Warren Buffett’s T-Bill Strategy: A Masterclass in Market Timing and his Money Glitch Playbook

Warren Buffett's T-Bill strategy is a masterclass in market timing and liquidity management.

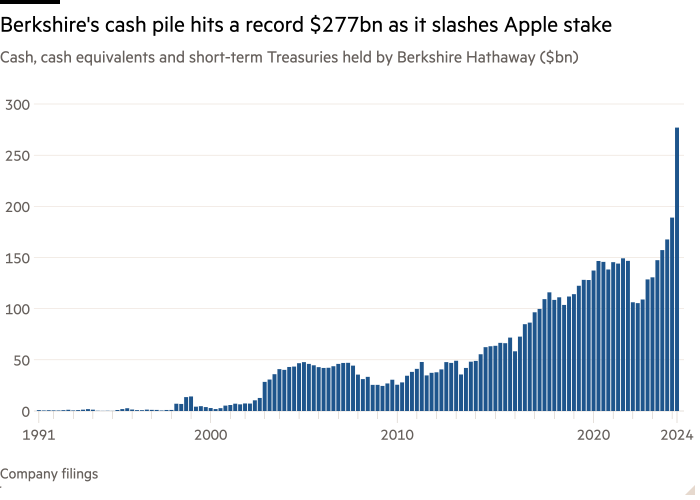

He now holds more T-Bills than the Federal Reserve, with $277 billion compared to the Fed's $195 billion.

This represents a staggering 4% of all publicly issued T-Bills.

BOOKMARK THIS for Buffet's money glitch playbook👇

The Oracle of Omaha's strategy is brilliantly simple yet effective.

During recessions, he sells T-Bills as rates drop and prices rise.

He then uses these proceeds to buy discounted stocks in the market downturn.

As the economy recovers, Buffett begins accumulating T-Bills again, setting the stage for the next cycle.

This approach offers multiple advantages:

- It provides flexibility with quick access to capital for opportunistic investments.

- T-Bills also offer safety, providing low-risk returns during times of uncertainty.

- Perhaps most impressively, it allows for countercyclical gains, profiting from both market ups and downs.

Buffett's strategy demonstrates his macro-economic foresight and highlights the importance of cash management in long-term investing. It also shows how large-scale investors can influence market dynamics.

However, there are risks to consider. These include the:

- potential for missed opportunities if one is too conservative

- reliance on accurate market timing

- scalability challenges for smaller investors.

RWA will be the end game use case for blockchains and TradFi.