstETH to ensure accurate asset valuation, while Rocket Pool’s RPIP-49 vote could improve growth and capital efficiency.

Starknet is gearing up for its first Mainnet vote on staking, and Clearpool’s Ozean, an Ethereum Layer 2 network for RWA yield protocols, is set to launch soon.

Babylon’s Phase-1 of Bitcoin staking mainnet is also just around the corner, alongside Polygon Labs’ MATIC to POL migration. These upcoming launches and proposals highlight the continuous innovation driving the crypto and DeFi ecosystems forward.

Other updates

Major Headlines

• July CPI Inflation: The inflation rate fell to 2.9%, slightly below expectations of 3.0%. Core CPI inflation aligned with forecasts at 3.2%.

• Binance Expands: Binance has officially registered in India, marking a significant move in its global expansion.

• Morgan Stanley’s BTC Holdings: The financial giant disclosed $187M in Bitcoin ETF holdings.

• Franklin Templeton Crypto ETF: Franklin Templeton has filed for a Crypto Index ETF, indicating increased institutional interest in digital assets.

• The Network School: Balajis introduces a new initiative, The Network School, focusing on decentralized education.

• SEC Denial: The SEC rejected Cboe’s 19b-4 filings for Solana ETFs, continuing its cautious stance on crypto ETFs.

Project Updates

• Metamask Debit Card: Metamask has launched a debit card, broadening its ecosystem’s financial utility.

• cbBTC Launch: Coinbase is preparing to launch cbBTC, further integrating Bitcoin into its offerings.

• New CTO at Sonic Labs: Andre Cronje, a prominent figure in DeFi, becomes Sonic Labs’ CTO.

• Swell & Renzo: Swell introduces swBTC, while Renzo launches ezSOL, expanding their DeFi product lines.

• Grass Beta: Grass ends its beta, announcing a snapshot and bonus epoch.

• Eigen Labs Drama: An internal issue at Eigen Labs involving employee wallets has surfaced.

• Aavegotchi’s New L3: Aavegotchi introduces its new L3 Geist, continuing to innovate in the NFT space.

• Gamma Swap Labs TGE: The Token Generation Event (TGE) for Gamma Swap Labs is scheduled for August 30th.

• Babylon’s Mainnet Launch: Babylon announces the first phase of its mainnet launch, marking a milestone in Bitcoin staking.

• Drift Protocol BET: Drift Protocol introduces BET, adding a new layer of functionality.

• ClearpoolFin’s L2 Chain: ClearpoolFin develops a Layer 2 chain powered by Caldera, enhancing its DeFi capabilities.

• Galxe Alpha Mainnet: Galxe launches the alpha mainnet of Gravity Chain, pushing the boundaries of Web3 infrastructure.

Interesting Projects

• Infinit Labs: A DeFi Abstraction Layer by Infinit Capital, aiming to streamline DeFi interaction.

• CrunchLabs: Data analytics solutions tailored for institutions, offering advanced insights.

• SunDog: The biggest meme project on Tron, gaining traction in the meme coin space.

• Puffer Unifi: A protocol from Puffer Finance focusing on enhancing DeFi operations.

• Fabric Crypto: Specializes in custom chips for advanced cryptography, pushing the limits of security.