We’re nearing the end of this trend.

Our Janbarometer study has been surprisingly reliable this year, and it’s flashing that we’re close to a reversal. The risk/reward feels skewed: the odds of a post-FOMC correction are high.

Lock in your gains first before the final leg.

Image credits to @RamboJackson5

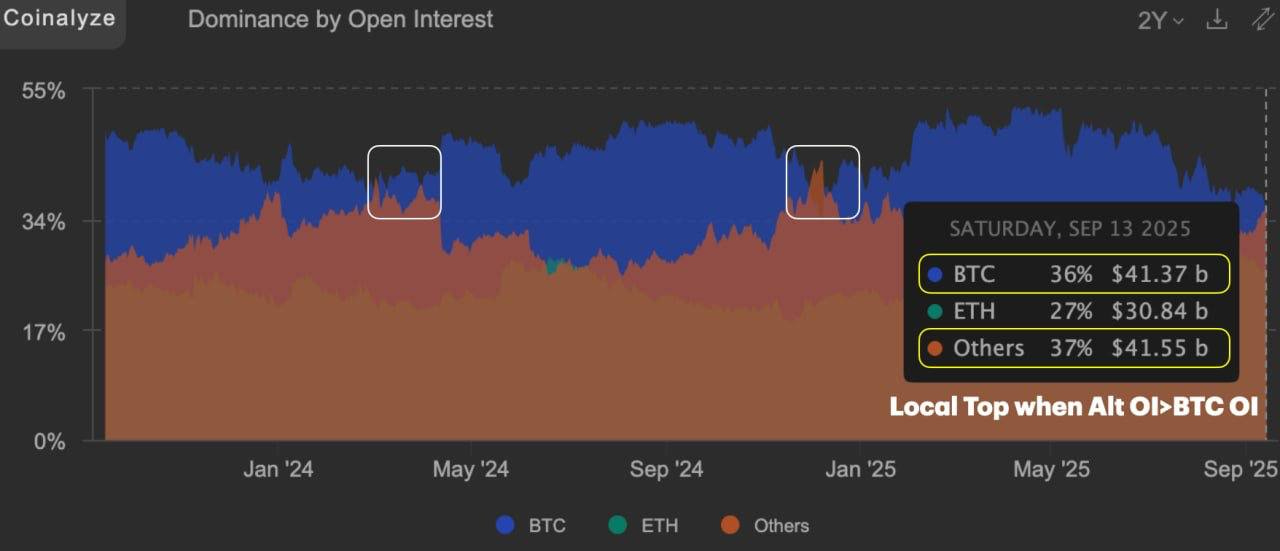

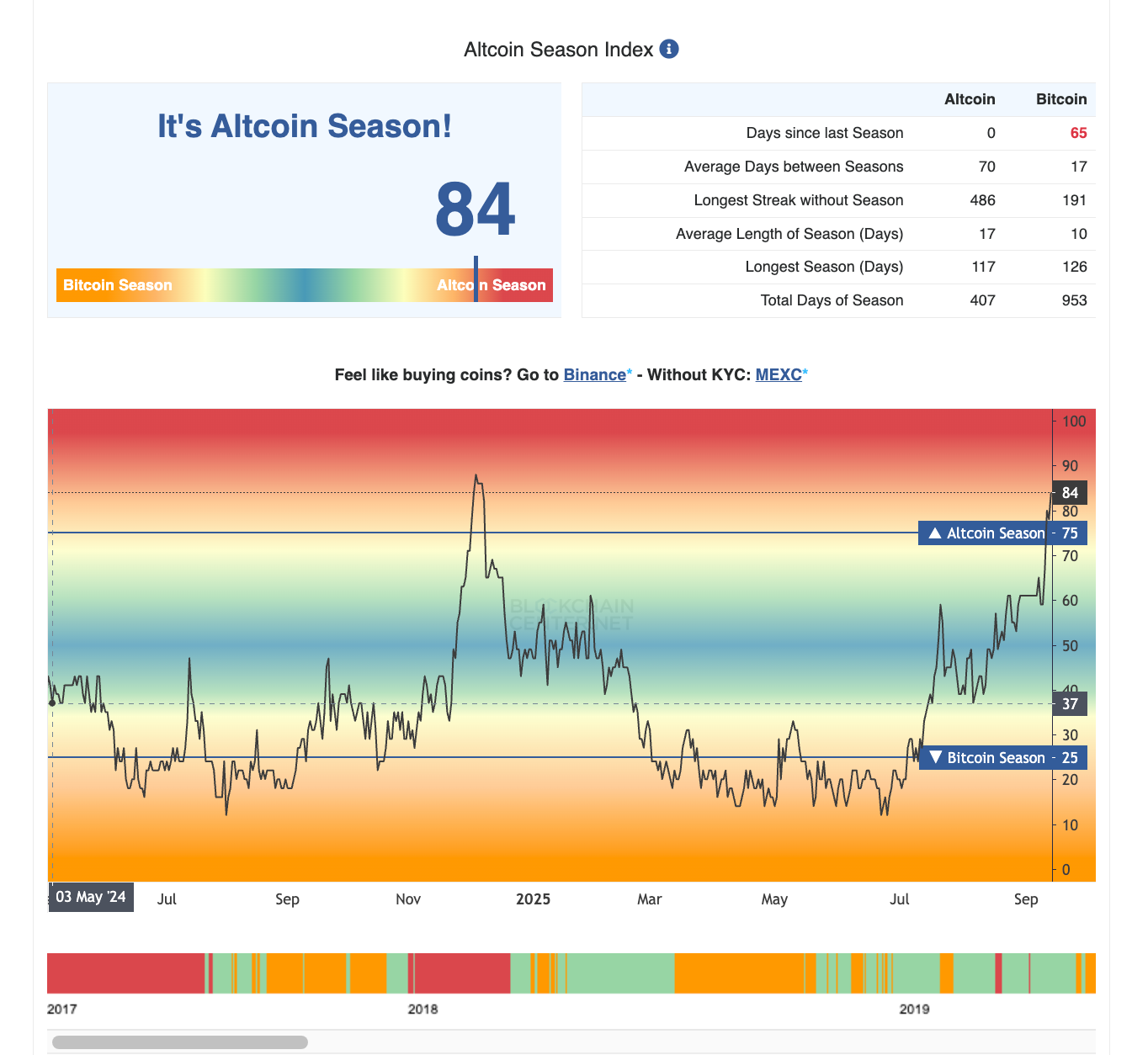

Open interest in alts has now surpassed BTC for the first time since December and the last two times this happened, it coincided with local tops.

Maybe 1% of participants feel true euphoria today. For everyone else, the winners will be those who position around assets that can sustain attention when the liquidity is thin.

Liquidity is selective, macro is hostile, and fiat is devaluing. Assets still climb despite hostile environment.

The biggest cycle difference: 2021 was a liquidity-fueled cycle. Credit was cheap, liquidity abundant, risk assets carried full tailwinds.

2025 is different. Rates are high, liquidity tight. Yet risk assets, BTC, equities, even gold, are grinding higher.

Rates are high, credit is tight, and yet assets from Bitcoin to gold keep climbing. The driver is fiat debasement: investors are hedging against the erosion of cash.

That changes the cadence of the market, broad risk-on rallies give way to selective flows into quality and resilience. The game has shifted from chasing everything to timing, patience, and discipline.

Why? Because fiat itself is weakening. Investors aren’t just seeking growth, they’re seeking protection against the erosion of cash.

2021: Growth powered by liquidity expansion → risk assets outperformed.

2025: Growth powered by fiat devaluation → strength in hard assets and quality names.

That makes the game tougher: you can’t lean on “money everywhere.” But it also creates sharper opportunity for those who adapt.

Liquidity Reality Check

Despite bullish signals (BTC dominance falling, alt OI > BTC OI, CEX tokens in rotation), liquidity is scarce. Years of meme-driven tax farms and celebrity coins gave us PTSD.

Image credits to @JukovCrypto

PTSD-ridden traders chase dopamine in the next shiny launch, leaving little sustained capital for builders.

As a result, liquidity is consolidating into higher-cap assets with loyal communities, names that can sustain attention and inflows.

Fed & Bonds

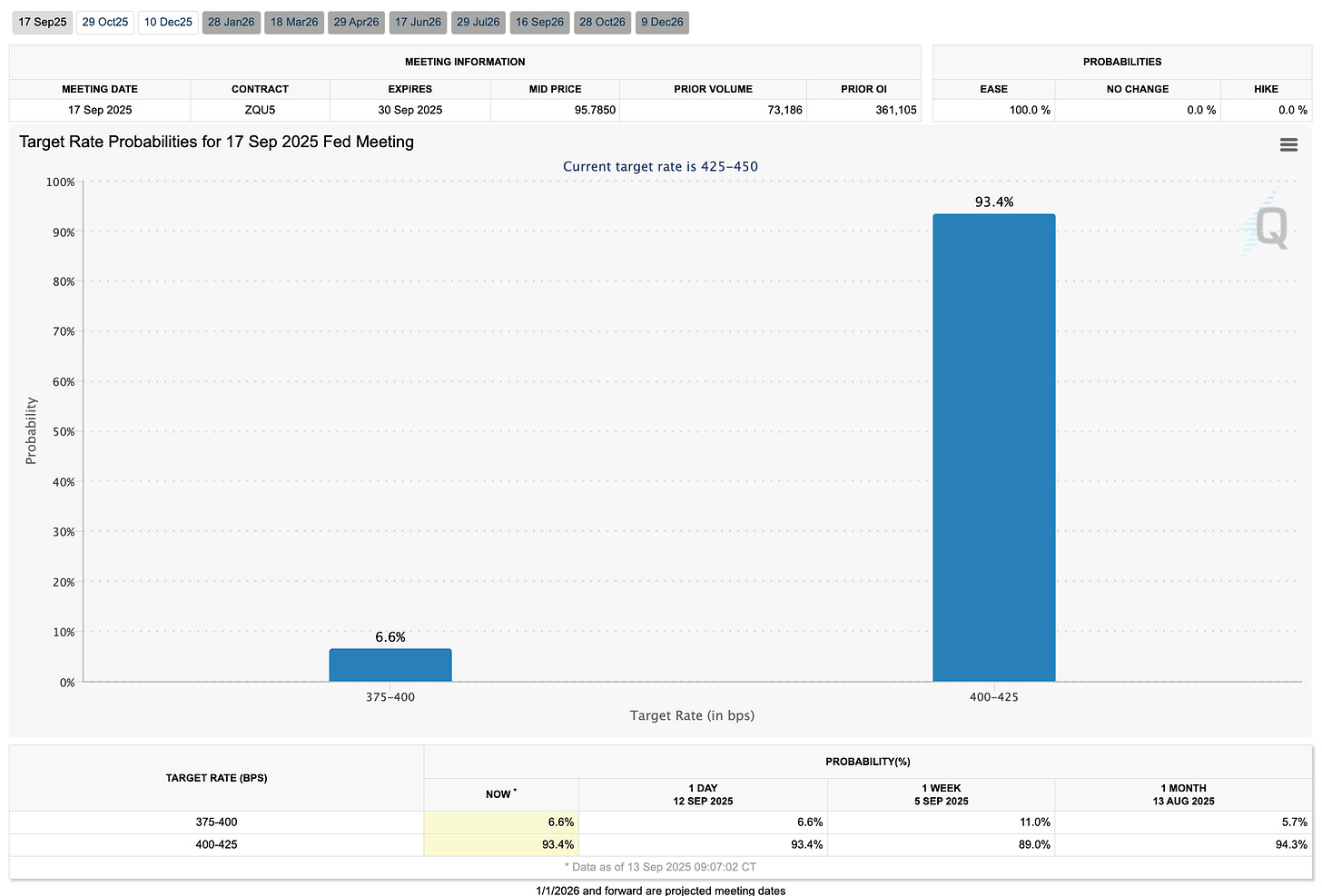

Bond markets already price in a downside move. FedWatch probabilities stand at ~88% for a 25 bp cut vs. ~12% for 50 bp. The nuance:

50 bp first cuts historically = recession signal, leading to slow-bleed markets.

25 bp cuts more often = soft-landing signal, supportive of growth.

We’re nearing a pivotal moment. Based on seasonal indicators (e.g., Janbarometer), risk of post-FOMC volatility looms large.

The Bottom Line

Consistency beats hype.

Patience beats FOMO.

Timing beats alpha.

👇🧵

Macro Pulse Update 14.09.2025, covering the following topics:

1️⃣ Macro events for the week

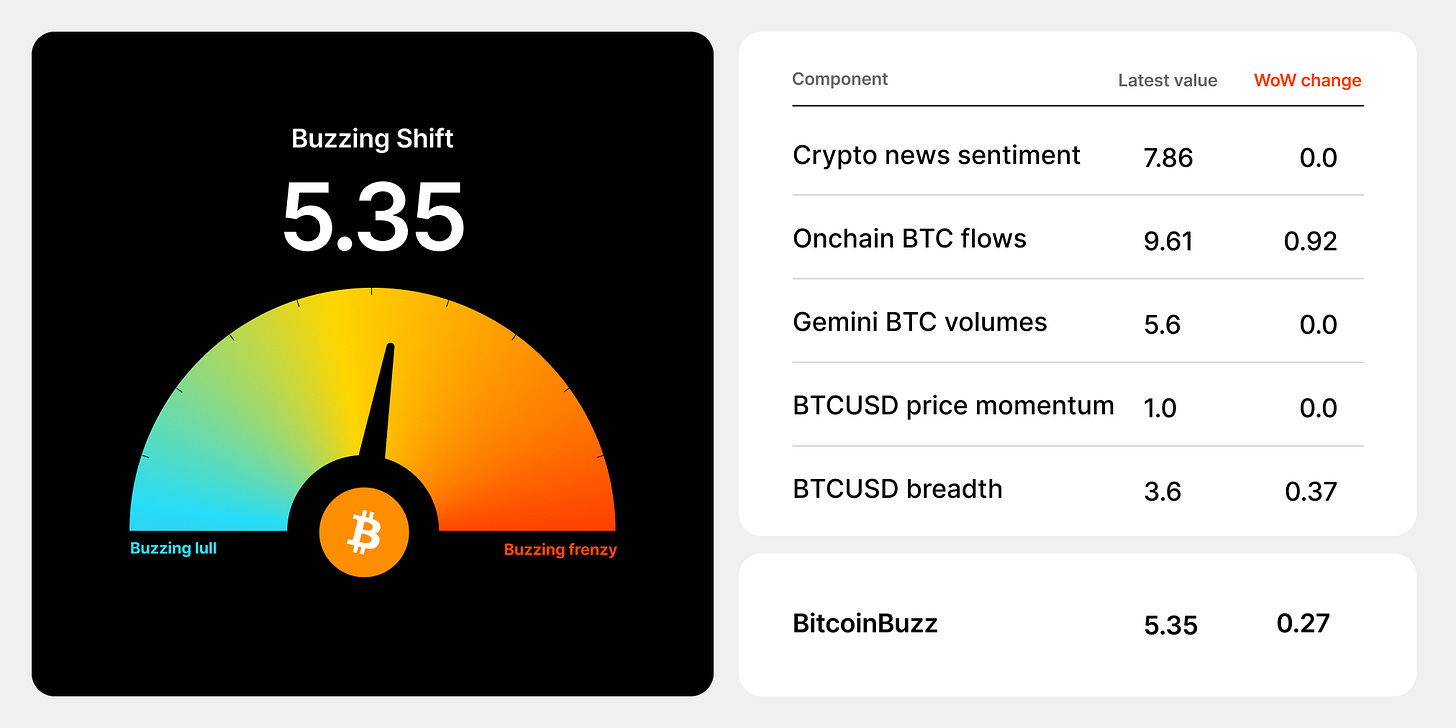

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

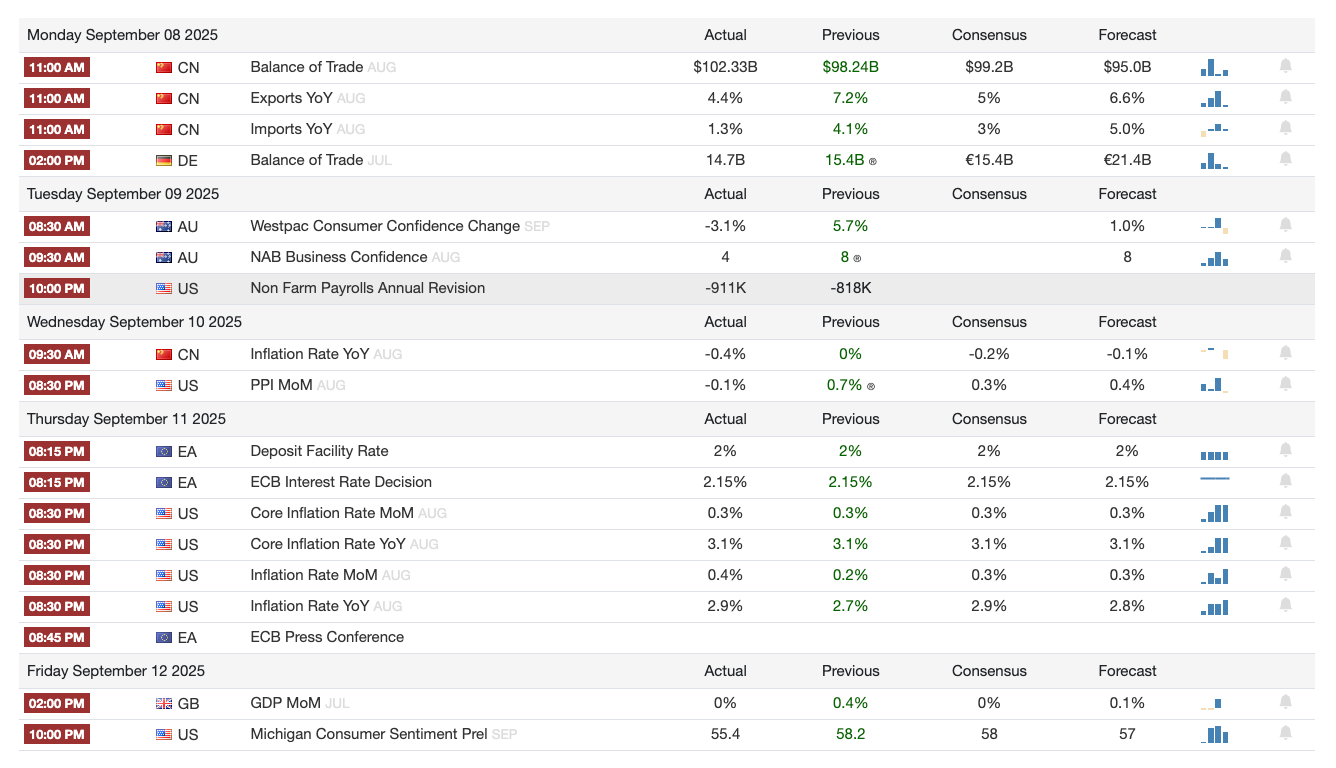

Last Week

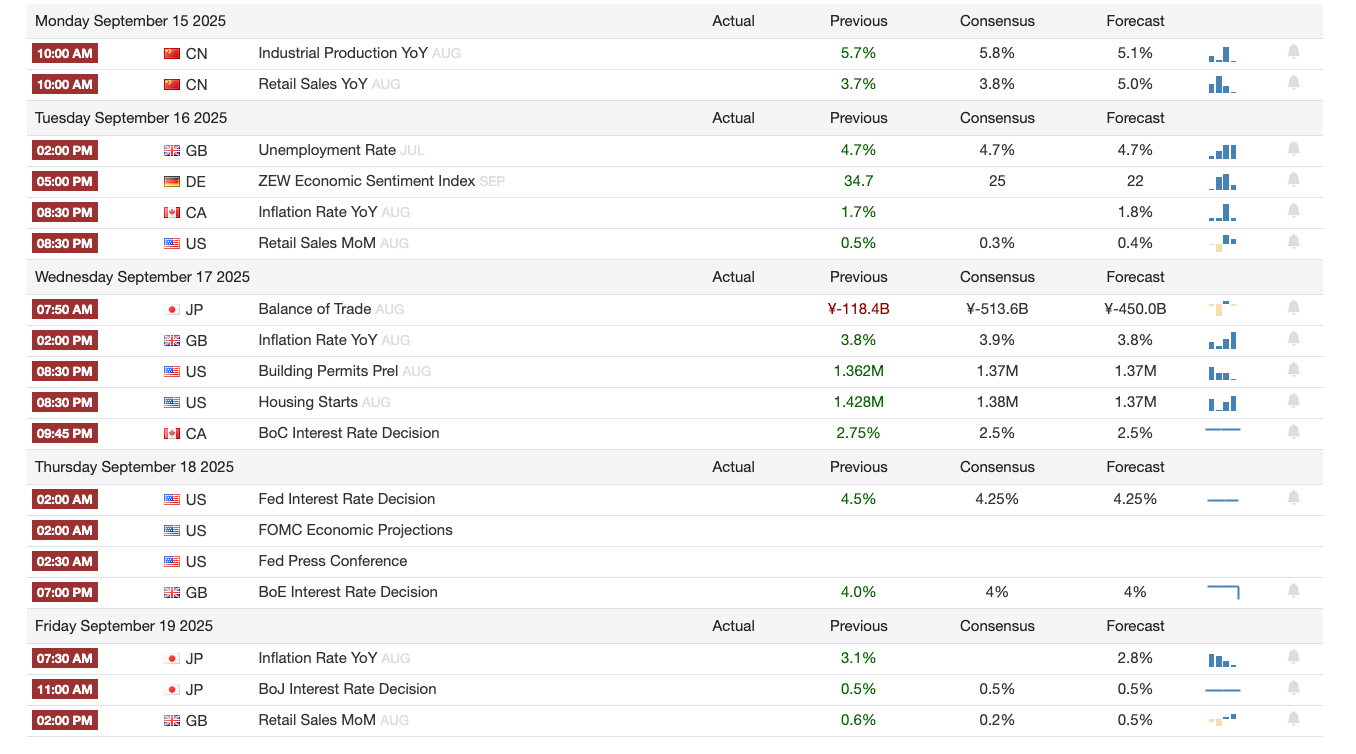

Next Week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

Dogecoin ETF milestone: REX Shares & Osprey Funds’ DOJE ETF marks the first U.S. fund directly tied to Dogecoin. It signals memecoin legitimization in traditional markets, though retail will likely dominate demand given DOGE’s lack of utility.

Cboe continuous futures: The proposed bitcoin and ether contracts extend up to 10 years with daily cash settlement. This could lower rollover costs, expand institutional derivatives strategies, and enhance liquidity—pending regulatory approval.

Ant Digital tokenization: By linking $8.4B of renewable assets to AntChain, Ant Digital introduces real-time production data and automated revenue distribution. This institutional-first model highlights blockchain’s role in infrastructure financing at scale.

Forward’s Solana treasury: A $1.65B PIPE led by Galaxy and Jump Crypto positions Forward Industries to become a cornerstone SOL holder. This represents one of the first major institutional treasury plays outside BTC/ETH, potentially reshaping Solana’s capital market narrative.

4️⃣ Key Economic Metrics

Bottom Line for Users

Jobs are harder to come by, especially in traditional industries. Upskill or pivot to resilient sectors like healthcare and services.

Your paycheck buys more today, but tariff-driven inflation could eat into that. Stay cautious on big purchases.

Debt relief may come soon if rates drop, but financial stress is rising—budget conservatively and prepare to refinance.

Investments face volatility: rate cuts may boost markets short-term, but inflation risk could reverse gains just as quickly.

Labor Market Dynamics

Fewer new jobs are being created → competition for openings is rising, especially for low-skill roles.

If you’re in healthcare or hospitality, demand is still strong. But if you’re in manufacturing, construction, or business services, hiring is slowing.

Sharp slowdown: Job creation dropped from 868k (Q4 2024) → 491k (Q1 2025) → 107k (Q2 2025). August saw just 22k jobs, signaling a near stall.

Sector bifurcation: Health care (+46.8k) and hospitality (+28k) remain resilient, but cyclicals—manufacturing, construction, business services—are contracting. This reflects tariff drag, investment uncertainty, and immigration constraints on supply.

Wage & Participation Trends

Wages are growing at 3.7%, slower than before but still higher than inflation. That means your paycheck stretches a bit further—a rare upside in today’s environment.

But if tariffs push prices higher, those gains could disappear quickly.

Earnings: Up 3.7% YoY—lowest since mid-2021, easing wage pressure but still above inflation → net positive for consumer purchasing power.

Labor force: Participation is creeping up, but unemployment at 4.3% (highest since 2021). The pain is concentrated in low-skill labor, while skilled/educated segments remain stable.

Macro Implications

Interest rates may soon fall. That could ease costs on mortgages, loans, and credit cards—if the Fed cuts as expected.

But right now, delinquencies are climbing—more people are struggling with credit cards, auto loans, and student debt. If you’re carrying debt, you’re not alone—and refinancing could get easier later this year.

Bond market: 10Y Treasury yield dropped to 4.1%, lowest in 10 months—markets pricing in slowdown + Fed cuts.

Fed outlook: Futures imply ~90% chance of a September cut, with 2–3 cuts priced by year-end. The market is betting on aggressive easing despite sticky inflation risk.

Financial stress: Rising credit card/auto loan delinquencies + resumed student debt payments = household squeeze, even as corporate financial conditions remain loose.

Strategic Takeaways

We’re in a divergence economy:

Institutions (corporates, markets) enjoy loose financial conditions.

Households face mounting stress.

Policy trade-off: Fed risks cutting into accelerating inflation, but the slowdown in jobs + rising delinquencies forces its hand.

Investment lens:

Resilient verticals: Healthcare, hospitality → demographic + experiential demand.

Fragile verticals: Trade-exposed sectors (manufacturing, construction) → tariff sensitivity + immigration bottlenecks.

Macro setup: Rate cuts + weaker labor market = potential asset reflation, but inflation risk creates asymmetric volatility across equities, credit, and commodities.

Euro Policy Outlook

Inflation is low compared to 2022 highs, but plateauing above target constrains policy easing.

Policy divergence: Fed leaning dovish (labor slowdown), ECB cautious (inflation sticky) → FX volatility risk (EUR/USD pressure).

Investor lens:

Rates: Limited room for ECB cuts → eurozone bond yields may stay relatively elevated.

Equities: Services disinflation is supportive for margins, but global tariff-driven cost shocks could compress earnings.

Macro risk: ECB constrained in easing just as growth momentum remains fragile → stagflation-lite setup.

ECB stance: With inflation still >2% target, ECB is unlikely to cut rates in September; December remains uncertain.

Market pricing: Futures imply ~50% probability of a cut by year-end—markets leaning dovish, but ECB signals remain cautious.

Lagarde’s line: “Wait and watch” → preference for holding, avoiding premature easing.

Global Linkages

Tariff spillover risk: U.S. tariffs could raise global input costs through supply chains. ECB officials (Schnabel) flag this as an upside risk to eurozone inflation.

Transmission mechanism: Even if eurozone demand is weak, imported inflation (via higher input costs) may limit ECB policy flexibility.

5️⃣ China Spotlight

China is playing a dual game, absorbing external shocks politically (by flipping India) while papering over economic fragility with liquidity and market narratives.

The bet is that technology leadership will bridge the gap.

The risk: markets stay buoyant while the real economy stagnates, creating fragility beneath the surface.

Tariff Realities

CICC data shows Chinese exporters absorbed just 9% of U.S. tariffs—versus far higher absorption in Europe and SE Asia.

Translation: U.S. importers are eating the costs and compressing margins. This won’t last—eventually, American consumers will feel the pass-through as higher prices, adding to inflation risk.

Meanwhile, Chinese exports to the U.S. are shrinking. Idle factories threaten domestic stability—a subtle but important vulnerability.

Geopolitical Rewiring

The U.S. undercut its own “China containment” strategy by slapping a 50% tariff on India over Russian oil imports.

China is moving fast to exploit the rift—bringing India and Russia to the table in Beijing for the first trilateral in years.

Insight: If China deepens ties with India, the “Quad” (U.S., Japan, Australia, India) risks being strategically hollowed out.

Capital Markets as a Safety Valve

Despite weak fundamentals, Chinese equities hit a 10-year high—driven less by earnings, more by liquidity flood and a US$22T savings rotation from deposits (yielding ~1%) into equities.

Yield dynamics (10Y bonds at 1.7%) make equities structurally attractive, while global investors are chasing exposure to China’s tech edge.

Insight: The market optimism is a bet on liquidity + tech narrative, not the real economy.

Macro Risk

Without real economic rebound, this equity surge risks becoming another liquidity-driven bubble.

If exports keep sliding and household demand stays weak, Beijing will need to lean even harder on monetary easing + capital market engineering.