🔥 Winning Narratives for 2024 🔥

Some top trends to watch would be Memes, AI, BRC-20, and RWA.

My strategy for the bull would be to double down on winners and stick to these narratives.

Narratives you can position yourself in November👇🧵

Weekly Updates

Election-Driven Momentum Ahead

Bitcoin is near all-time highs, but a quiet market signals anticipation. With the U.S. election days away, big moves could be on the horizon.

Despite Trump leading on Polymarket predictions, the election remains incredibly close. Candidates can no longer ignore a $200M industry and millions of holders. A pro-crypto win could be the spark for a breakout.

BTC After Election: Rally Ready

Trump’s stance is clear—crypto leadership, a BTC reserve, and new SEC leadership. Harris has hinted at support but remains noncommittal. Either way, post-election clarity has historically driven BTC rallies. Expect some turbulence, but patience should pay off.

Why This Setup Matters

ATH highs are in sight, but retail money hasn’t flooded in yet.

BTC supply on exchanges is shrinking fast.

Gold and the S&P 500 are pushing new heights.

Rate cuts are likely coming.

The stage is set. Short-term volatility is probable, but the outlook for gains is solid.

Winning Narratives for 2024

Top narratives? Memes, AI, BRC-20, and RWA.

Strategy going forward: double down on winners. Stick with these trends for an edge as the cycle heats up.

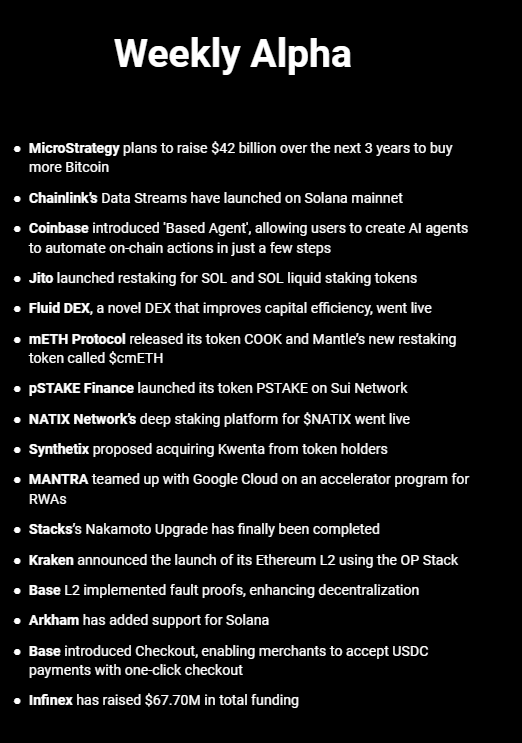

Weekly alpha by @TheDeFinvestor

Narrative Overview

The real strategy is to avoid the hype of newly launched memecoins.

The real alpha actually lies in the older memecoins that have survived the market’s turbulence.

Why Buying New Launches is a Trap for Most Traders

Murad recently took the stage at Token2049, sending $SPX (one of his top picks) skyrocketing. But the real insight from his thesis is about finding survivors.

When it comes to maximizing expected value (EV) on-chain, “old” memecoins with a history of volatility—ideally down at least -80% from their all-time highs—are where the gold is.

Let’s break it down the Goldmine strategy👇

The Problem with Chasing New Coins

Chasing new launches sounds lucrative, but it’s always rough in the trenches. Most traders focus on the latest coins, using tracking tools to snipe early gains. But the reality is that for every coin that goes 50x or 100x, there are hundreds that go to zero. Only the best traders with elite tools and relentless hours can consistently pull off EV-positive results here. For most, it’s a quick road to losses. If you don’t have the skills to compete with the on-chain elite, this approach likely won’t work.

A Better Play: Target Coins with “Dino” Potential

Instead of sniping new tokens, I focus on older memecoins that have withstood the test of time. Most new launches die out in hours or days. But when a coin has survived for months, enduring major drawdowns without collapsing, it shows strength. These coins may not offer instant 100x returns, but the strategy has significant upsides.

Your Secret Formula for Looking into a Memecoin

Launched a few months ago

Drawn down 80% or more from ATH

Flat or upward-trending chart (higher lows, not lower lows)

Active, loyal community—not just bots or hype

Unique meme and “cult” potential

High mindshare relative to market cap

Low market cap

Other updates

Runes Exploding

Runes activity is exploding, with trading volume up 3x and transaction numbers soaring 4x since August. Bitcoin’s on-chain fees have also risen 32%, largely driven by Runes—a sign of Bitcoin’s adaptability and resilience.

Magic Eden’s Role

Magic Eden is dominating Runes trading, capturing a solid 90% of user activity in the Bitcoin ecosystem. With Runes now adding true fungibility to Bitcoin, it’s no longer just digital gold—it’s a platform for memes and collectibles. High fees and slow speeds? A thing of the past, thanks to innovations from Runes and OP_CAT, which could trigger a “memecoin supercycle” on Bitcoin.

Top Movers

$DOG leads the pack, but rising stars like $PUPS, $GIZMO, and $BDC (especially with OP_CAT on the horizon) are shifting the spotlight toward cat-themed tokens.

Growth Potential

BTC memecoins sit at $2B—just 0.11% of Bitcoin’s $1.9T market cap. ETH memecoins hold $20B, while SOL’s stand at $12B. BTC’s memecoin market has ample room to grow, and early CEX listings could drive substantial gains for those who invest now.

Token Unlocks

It’s been a turbulent week for token unlocks:

$PORTAL: Classic crypto volatility with wild 10% swings 📈

$TIA: Plummeted 21% ahead of a significant unlock 📉

$OP and $SUI: Holding strong, nearing neutral ground 💪

Spotlight on $TIA

With a 92.3M TIA increase imminent, this unlock is one of the biggest events of the year. Open interest is close to record highs, and the market is cautiously preparing—this month’s approach feels much more calculated than September’s wild 30% rally.

Despite recent price dips, early $TIA investors are sitting on massive returns: Seed investors are up 526x, Series A at 50x, and Series B at 5x.

BlackRock’s Bitcoin ETF is Breaking All the Records

BlackRock’s Bitcoin ETF is making history with $30B AUM in under a year, marking it as the fastest-growing ETF to date. This isn’t a trickle of institutional interest—it’s a flood.

The Bigger Picture

Positive inflows continue, and March alone saw a peak inflow of over $1B daily. This level of interest suggests we’re at the forefront of a new wave of institutional adoption. Watch the daily inflows—they’re a clue that a large-scale adoption wave could be on the horizon.

BTC Price Action: Consolidation with a Bullish Bias

BTC is in consolidation, but the long-term trend looks bullish. We’re above the 50 EMA, circling previous all-time highs, and prepping for a possible breakout.

A breakout now could trigger the next big bullish run, or BTC could dip slightly, building up for a new wave of accumulation before surging upward.

A breakdown with distribution would be concerning, though that’s not yet in sight.