Unlocking Bitcoin: Solv Protocol Over $1.2B TVL Takes the Lead as Babylon’s Go-To LST

In less than 5 blocks, Babylon cap fills with 1,000 $BTC

Solv Protocol paid for over 12 $BTC in gas fees, with more than $1.2B in TVL, and 400K users. Backed by Binance and Jump.

This why you should get involved in earning Solv Points and airdrops across 3 protocols 🧵👇

Key Takeaways

Solv Protocol: Pioneering a Bitcoin Reserve for Everyone, where Bitcoin holders can earn yields on top of their Bitcoin holdings

Funding: Raised $16 million from investors like Binance Labs, Blockchain Capital, and Laser Digital.

Earning Points: Users can earn Solv Points by holding and staking SolvBTC.

Potential Airdrop: TGE soon (Q4)…but Solv Points could potentially be linked to future airdrops…

Thoughts on BTC Eco

I've been mulling over the idea of moving some of my ETH to BTC, and I wanted to share my thoughts. Throughout last year, despite BTC's downtrend, holding ETH made sense for many of us due to:

Yield opportunities

Airdrop farming on L2s

Protocols like Eigenlayer

Switching some ETH to BTC could be a smart play right now, given the potential for yield farming and airdrops with upcoming BTC L2 developments. It's a relatively low-risk move that could pay off big if we see even one successful ecosystem emerge.

The BTC Opportunity

Now, with Babylon live, we might see similar opportunities emerge for BTC. Yes, we've had disappointing outcomes with most BTC L2s so far, both in terms of on-chain activity and ecosystem development. But remember, it only takes 1-2 successful ecosystems to get everyone excited about L2s or new L1s again (think Arbitrum/OP ecosystem in 2023).

Why Consider the Switch?

Switching some ETH to BTC seems like a low-downside trade when you factor in potential yield farming and airdrops, especially for retail investors like us.

My thoughts on BTC L2 Development

New BTC L2s should focus on incentivizing on-chain activity, not just "deposit BTC and get points."

Study successful points programs: Most offer 1.5-3x boosts to promote LP or lending, diluting "basic" depositors.

Potential for WBTC to BTC L2 bridge to earn arbitrage and fees.

Don't rule out the potential for a meme BTC bridge like $MUBI to have another run.

All that said, very certain that Babylon is coming live, so I am very bullish on Solv Protocol and get you in before the masses.

Babylon cap fills near instantly when it just gone live: https://x.com/SolvProtocol/status/1826649496467767689

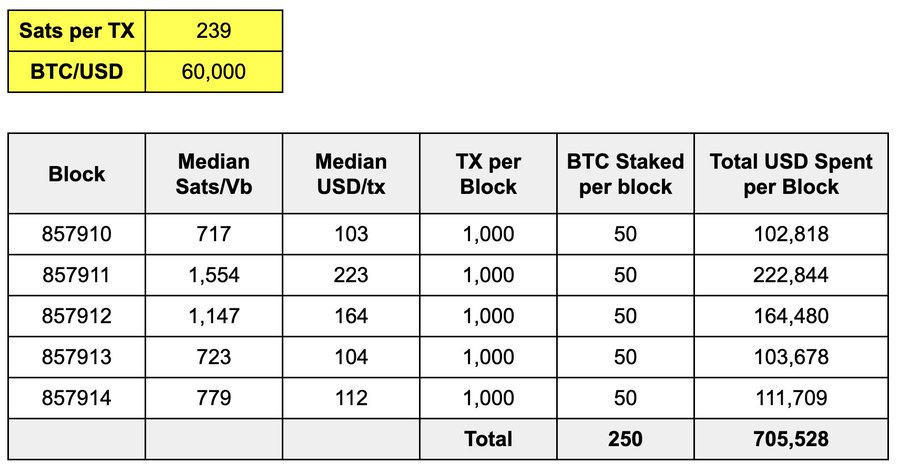

Babylon staking hit 1,000 BTC cap in 5 blocks, showcasing immense demand.

Stakers paid $3.2M in fees, and securing a stake of 250 BTC costs around $700K in fees and Solv paid for all those fees!

Here is a deep dive 👇

What Is Solv Protocol?

Solv is pioneering a Bitcoin Reserve with SolvBTC, unlocking over $1T in Bitcoin assets through a transparent Proof-of-Reserve and seamless liquidity integration.

This creates a gateway to BTCFi and paves the way for traditional funds to enter the crypto world confidently. Their flagship offering is Liquid Staking Bitcoin on the Babylon platform, SolvBTC.

It’s currently the leading LST on Babylon with over 2,800+ BTC staked to SolvBTC.BBN, and more than 30,000 users.

Solv Protocol enhances yield and liquidity by establishing a Bitcoin Reserve For Everyone, addressing the challenge of idle BTC across blockchain networks. The platform operates on three core pillars:

Liquidity Consensus Network (LCN): Manages cross-chain liquidity with dynamic, transparent, and auditable operations, integrating diverse liquidity sources and supporting seamless Bitcoin transfers across networks.

SolvBTC

SolvBTC is a liquid token backed 1:1 by Bitcoin.

SolvBTC can also be converted into liquid staking tokens like SolvBTC.BBN and SolvBTC.ENA, with deployment across multiple networks including Bitcoin mainnet, Ethereum, and BNB chain.

First Multi-Chain Bitcoin LST: SolvBTC.BBN

One of the most groundbreaking aspects of SolvBTC.BBN is its status as the first truly multi-chain Bitcoin LST.

Unlike its competitors, SolvBTC.BBN can be minted across multiple chains, including BNB Chain, Ethereum, Arbitrum, Mantle, Avalanche, and Merlin. This cross-chain capability allows users to leverage SolvBTC.BBN across various DeFi ecosystems, enhancing liquidity and enabling seamless integration into a wide range of DeFi applications.

This multi-chain approach not only provides flexibility but also establishes SolvBTC.BBN as a robust and versatile asset, further setting it apart from other Bitcoin LSTs and this this allowed Solv to scale with more partnerships.

What’s more exciting is that through Solv, users get exposure to more farming opporunities on Fuel and Mezo network, which are 2 huge protocols with potential airdrops.👇

Strategic Partnerships Ahead of Babylon’s Mainnet Launch

In preparation for Babylon’s mainnet launch, SolvBTC.BBN has secured multiple tier-1 partnerships that are crucial for its continued growth and adoption.

The integrations with Fuel Network and Mezo Network are particularly noteworthy, as they align with Solv’s vision of creating a Bitcoin-centric financial ecosystem.

Fuel Network: Known for its Rollup OS for Ethereum, Fuel Network’s integration with SolvBTC.BBN is a testament to the strategic alignment between the two platforms.

With Fuel Network’s focus on modularity and parallelization, SolvBTC.BBN users can look forward to participating in Fuel’s pre-deposit program to farm Fuel Points, positioning themselves for Fuel’s mainnet launch.

The $80M raised by Fuel during a period of Bitcoin’s low valuation underscores the confidence and backing Fuel.

Check out their points program here

Mezo Network: Mezo Network, which focuses on building Bitcoin’s Economic Layer, shares Solv’s commitment to a more Bitcoin-centric world.

Mezo’s integration of tBTC, a decentralized BTC bridge, complements SolvBTC.BBN’s vision of a comprehensive Bitcoin Reserve.

With Mezo’s $28.5M raise and their Q4 mainnet launch on the horizon, Solv Protocol users can expect increased opportunities for yield generation and DeFi participation

The partnership with Mezo opens the door to BitcoinFi applications, Bitcoin-native financial infrastructure, and real-world asset tokenization, further expanding the utility and reach of SolvBTC.BBN.

Solv Points and AIRDROPS!

You might just want to BOOKMARK and save this. Here I will share with you on the steps.

Users can now earn Solv Points by holding and interacting with SolvBTC. Although there is no official confirmation of a token launch, early participation in the Solv Points system positions users for potential future rewards as interest in cross-chain Bitcoin deployment grows.

Steps to Earn Solv Points

Connect Your Wallet:

Visit Solv Points Page and connect your wallet (e.g., MetaMask, Rabby).

Ensure you have BTC assets like WBTC on Arbitrum and enough ETH for gas fees.

Acquire SolvBTC:

Go to the “SolvBTC” section, select your network, input the amount, approve, and confirm the transaction.

Receive SolvBTC in your wallet.

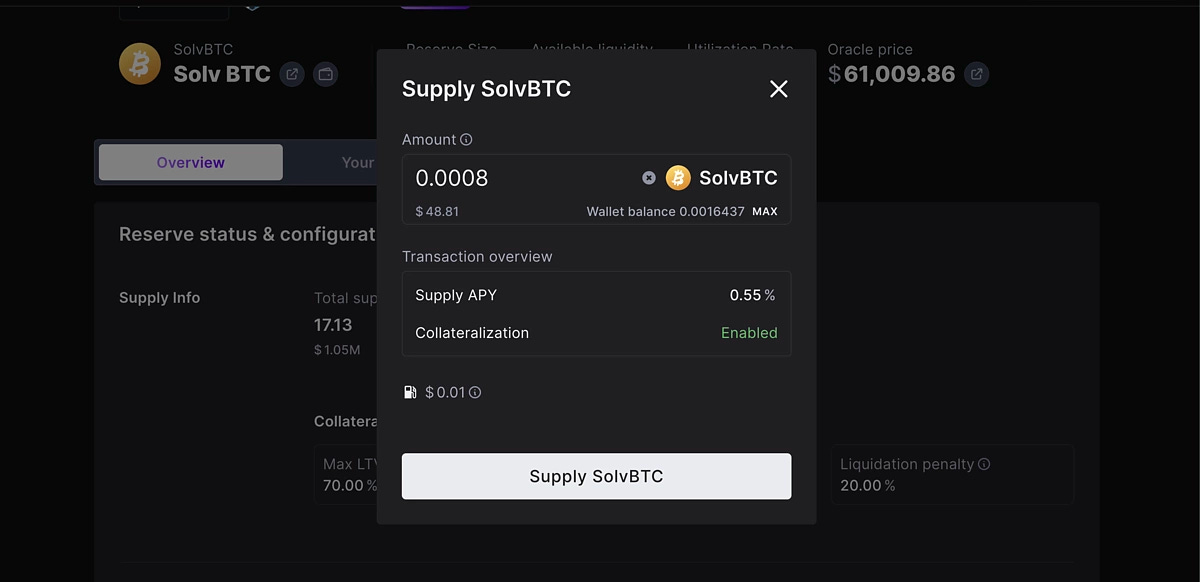

Stake SolvBTC (Optional):

Navigate to “SolvBTC.ENA” and complete KYC to stake your SolvBTC for additional rewards.

This step is optional; points can still be earned by holding SolvBTC.

Provide Liquidity

All of Solv ecosystem is put in one place for users to have easy access to the rich and diverse ecosystem of SolvBTC. This motivation is driven by the need for liqudity as it is the oxygen for defi.

Visit “Liquidity,” select a DeFi protocol, input the amount, and confirm the transaction to earn points.

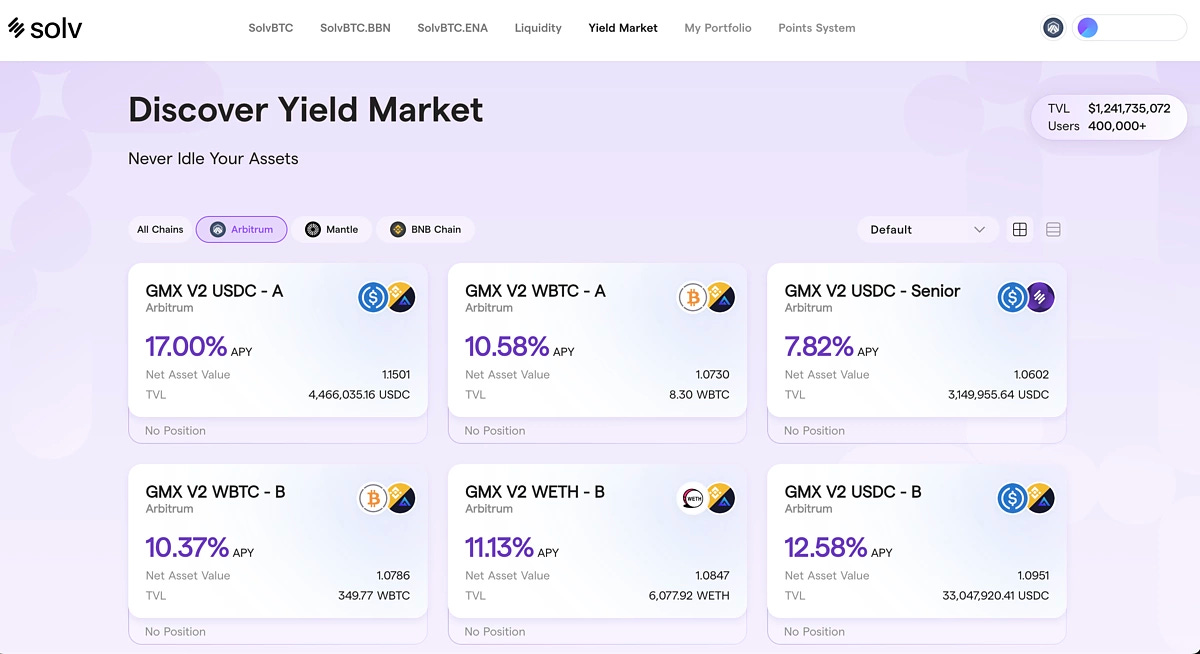

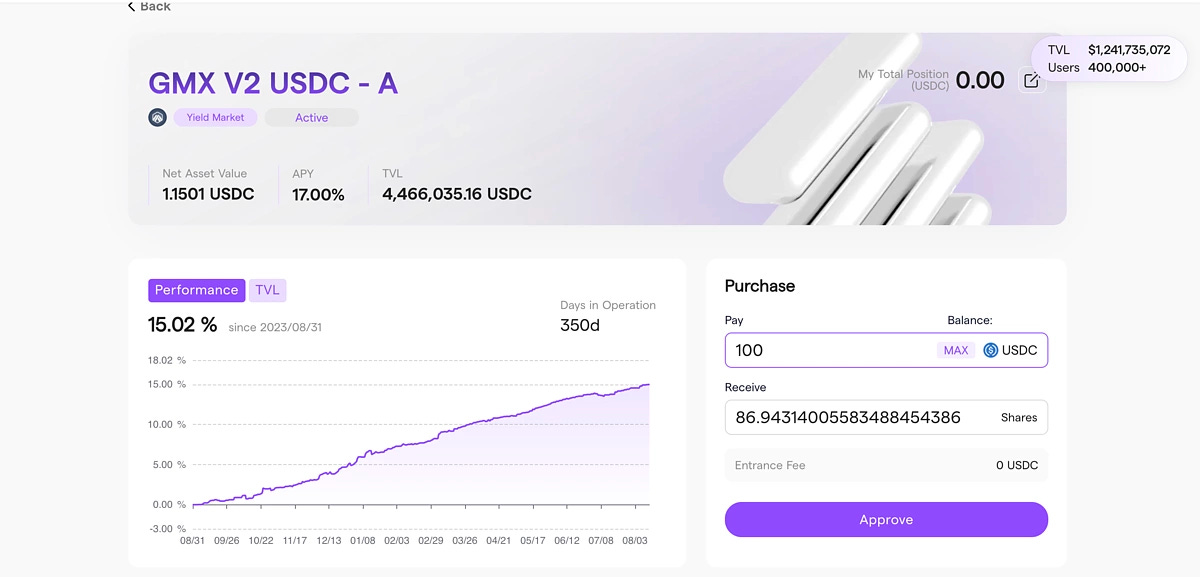

Explore Yield Market:

Check the “Yield Market” for farming opportunities.

Select an option, approve, and confirm the transaction.