We’re now in the most obvious bullish setup for any market in leap years

Here’s the play:

Worldcoin’s rebrand, AI memecoin surge, and $DOGE as a Trump trade proxy

Murad’s picks are creating a reflexive loop: his bullish posts draw interest, which pumps prices, sparking even more buying.

$SPX exploded from $10M to $900M in October alone.

Murad’s influence is putting memecoins on the map as serious sentiment drivers in crypto.

Funds are creating memecoin ETF along with the largest stars aligning.👇🧵

Weekly Updates

Trump’s Win & Crypto’s Big Moment

The US presidential election results are in, and it’s official: Donald Trump has won! Beyond this, there’s a broader crypto narrative unfolding. With BTC edging back toward all-time highs, the atmosphere is charged, and things are heating up for crypto in Washington.

Crypto’s Most Pro-Crypto Congress Yet

In a groundbreaking shift, over 270 pro-crypto candidates have secured seats in Congress. This majority is poised to reshape crypto legislation, likely giving us the most favorable regulatory environment the industry has seen.

🔹 The SEC Shake-Up: Trump has pledged to fire SEC Chair Gary Gensler, who has been known for his hard stance on crypto. This move could remove a longstanding barrier to crypto’s growth in the US.

🔹 A US Bitcoin Reserve? If you tuned into the Bitcoin 2024 conference, you might remember Senator Cynthia Lummis unveiling a proposal to create a US Strategic Bitcoin Reserve, potentially acquiring up to 1 million BTC. With a pro-crypto Congress, this bold vision could become reality, triggering a domino effect where other countries follow suit.

Massive Stablecoin Inflows Signal Buying Pressure

On the day after the US election, Binance and Coinbase saw an impressive $9.3 billion in stablecoin inflows. This surge hints that a significant portion of this capital is preparing to flow into BTC and altcoins.

Oct In Review

Key Insights and Looking Ahead

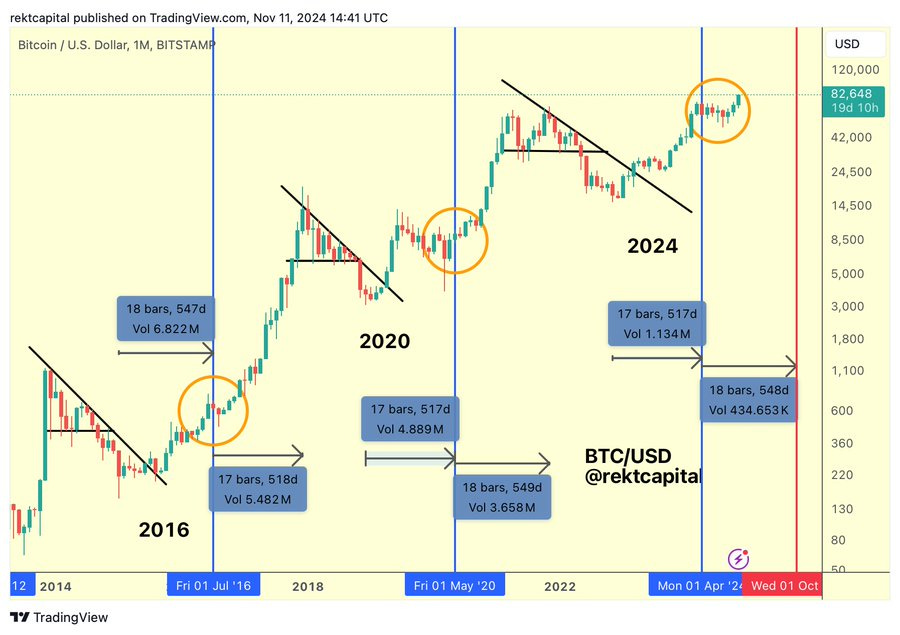

BTC's Continued Dominance: The ‘Uptober’ trend and Bitcoin’s climb suggest a sustained preference for BTC over altcoins as macro uncertainties and regulatory shifts unfold. With the US elections ahead, BTC’s status as a hedge asset could further solidify if pro-crypto policies gain momentum.

Layer 2 Value Re-Evaluation: With L2 tokens like $SCR and $EIGEN underperforming, investors are signaling doubts about L2s’ ability to capture meaningful value in the current landscape. This shift may prompt a focus on protocols with clear revenue models and user adoption, setting a higher bar for future Layer 2 projects.

Memecoin Market as Sentiment Driver: October demonstrated that memecoins, while speculative, serve as a powerful barometer for market sentiment. Murad’s influence over $SPX, $GIGA, and others shows how narratives can drive price action in smaller, community-driven tokens.

Emerging AI and Web3 Crossovers: The success of AI-driven tokens like $GOAT hints at future crossovers between AI and Web3.

Key Token Launches and Price Reactions

$EIGEN: Launching on October 1, $EIGEN has been one of the month’s most notable disappointments. The token has declined nearly 50% from its ATH, highlighting a stark dependency on $ETH performance. This serves as a cautionary tale for tokens strongly tied to ETH’s price action, especially in a market where ETHBTC trends are downward.

$SCR (Scroll’s Governance Token): Scroll, a zk-rollup Layer 2 on Ethereum, faced similar pressure. Since its October debut, $SCR has fallen from an FDV of $1.3B to $600M. This decline aligns with a larger trend: 2024 has seen significant re-evaluation of Layer 2 tokens, reflecting skepticism around their ability to capture sustainable value in current market conditions.

Other Launches and Rapid Cycles:

$PUFFER and $CARV spiked several times their initial value before retracing.

$DEEP gained sevenfold on launch before seeing a significant correction.

Worldcoin’s Strategic Rebrand

Worldcoin rebranded to "World" on October 17, aiming to expand its narrative with the World App 3.0 and World Chain launch. The rebrand and event led to a +50% surge in $WLD before selling off, exemplifying the short-lived pumps often associated with ecosystem expansion announcements. However, World’s evolution into a super app could serve as a test case for future Web3 applications integrating broader functionalities akin to traditional tech ecosystems.

Major October Market Trends

1. Bitcoin Dominance: Uptober Proves the Meme True

October saw Bitcoin’s dominance (BTC.D) rise as it reclaimed the spotlight with a +10% monthly gain, closing near $70k. This ‘Uptober’ effect, fueled by renewed optimism around a Trump presidency’s pro-crypto stance, underscored BTC’s role as the preferred hedge amid macro uncertainty. As BTC dominance climbs past 60%, it highlights an increasingly bifurcated market where capital flows favor BTC over altcoins.

2. Layer 2 Tokens Under Pressure

The repricing of L2 governance tokens like $SCR and $EIGEN reflects investor caution, potentially signaling doubts about Layer 2 value capture in the current economic environment. With ETH and ETH-adjacent tokens underperforming, market participants may be reassessing their expectations of Layer 2 solutions' ability to drive substantial returns, particularly as BTC and SOL gain traction.

3. Murad's Memecoin Cycle

The memecoin narrative took off in October, largely driven by fund manager Murad and his bullish outlook on specific tokens like $SPX, $GIGA, and $POPCAT. Murad’s thesis catalyzed a self-reinforcing cycle where interest in his picks increased their value, drawing further attention and participation.

4. The Rise of AI-Driven Memecoins

AI memecoins, led by $GOAT and driven by personalities like AI developer Andy Ayrey, have created a unique fusion of AI and crypto culture. $GOAT surged from $100k to $900M MC within a week, buoyed by social media and interest in ‘AI-generated tokens.’

DOGE and the Trump Trade

The DOGE narrative gained renewed momentum in October as Elon Musk’s ‘D.O.G.E. Department of Government Efficacy’ meme boosted interest in $DOGE, leading to a +41% gain for the token. DOGE became a speculative proxy for the Trump trade, driven by Musk’s influence and its cultural connection to the former president. This surge reflects the growing influence of social narratives on certain tokens and reinforces the potential for DOGE to act as a sentiment gauge for broader socio-political themes.

Geopolitical Events and Market Sentiment

The Israel-Iran conflict added volatility to the markets, triggering sell-offs on October 1 and 25. These events highlight how geopolitical tension can impact risk assets like crypto, with BTC often emerging as a hedge during uncertainty. This effect may intensify in a pro-crypto political climate where BTC is increasingly viewed as a store of value in volatile times.

Twitter: