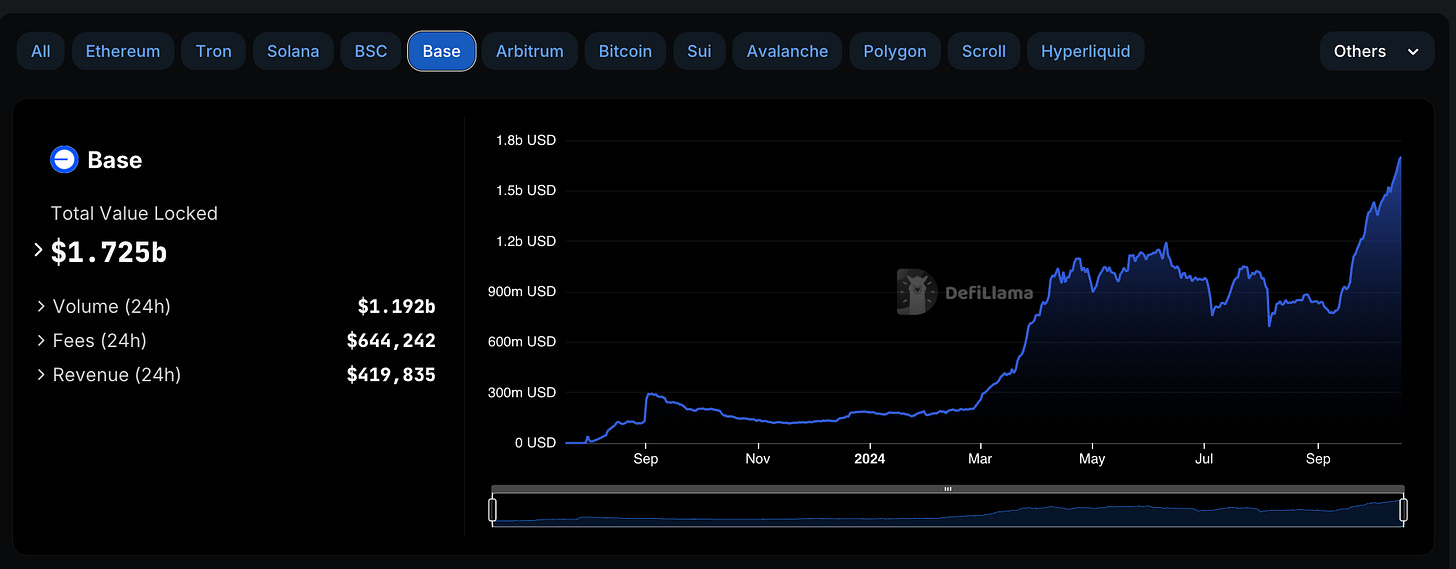

In less than 10 months, Base has catapulted from a modest $440 million in total value locked (TVL) to a staggering $2.5 billion. That’s a 5x explosion, and it’s just the beginning.

In just the last month and a half, Base added a cool billion dollars in DeFi deposits.

Top 10 applications on Base

With over $5.7 billion in weekly trading volume, Base is the fastest-growing L2 in the space, flipping giants like Arbitrum on its way up (Base in blue)

If you’re not paying attention to Base, you’re already behind.

On the DEX front, Base is dominating. Last week alone, DEXs on Base saw $5.7 billion in trading volume, eclipsing previous records and leaving competitors in the dust. Just six weeks prior, the weekly volume was a mere $1.5 billion. We're witnessing an exponential curve here, folks, and it's pointing straight to the moon.

Layer 2s Landscape

Base has now leapfrogged Arbitrum to become the largest Ethereum Layer 2 in terms of TVL.

It's also one of the top three chains in 24-hour trading volume, rubbing shoulders with giants like Solana and Ethereum itself. Base stands strong at $1.2B, second only to Arbitrum's $960M.

Base has the largest active address on chain.

Opportunity Knocks: Yield Farming and Airdrops

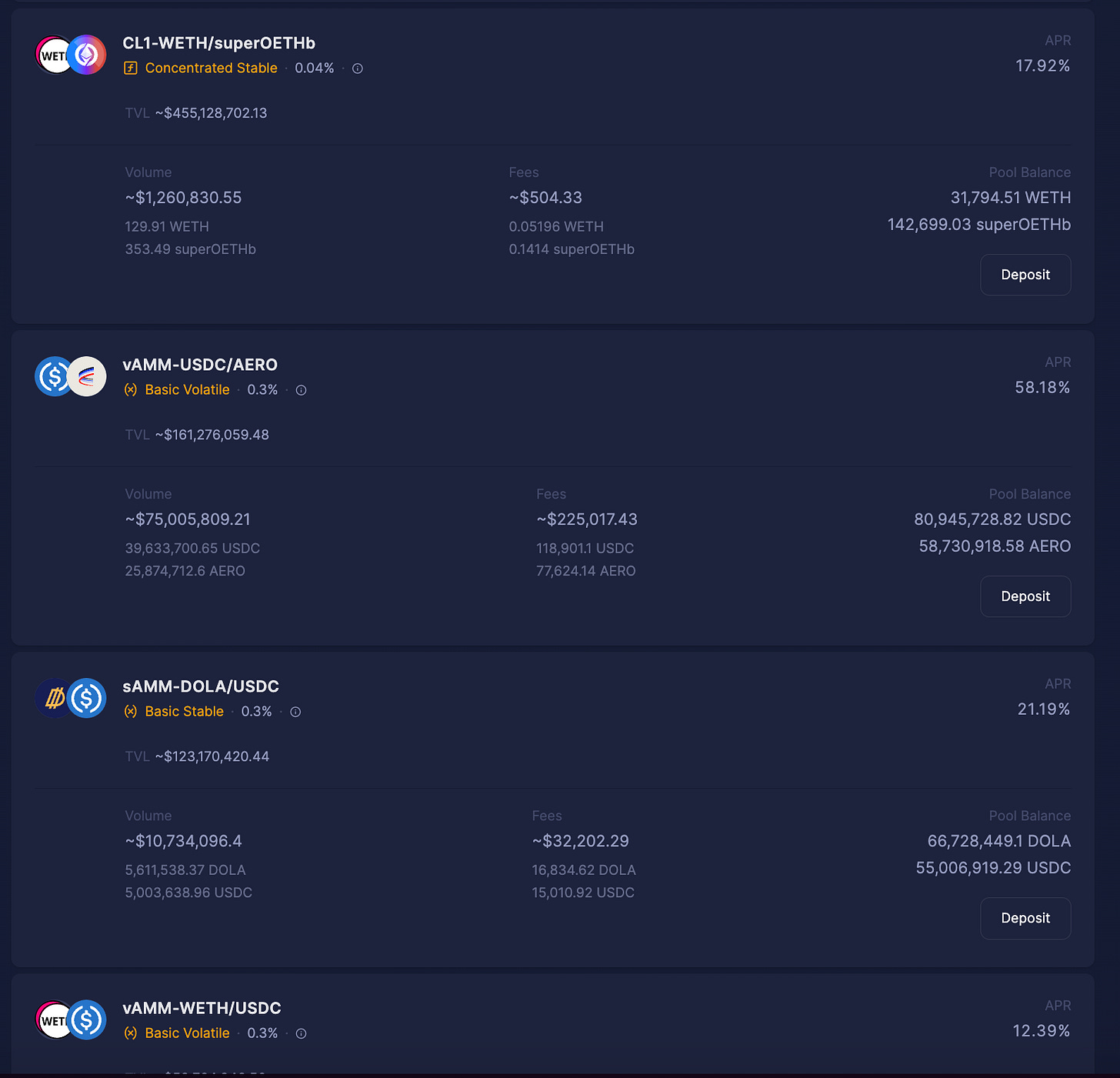

With this kind of growth, opportunities for yield farming would be plenty. The core of this activity is @AerodromeFi—the liquidity marketplace that's become the beating heart of Base's DeFi ecosystem.

Aerodrome offers substantial yields on blue-chip assets.

Think 59% APR on AERO/USDC pairs or 22% on DOLA/USDC stablecoin pairs. Even ETH/USDC pools are offering over 12% APR. And let's not forget the concentrated liquidity pools (CLPs), which, can offer even higher returns.

Platforms like @beefyfinance and @Velvet_Capital are adding layers of optimization, allowing you to maximize returns with managed risk. Beefy's yield aggregators, for instance, take the headache out of managing CLPs, while Velvet Capital lets you diversify through vaults containing collections of high-yield assets.

Universal Assets: Breaking all other Chains

One of the most exciting developments is the introduction of Universal Assets on Base. For the first time, you can access non-EVM tokens like Solana (uSOL), Sui (uSUI), Dogecoin (uDOGE), and Near Protocol (uNEAR) directly on Base. This is a game-changer. It allows for unprecedented interoperability and liquidity.

The Airdrop Gold Rush

Let's talk about airdrops. Protocols like @AnzenFinance and @SynFuturesDefi are offering points programs that could translate into lucrative airdrops down the line.

Anzen’s USDZ stablecoin is backed by real-world assets like private credit, offering higher interest rates for those willing to take on a bit more risk.

SynFutures, the largest perpetual trading platform on Base, is another hotspot. Their Odyssey program rewards you with points for trading, which could very well convert into tokens in the near future.

Final Thoughts

Base will be leading the DeFi revolution. The convergence of high yields, innovative protocols, and lucrative airdrop opportunities makes Base the place to be for any serious DeFi enthusiast.

In the bull, fortune favors the bold.