Forget Complexity

An SDK that allows anyone to create their own yields

Discover what this protocol have been building for over 2 years 🧵👇

In this thread, I will cover the following topics:

About

Differentiation

Tokenomics

Conclusion

If you enjoyed the read, please RESTACK, LIKE and COMMENT on what you like to hear next. It will be super helpful!

🔷 About 🔷

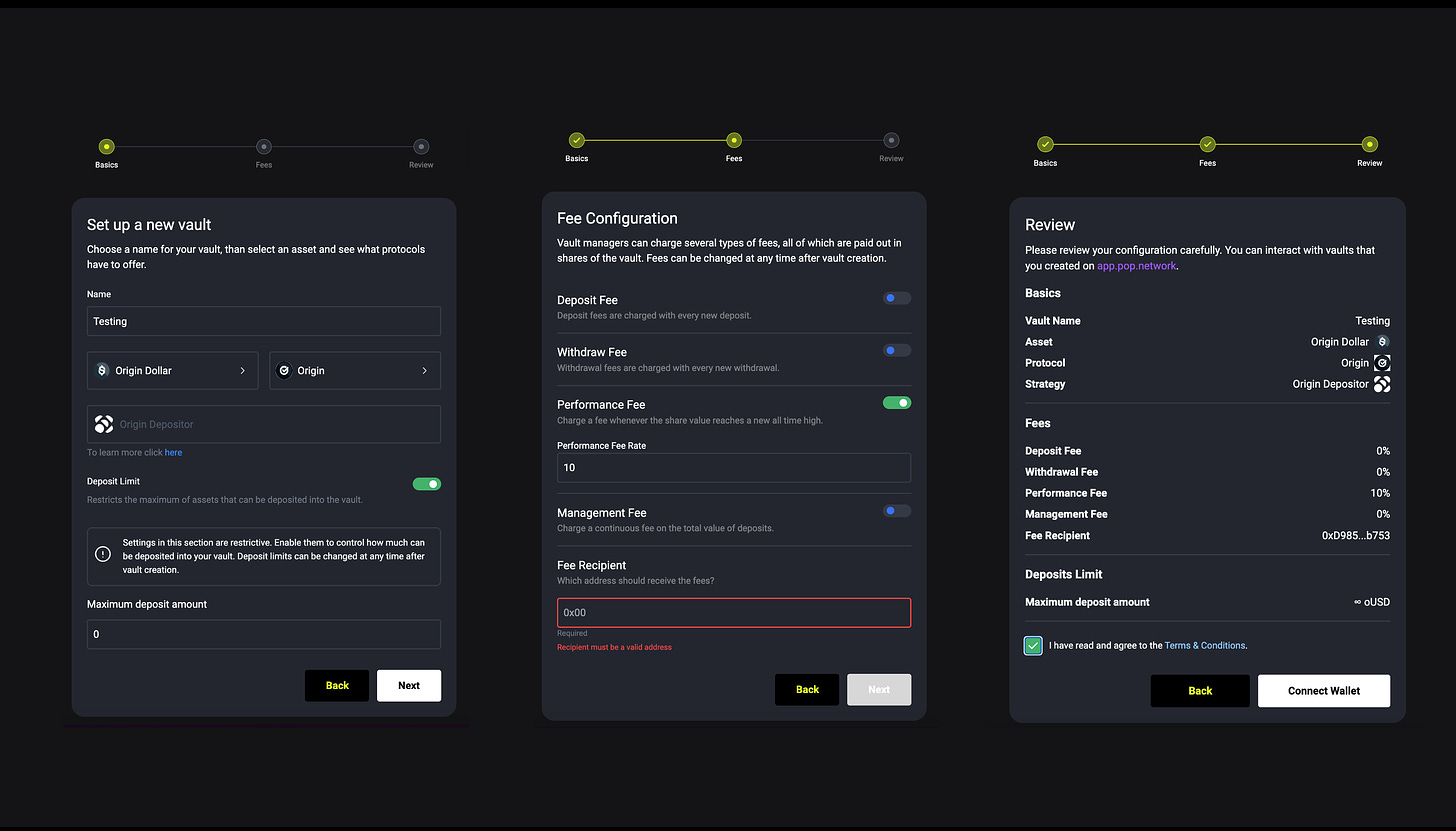

@VaultCraft_io allows anyone to build their own DeFi strategy across any chains in just 2 clicks

Choose asset and protocol

Set the vault fees and enter your wallet

Their mechanism behind this is through yield optimization across chains via thier smart vaults:

It allows users to zap and deposit from any chain, boost yield with VCX token, customize strategies, and integrate the SDK

VaultCraft makes it simple for users to deposit crypto, optimize yield for any asset on any EVM chain, and customize yield strategies

🔷 Differentiation 🔷

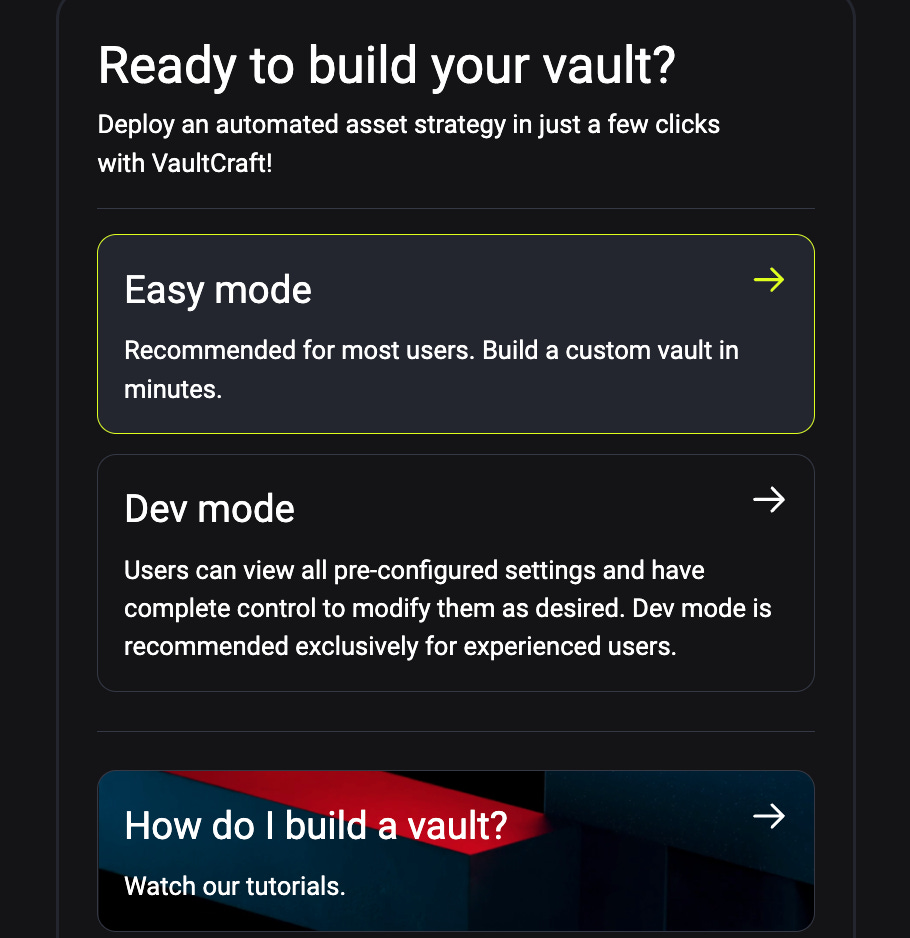

They allow any kind of users to build vaults with 2 modes:

Easy mode

Dev mode

Build your own Vault

Easy mode: Select an asset, protocol, Configure deposit limits (min, max)

Dev mode: Is pretty much similar to easy mode and very easy to set it up too

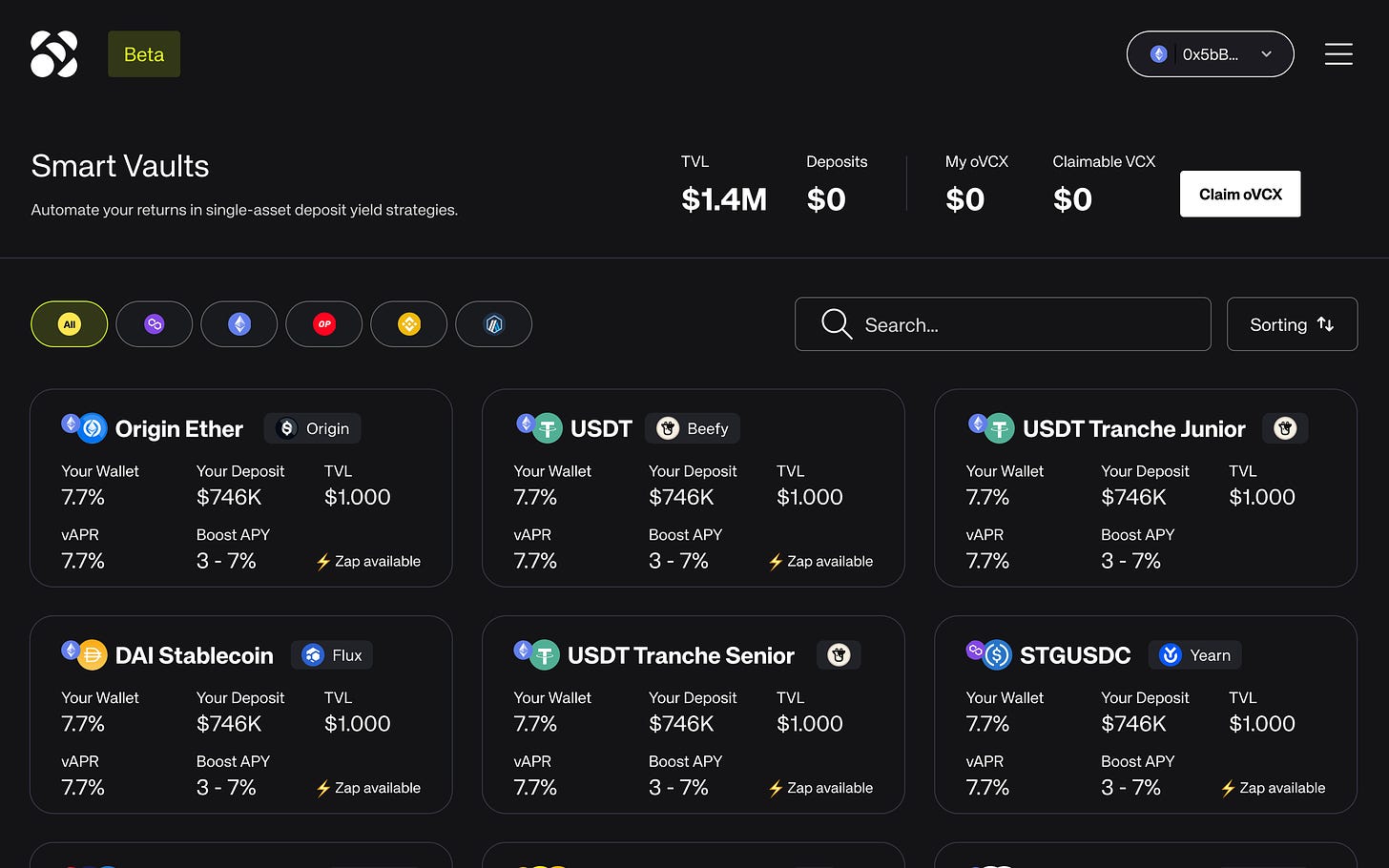

Smart Vaults

Smart Vaults are @VaultCraft_io non-custodial, multi-strategy, auto-rebalancing vaults.

They have a built-in zap feature - meaning users can zap any asset into any vault ie USDC into USDT or DAI into ETH

🔷 Tokenomics 🔷

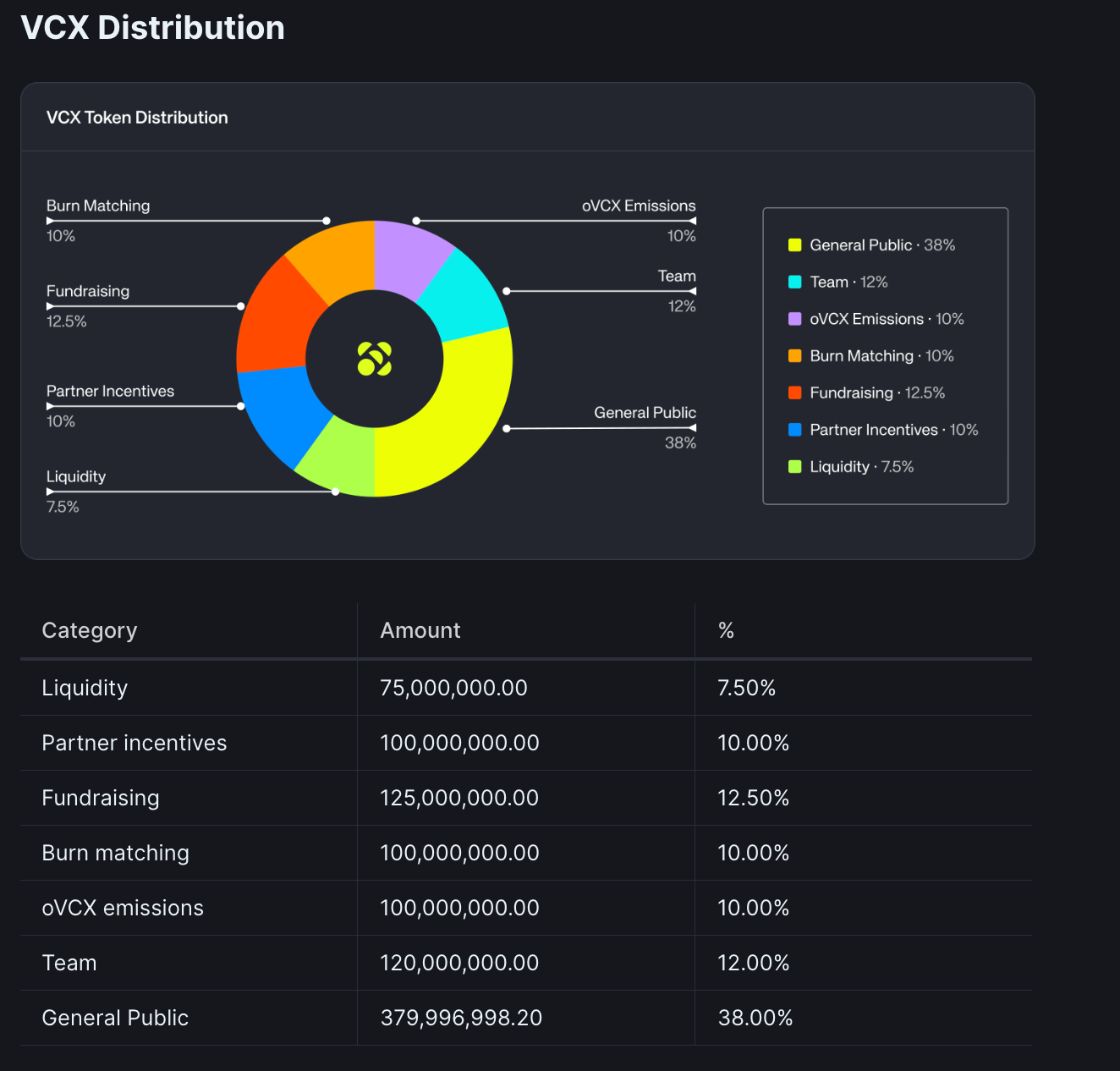

VaultCraft is a rebrand from Popcorn DAO. And those holding $POP tokens can convert to $VCX with a 1:10 ratio.

VCX used as liquidity incentives

veVCX (vote-escrowed VCX)

veVCX is based on Curve’s veCRV

Used for voting for governance proposals and gauge weights

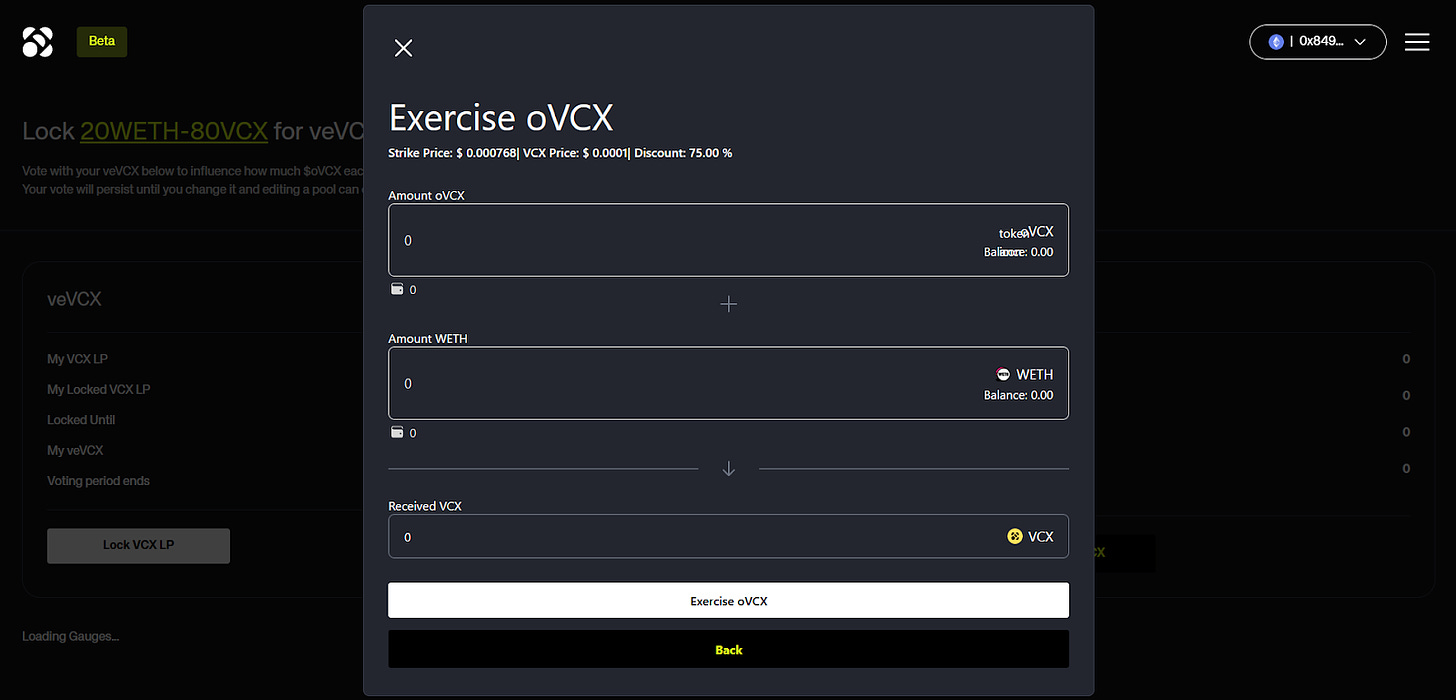

oVCX

oVCX is a call option token for VCX that lets its holder purchase VCX at a discount to the market price. oVCX does not expire.

They follow an interesting option model token model which comes from one of my favourite protocols called @Timeless_Fi $LIT and have partnered with them. This is really good development for both projects. (Disclaimer: I am a fan of $LIT)

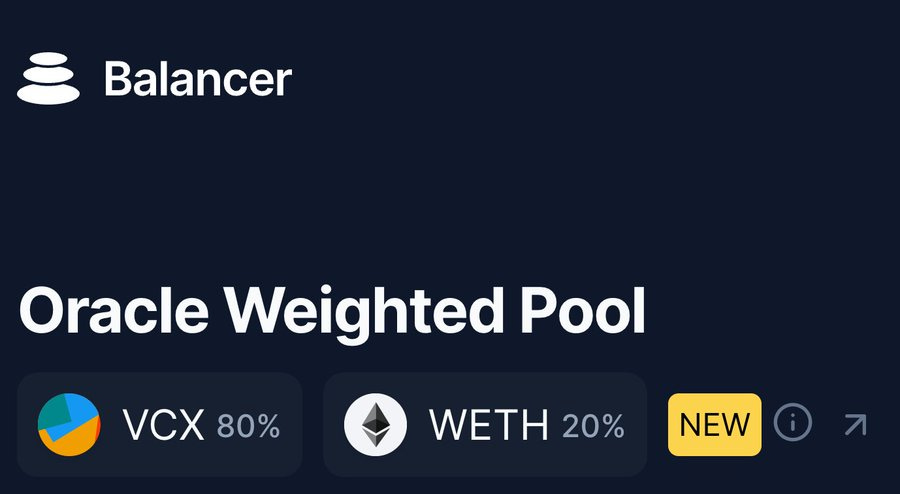

VCX holders must now lock their tokens in an 80VCX-20WETH Balancer LP token in order to obtain veVCX voting power. This aligns incentives between liquidity providers and VCX holders.

New staking contract where users can stake assets and earn rewards pro-rata based on their share of total veVCX. Aligns incentives and encourages veVCX accumulation.

Reward token is now a call option on VCX (oVCX) rather than VCX itself. This allows protocol to accumulate more cash reserves while giving loyal VCX holders the option to buy VCX at a discount in the future.

10X maximum boost enabled for LPs providing liquidity to Sweet Vaults if they hold veVCX. Significantly increases the advantage of holding veVCX for governance.

🔷 8020 Balancer Model 🔷

The $VCX token is the native ERC-20 token of VaultCraft. It is required to provide liquidity into the 20WETH-80VCX Balancer pool to receive veVCX, VaultCraft's liquidity governance token.

Initially, 20% WETH and 80% VCX will be paired in the Balancer pool. By adding liquidity to this pool, users will receive vote-escrowed VCX (veVCX) in return. veVCX allows holders to govern certain parameters of VaultCraft.

Though this would have been better done once there is enough liquidity depth for the token, but still excited to see how the launch would go on the 30th Nov.

🔷 Conclusion 🔷

In conclusion, VaultCraft presents an innovative opportunity to optimize yields by building customizable vault strategies with ease.

While the project is still new, the possibilities seem endless for both the platform capabilities and user yields. It will be exciting to watch VaultCraft develop and hopefully realize its vision of making DeFi prosperity accessible for all.

Twitter: https://twitter.com/arndxt_xo/status/1730183701018157151