Now we are ATH $93K, 60% chance of $100K by year-end, ETF inflows + Trump win fuel the bull run.

Memecoins surging like $DOGE, $PNUT, $PEPE.

Dino coins and base coins rallying.

BlackRock $IBIT ETF smashes records: $40B in 211 days.

We are in the early innings of a bull 👇🧵

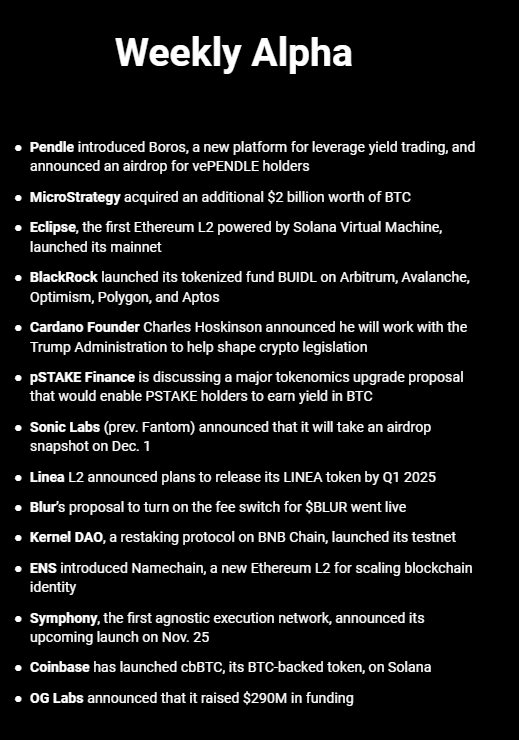

Weekly Updates

DeFi Comeback and the Latest Market Trends

The latest market pump almost feels surreal. Bitcoin is hitting new highs almost daily—a sight we haven’t seen in a very long time. It feels great to finally be back.

One particularly exciting trend to watch is the resurgence of DeFi. Recently, DeFi hit a new annual high in mindshare on Crypto Twitter, marking a strong return to relevance.

I’ll dive into five DeFi projects that I’ve been closely following over the past few months.

1. Pendle

Pendle is already a household name for DeFi degens as the largest yield trading protocol. It allows users to:

• Long the yield of specific opportunities.

• Earn a fixed yield on assets.

A recent boost in Pendle’s Total Value Locked (TVL) came from the introduction of its points trading pools, enabling speculation on airdrop points.

Pendle’s next big catalyst is Boros (Pendle V3), which will introduce leveraged yield trading. This innovation enables trading funding rates from perpetual exchanges, a feature delta-neutral projects rely on for high returns. With a bull market’s hunger for yield, Boros could be a game-changer—though its mainnet launch date remains under wraps.

2. Instadapp (Fluid)

As an OG DeFi aggregator, Instadapp has evolved into a capital-efficiency pioneer with its new protocol, Fluid.

Fluid operates as a lending and borrowing platform but introduces several innovations:

• Low liquidation penalties: as low as 0.1%.

• High liquidation thresholds: up to 97%.

• Debt as liquidity: Borrowers can use their debt to earn a yield.

• Dual earning for liquidity providers: Trading and lending fees.

Fluid’s DEX launched recently and quickly climbed into the top 5 DEXs, solidifying its reputation as a leader in capital efficiency.

3. Mantle

Primarily known for its Ethereum L2 solution, Mantle boasts one of the largest treasuries in crypto. The team has launched several successful products:

• mETH: An ETH liquid staking token with $1.5B+ TVL.

• cmETH: A composable liquid restaking token enabling yield and airdrop farming.

• FBTC: An omnichain BTC asset with $600M+ TVL.

Mantle’s adaptability to market trends is its key strength. cmETH, its latest product, surpassed $250M TVL in just weeks, proving the demand for versatile, high-yield assets.

4. Resolv Labs

Resolv introduced USR, a delta-neutral stablecoin that minimizes risks with its dual-token model:

• USR: The stablecoin itself.

• RLP: The risk-layer token.

This separation ensures USR remains stable, while RLP absorbs risks in exchange for higher yields. As delta-neutral strategies grow in popularity, Resolv’s innovative design positions it well to attract both risk-takers and conservative users.

5. Thorchain

Thorchain facilitates native cross-chain swaps, gaining momentum from integrations with major platforms like Ledger Live and Trust Wallet.

Its upcoming App Layer promises to take things further, with high-quality DeFi apps joining the ecosystem. Notably, Kujira, a popular Cosmos project, is building on Thorchain to expand its offerings.

Airdrop Opportunity: INFINIT’s Rewards Program

For stablecoin holders, INFINIT, the first DeFi Abstraction Layer, offers a triple airdrop farming opportunity via INIT Capital on Mantle.

Here’s how to participate:

1. Sign up on INFINIT’s rewards page.

2. Buy USDe stablecoin on Ethena.

3. Bridge USDe to Mantle L2 using Stargate.

4. Deposit and borrow via INIT Capital’s Neutral USDe Looping Hook.

Earn 1x INFINIT points per USDe lent and 2x points per USDT borrowed. With INFINIT’s projected FDV, points could equate to a 50-100% APR on stablecoins. Plus, you qualify for additional airdrops from INIT and Ethena.

On-Chain Alpha: BlackRock’s BTC ETF Dominance

BlackRock’s spot BTC ETF has surpassed its Gold ETF in size—a chart more bullish for Bitcoin than ever before.

Despite years of public skepticism from institutions, the success of spot BTC ETFs is undeniable. As retail investors turn their attention back to crypto, we’re likely to see substantial inflows in the coming months.

Weekly alpha by @TheDeFinvestor

Narrative Overview

$BTC and the Bull Market Revival

Election night kicked off with $BTC at $70K, surging to a new ATH of $93K within days. Key highlights:

• BTC closely followed Trump’s odds on Polymarket.

• Post-election ETF inflows have been massive.

• BTC dominance hit 60%, briefly giving way to ETH and alts before rebounding.

Opinion: We’re entering the early stages of a bull run, reminiscent of December 2020. Polymarket suggests a 60% chance BTC hits $100K by year-end.

Memecoins Lead the Post-Trump Pump

Memecoins exploded, with $DOGE leading the charge:

• $DOGE: +30% pre-election, +30% on election night, then nearly 2x in 2 days. Consolidating after Musk announced the D.O.G.E. (Department of Government Efficiency).

• $PEPE: Listed on Coinbase and Robinhood, pumped +50% in a day.

• $PNUT: Mentioned by Elon, skyrocketed to a $2.4B market cap before retracing.

• $ACT: Binance-listed AI memecoin pumped 2x to $900M, flipping $GOAT temporarily.

• $BONK: Up 80% in a week, boosted by on-chain sentiment.

Key narrative: Memecoins are thriving as retail piles in, led by DOGE and new listings.

Dino Coins Resurface

Retail-driven tokens saw massive rallies:

• $XRP: +70%, fueled by SEC-Gensler backlash post-Trump win.

• $ADA: +2x amid rumors of Charles Hoskinson advising Trump.

• $HBAR: +50% on retail momentum.

• $CRO: 3x pump, driven by exchange loyalty.

Even $LTC joined the party, gaining attention from a viral (and unhinged) intern running its Twitter.

Solana and AI Coins Make Moves

Solana mid-caps shined briefly:

• $FWOG: Reached a new ATH at $700M, maintaining strong upward momentum.

• $LUCE: 10x in 2 weeks to $300M.

AI coins rallied ahead of Nvidia’s earnings:

• $GRASS: Pumped from $0.7 to $4 in 10 days, fueled by AI narrative.

• $AI16Z and $FARTCOIN: Both reached $280M.

Base Season Incoming?

The Base chain narrative is heating up:

• $DEGEN: +220%, listed on Binance Futures, spearheading Base season.

• Other Base memecoins: $VIRTUALS (+70%), $BRETT (+85%), $DOGINME (+6x).

Expect Coinbase to amplify Base coins, potentially listing small caps for explosive growth.

Shiny New Coins and CEX Action

• $GRASS: AI coin surged on CEX hype.

• $SUI: Quietly reached an ATH of $3.5 despite minimal buzz.

Meanwhile, most ETH-related VC coins underperformed, with $EIGEN, $TIA, and $SCR falling despite the broader market pump.

The Big Picture

The post-Trump election bull run is gathering steam, with BTC leading the charge and altcoins positioning for dominance. Memecoins and dino coins are thriving in this retail-driven rally, while AI narratives and Base chain season add fuel to the fire.

👉 Next big catalyst: Nvidia earnings on November 20, likely boosting AI tokens further.

Other updates

Price Action: BTC Hits New ATHs

$BTC has smashed through its sideways consolidation, reaching new ATHs above $93K. The market sentiment is extremely bullish, making this an opportune time to hunt for bullish trades on lower timeframes.

On higher timeframes (1h, 4h), caution is warranted. After such a violent push, we’re likely to see some liquidation of lows before the next move higher. This is a bullish market, but patience is key.

Key points:

• HTF Bullish Market: Validated re-accumulation.

• Technical Trends: Trading above the 50 EMA.

• Expectations: Re-accumulation before continuation higher.

🔍 Market Watch: Sectors in Focus

Memes Dominate

Memecoins stole the spotlight, with $PNUT hitting a $2.5B market cap in just two weeks. The hype hasn’t waned, as experimental sectors like AI, Memes, and Infrastructure outpace traditional Layer 1s and DeFi.

Binance Listings Bounce Back

Binance’s listing momentum is rebounding:

• $ACT and $PNUT saw 1200%+ returns post-listing.

• This recovery could flip the bearish narrative around Binance’s listing strategy.

ETF Milestone

BlackRock’s $IBIT ETF hit $40B AUM in just 211 days, breaking records and outperforming every ETF launched in the last decade. The fund added $10B in two weeks, cementing its dominance.

Key News: Major Headlines

• Fed Cuts Rates by 25bps: Easing financial conditions in October.

• FTX vs CryptoCom: FTX sues for $1.8B.

• Tether Milestone: Funds first Middle Eastern crude oil transaction.

• Trump Administration: Elon Musk & Vivek Ramaswamy to lead the Department of Government Efficiency.

• Bitcoin Reserve Bill: Senator Lummis expects passage within Trump’s first 100 days.

• $PEPE Listings: Coinbase and Robinhood boost memecoin momentum.

With $BTC breaking past $90K and BlackRock’s ETF redefining TradFi norms, the market feels like it’s gearing up for something massive.