Unmasking the Crypto VC Scam: How Insiders Exploit Retail Investors and Undermine Innovation

A case study: Starknet

We are facing a systemic issue that's stifling true innovation and retail participation.

The current VC model is not just unfair; it's undermining the long-term viability of the crypto ecosystem.

An example is @Starknet

Why launching tokens is broken and how crypto VCs are manipulating the market👇

I see a core problem: All upside is taken by insiders & VCs before retail investors can even participate. This creates a cycle where the average investor becomes exit liquidity for well-connected players.

The process typically unfolds like this:

a) VCs pump billions into unproven projects

b) Projects list on exchanges at inflated valuations

c) Market makers maintain artificially high market caps

d) Retail investors buy in, providing exit liquidity

e) Price collapses

Let's look at a case study: Starknet, an Ethereum L2 solution.

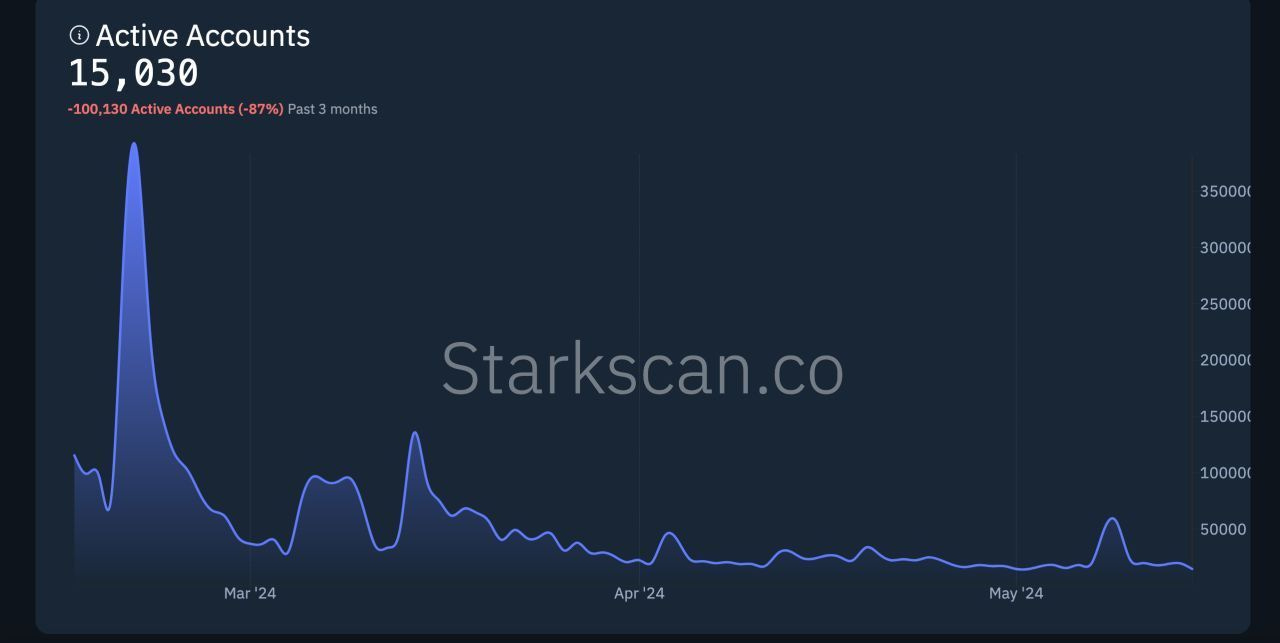

Despite minimal adoption (15,000 active accounts, hundreds of weekly users), it achieved an $8B valuation in 2022.

$STRK market cap at launch: $2.8B.

Current market cap: $800M.

This dramatic decline exemplifies the larger issue plaguing the crypto industry.

This pattern repeats across numerous projects, creating a market where:

- VCs and insiders capture most gains

- Retail investors face significant downside risk

- True price discovery is inhibited

The consequences are widespread causing:

- No genuine "altcoin season"

- Lack of retail participation

- Distorted market dynamics

But why hasn't this changed?

Market makers often have call-option SLAs (Service Level Agreements) that incentivize maintaining artificially high market caps, even when fundamentals don't justify the valuation.

This creates a facade of success and growth, masking the underlying issues and lack of genuine adoption or utility in many projects.

The crypto industry, once touted as a democratizing force in finance, is increasingly resembling traditional markets with their information asymmetries and insider advantages.

This trend is unsustainable.

As more retail investors become aware of these dynamics, they're likely to become more cautious, potentially leading to a liquidity crisis for overvalued projects.

For the crypto market to mature and fulfill its potential, we'll need:

- More transparent tokenomics

- Fairer distribution models

- Stronger focus on real-world utility and adoption

Investors should prioritize due diligence, focusing on:

- Token distribution

- Vesting schedules

- Actual user adoption metrics

- Real-world use cases

Without change, we risk losing the innovative potential that initially drew so many to this space.

Lastly, I like to end off with this where the developer report is featured. Even with the growth of developers, there is still a lack of real users on Starknet.

https://x.com/barretodavid/status/1814434295085212128

Deep down I still admire the tech by Starknet.