Some of My Cross-Theme Takes

Buybacks ≠ fundamentalsa as network buybacks can be reflexive. In a downcycle, they drain runway and increase fragility unless paired with non-cyclical revenues (e.g., FX settlement).

XP/points work until sybil costs fall again. Without verifiable uniqueness (not necessarily KYC), ROI on points programs will compress.

Agent UX will commoditize. The delta won’t be “we automated zaps,” it’ll be risk governance & best-execution guarantees, think ISO-style standards for DeFi agents.

A single “aligned” stable dominating a chain creates governance capture and systemic risk. Expect multi-issuer baskets or circuit breakers.

FX on-chain is a distribution problem. The moat will be banking partnerships and compliance rails for corporate treasuries, less about matching engines, more about onboarding rails and dispute resolution.

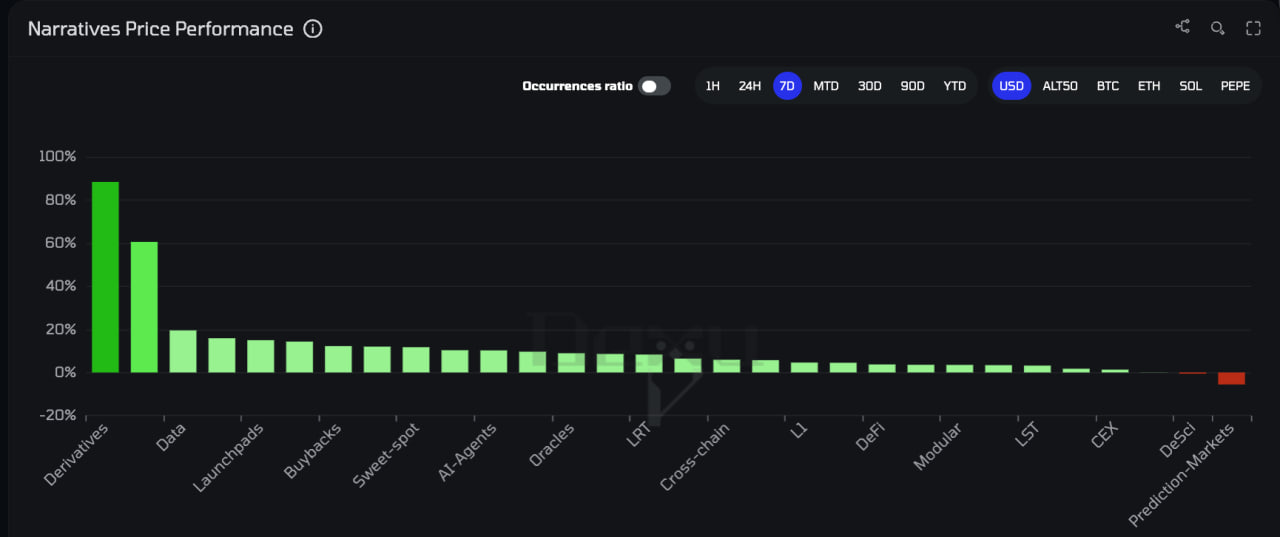

1. Narratives Are the Real Currency

Everyone’s obsessing over whether BTC is topping. Wrong question.

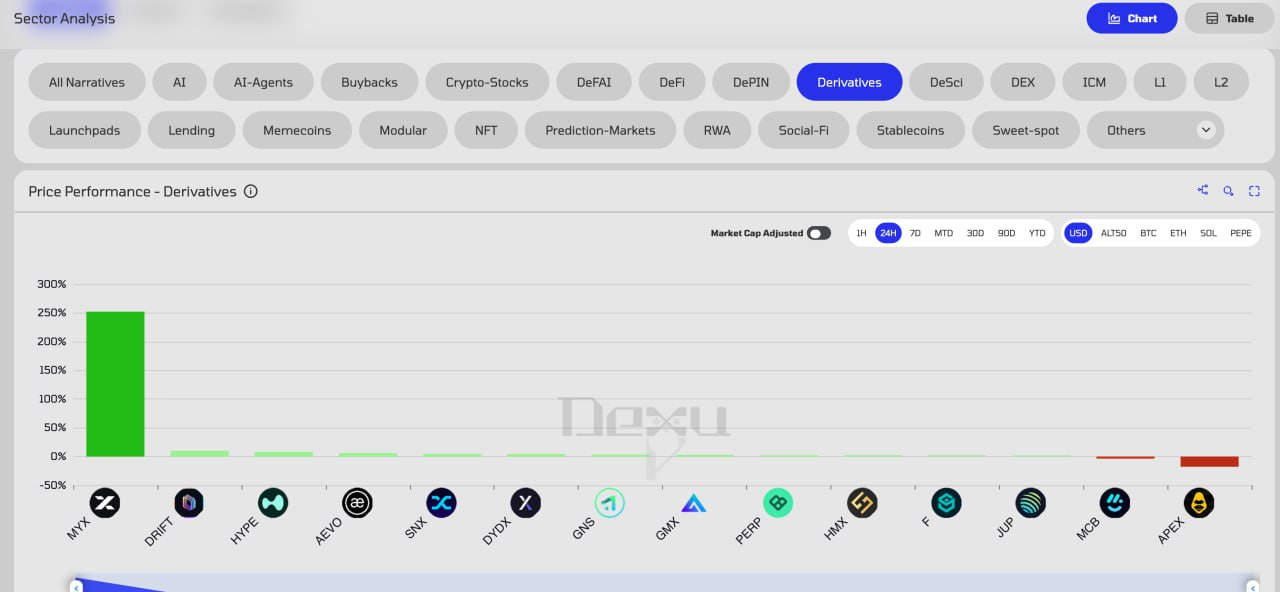

The real story is narrative breadth. When MYX does +1500% in a week and the Derivatives sector does +112%.

It’s proof that capital now flows at the narrative layer rather than coin-by-coin.

That’s a shift: narratives are the new risk rails. Ignore that and you’ll keep missing the next $MYX.

2. The Dead Internet Is Here, where Proof of Humanity Will Be the Next Primitive

AI has already eaten the internet and as pointed out by @schizoxbt.

Most of what you read online isn’t human, and soon, most of what you interact with won’t be either.

That makes humanity itself the scarce resource. Proof-of-humanity will be the single most important primitive for the next cycle.

Verified humans get higher DeFi yields (Self + Aave).

Verified humans can’t be sybil’d out of incentives.

Verified humans can insure wallets, prove credit, and transact.

Every protocol that ignores this will drown in bot liquidity and AI noise. Every protocol that integrates it gets the trust.

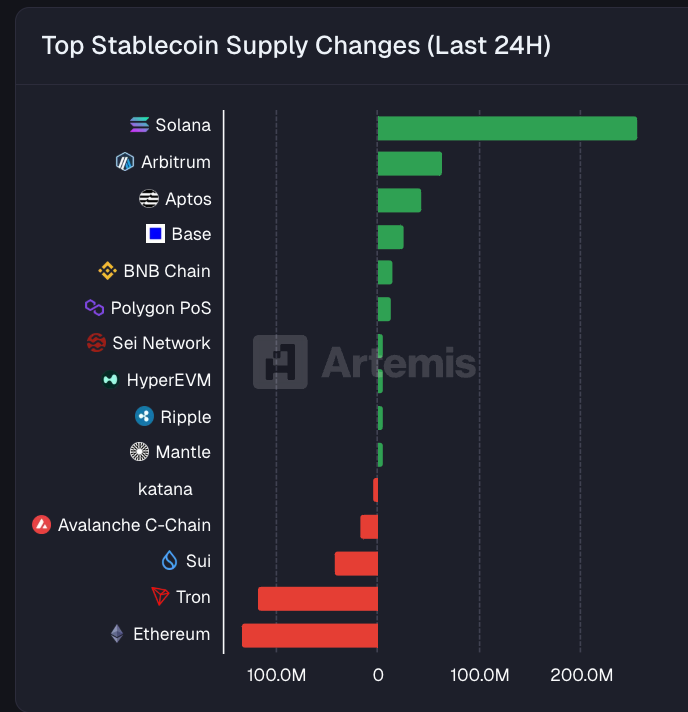

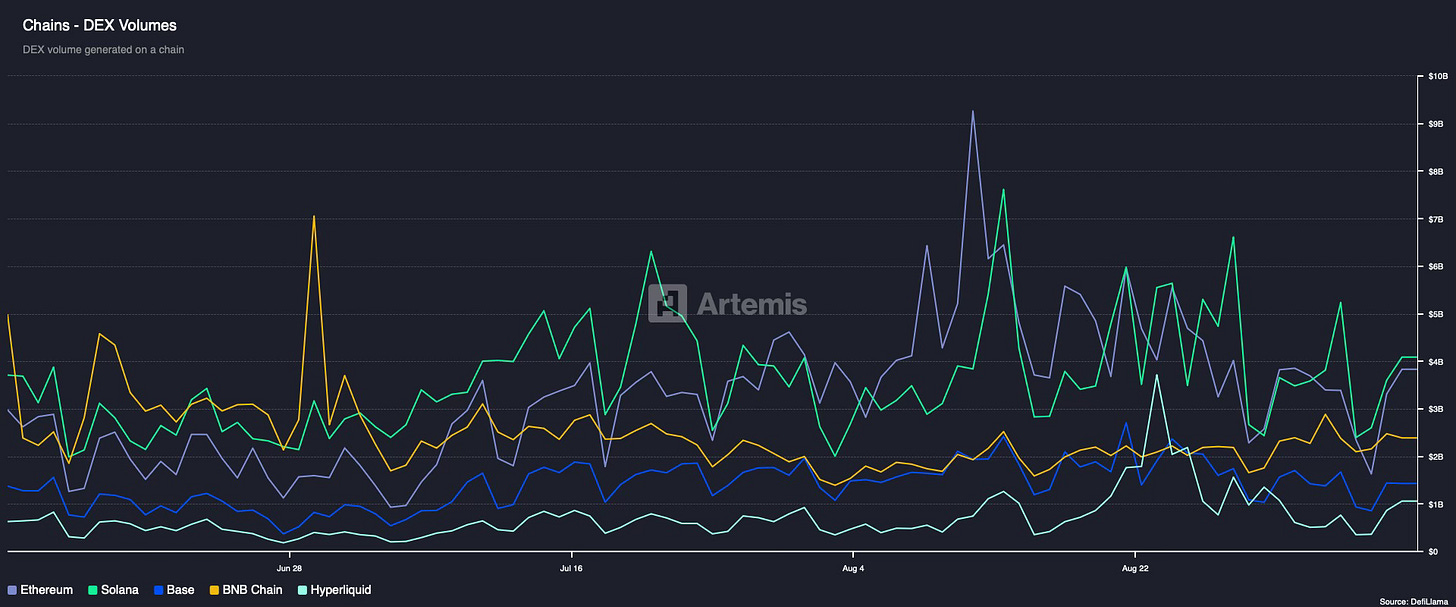

3. Flows Don’t Lie: Solana as Next Phase

Forget the cycle-top doomers. The data is clear:

Solana inflows are accelerating after a negative summer.

Base is capturing attention with VIRTUAL and AVNT, incubated by Coinbase + Pantera.

ETH remains dominant, but liquidity is fragmenting into RWAs, derivatives, and perps.

DEX volumes are bouncing hard across majors.

Rotation at work. The next wave of winners are the protocols that can absorb this fragmented liquidity and route it efficiently.

4. The Age of DeFAI Agents

We automated money with DeFi. Now we’ll automate participation with DeFAI. Agents will bid, stake, govern, farm, and arbitrage on our behalf. The intersection of verifiable humans and programmable agents will define the next rails of crypto. Humans supply trust. Agents supply liquidity. Together, they create a system resilient to both bots and clankers.

The Bet

It’s the start of a bull cycle with:

Narratives as capital flows.

Humanity as a scarce resource.

Agents as the new middleware.

The builders who recognize this will own the next cycle. The rest will still be arguing about whether BTC is up 1% or down 3%.

1) Hyperliquid’s “Sovereign Capital Markets Stack”

HL is evolving from a high-performance exchange into a full-stack capital markets OS—L1 + order book + native stablecoin + staking + buyback flywheel + FX rails—wrapped in institutional wrappers (ETP/ETF talk), and governed by market primitives (decision markets).

If USDH + buyback alignment lands and FX actually clears on-chain, HL can capture both speculative flow (perps) and real-economy flow (FX/stablecoin settlement). That’s a moat via flow gravity and fee recycling.

Updates:

@vaneck_us exploring a Hyperliquid spot staking ETF

a wave of USDH proposals (@Paxos, @SkyEcosystem, @ethena_labs, @Frax, @withAUSD)

beHYPE LST

decision markets (Butter) to forecast proposal outcomes

Hyperwave’s House of Payments (on-chain FX rails).

2) Stablecoin Wars 2.0: From “Who Mints?” to “Who Shares Economics?”

The battle has shifted from collateral model to economic alignment. Chains want stablecoins that pay the network, via fees, buybacks, and validator distributions.

Aligned stables can subsidize ecosystem growth and underwrite security; misaligned ones become pure rent extractors.

Updatees:

free ramps, exchange listings lined up

USDai caps filled in minutes

@term_labs and other yield markets pushing risk-adjusted stable yields.

Tensions/Risks:

“Yield on dollars” introduces path-dependency on TradFi liquidity & redemption gates.

Rehypothecation risk across L2s/L3s and bridges; regulatory reclassification.

3) Distribution Is Getting Professional: Points → Loyalty Systems

Points are maturing from mercenary airdrop bait into behaviour-shaping loyalty systems with clear funnels (checkers, seasons, boosts, sybil friction).

Properly designed, they compress CAC and improve LTV by rewarding multi-asset, multi-venue behavior—not just TVL vanity metrics.

Updates:

Aster checker live;

$LINEA TGE & ecosystem-first tokenomics @LineaBuild

@ResolvLabs S3 with asset clusters;

@onrefinance points tied to on-chain usage;

@Hyperwavefi Wave Points;

@Almanak__ multipliers;

@hylo_so XP.

4) Agentized Yield & Unified Risk: “One-Click Basis Trades”

The interface layer is becoming agentic: intent, hedged/levered portfolio, under a single risk budget. This collapses retail complexity and institutionalizes DeFi flows.

If agents can provably manage basis, IL, and funding while minimizing tail risk, you unlock the next cohort of capital (family offices, fund treasuries).

Updates:

@0dotxyz unified margin on Morpho;

@gizatechxyz Pendle agent (portfolio construction, rebalancing, maturity mgmt.);

DeFi Saver Trending Zaps;

@superformxyz v2 smart accounts;

@GammaSwapLabs gBTC (hedged IL); Kamino multiply backtesting;

@sommfinance cross-venue stETH vaults.

5) RWAs as the New Base Rate Rail

Tokenized MMFs/T-bill rails are standardizing the DeFi base rate. Everything else (loops, options, perps) stacks on top.

This anchors risk premia and enables composable term structure (via Pendle PT/YT) for sophisticated treasury mgmt.

Update:

@aave adds USYC collateral

@Theo_Network thBILL

Term Labs’ blue-chip lending

@USD_AI_ demand

@pendle_fi maturities across USDe/ETH/BTC.

6) Chain-Level Tokenomics: Ve-Systems as Coordination Engines

Ve-mechanics are moving from app-level to network-level, governing emissions, liquidity routing, and fee burns across an ecosystem.

When done right, this makes liquidity a programmable public good and deters mercenary rotations.

Update:

@katana vKAT (chain-wide ve)

avKAT liquid wrapper

$WLFI fee burn votes

Sky’s sizable buybacks