Altseason Is Inevitable. Most Won’t Catch It.

The part of the cycle where 99% of market participants are too exhausted or too uncertain to react… and the 1% lock in generational trades.

Last week, Bitcoin made history, highest monthly close ever. And yet, its dominance just rolled over.

At the same time, whales quietly absorbed over 1 million ETH, nearly $3B, in a single day. Exchange balances for BTC are at multi-year lows.

Retail? Still sidelined, still skeptical. Sentiment metrics are scraping the bottom, exactly where you want them when you’re early.

This is where it always begins.

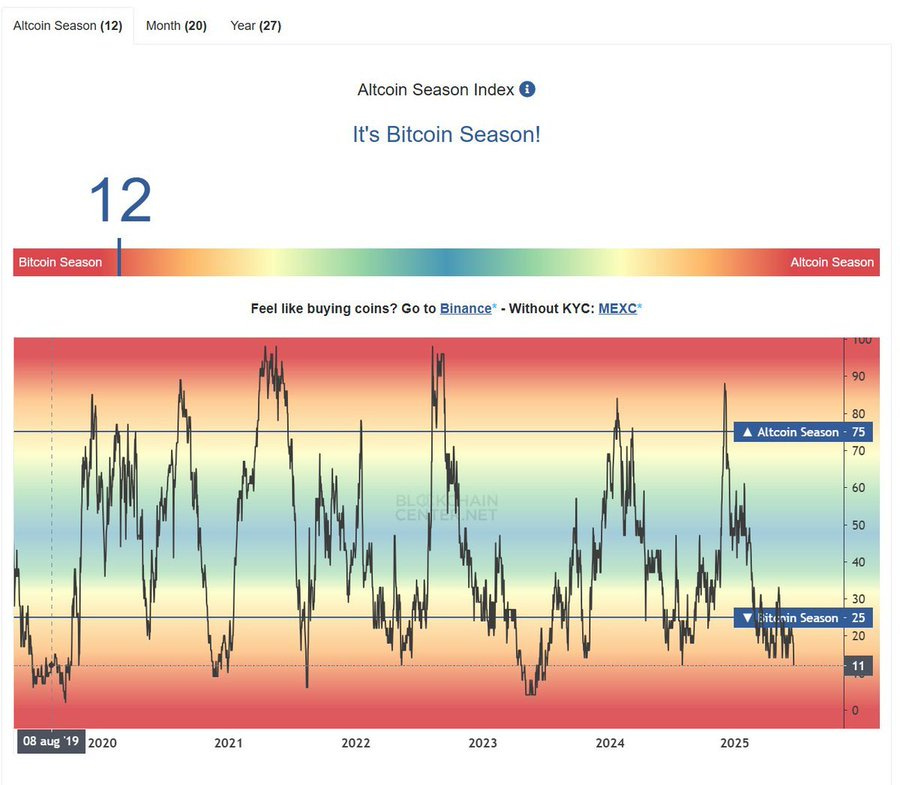

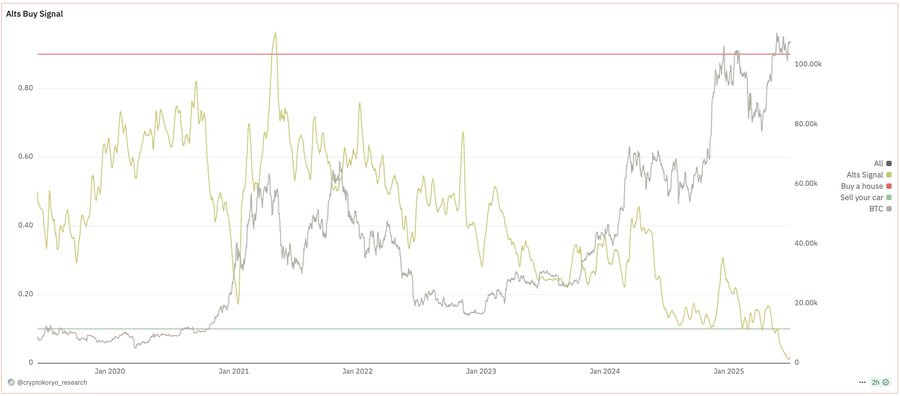

Altcoin Speculation Index is still sub-20%. ETH/BTC just printed its first weekly green candle in ages. Solana ETF is approved. And on-chain rotations are beginning, subtle flows into narrative-aligned DeFi, RWA, and restaking sectors.

We’re not in 2021 anymore. The next wave won’t be an “everything rally.”

It’ll be seletive, aggressively narrative-driven. Capital is migrating toward real yield, chain abstraction infra, and ETF-wrapped upside with staking mechanics.

If you’ve been stacking, this is your signal.

If you’ve been wrecked…you get more airdrops @cookingcityHQ

Let’s dive in 👇🧵

DeFi Happenings

What we’re witnessing is DeFi becoming both more institutional and invisible. Institutional primitives, restaking bonds, fixed-rate auto-renewing credit, and stablecoin loop vaults, are flourishing, while composability layers like Enso and Dynamic abstract away the complexity for everyday users.

But only protocols that move beyond points and integrate real economic value or usage will sustain capital. And underneath it all, the winners will be those who combine frictionless cross-chain UX, secure infra, and predictable, real-world-like returns.

1. Stablecoin Yield Optimization & Fixed-Income DeFi

DeFi is increasingly mimicking TradFi by turning stablecoins into high-yield, pseudo-fixed-income assets. As spot markets remain choppy, protocols are shifting attention toward capital efficiency and fixed-rate structures to satisfy both institutions and retail.

@eulerfinance Super Lending App on Arbitrum is leading this push with lending for blue-chip assets like ARB, WETH, USDC, and WBTC—offering incentives via rEUL rewards.

@YieldNest is taking a stablecoin-native approach with its newly launched $ynUSDx, optimizing stablecoin returns through Superform and a strategy heavily weighted toward SuperUSDC.

Meanwhile, @SizeCredit is creatively enabling users to loop fixed-yield Principal Tokens into lower-cost USDC borrowing—an attempt to squeeze double-digit APYs from idle capital.

On the restaking front, @RenzoProtocol has introduced fixed-term, zero-coupon “Restaking Bonds.” These provide predictable cash flows for AVSs while offering LPs bond-like exposure to fixed yields, a format that may become the fixed-income building block of @eigenlayer security markets.

But caution is warranted. The high advertised yields (15%+) typically require leverage, restaking lockups, or loop strategies. True net returns—after fees, slippage, and risk drag—likely settle closer to 6–9%. The composability that enables these loops also increases exposure to cascading liquidation or depeg risks.

2. Cross-Chain Liquidity & UX Unification

A major evolution is unfolding in how users interact with multi-chain liquidity. Cross-chain UX is shifting from clunky bridge flows toward seamless, intent-based deposit systems that abstract away chain boundaries.

The launch of @GHO on @avax—its first deployment outside Ethereum—demonstrates the push for native, cross-chain stablecoin utility. But it’s @EnsoBuild embeddable Cross-chain DeFi Deposits widget that represents a generational UX leap. Built on @LayerZero_Core and @StargateFinance, Enso enables users to bridge, swap, and enter a strategy in one click. Projects like @plumenetwork and Yield are already integrating it to power vault inflows.

t1’s Proof of Read system, meanwhile, offers real-time cross-chain proving between Arbitrum and Base, using TEE infrastructure to avoid multisigs and dramatically boost bridge speed and trust assumptions. Add @wormhole new partnership with @Ripple to enable messaging across the XRP Ledger, and the trend is clear: the chain wars aren’t ending, but the UX is being unified beneath them.

This trend fundamentally shifts value accrual away from L1s and toward composable infra and messaging layers—Wormhole, LayerZero, Enso—all fighting to be the default rails for multichain capital.

3. Restaking & Onchain Security Markets

Restaking continues to evolve into a standalone security market, with restaked ETH powering structured products that resemble corporate bonds or treasuries.

@RenzoProtocol new Flow vaults and Restaking Bonds allow AVSs to plan budgets around known yields while letting LPs lock ETH into predictable fixed-income style products. @SuccinctLabs Stage 2.5 testnet adds a decentralized proving layer with competitive proof auctions, staking mechanisms, and hardware optimization—all precursors to a performant restaking ecosystem. Meanwhile, @jito_sol is powering projects like Magicnet for Solana, offering restaking-backed rollup performance.

As capital migrates into EigenLayer primitives, we’re seeing the beginnings of a restaking yield curve—short vs. long-dated bonds, with discounts or premiums depending on perceived risk, exit liquidity, and slashing risk.

But with composability comes fragility. Zero-coupon structures imply locked principal until maturity. Any slashing event or validator downtime could heavily impair principal—even without smart contract bugs. These aren’t risk-free yields, but they do attract long-duration capital looking for non-correlated onchain returns.

4. Monetized, Programmable Data Infrastructure

Blockspace is no longer the bottleneck—data latency and composability are. Projects like @shelbyserves (Aptos), and @dynamic_xyz are aiming to monetize real-time read/write infrastructure for Web3 builders.

Shelby, developed by Aptos and Jump, enables sub-second reads, dynamic content, and monetized data access, essentially aiming to replace static cold storage with real-time, streaming compute.

ZKsync’s Airbender offers Ethereum zkVM proofs in under 35 seconds at $0.0001 cost—6x faster and cheaper than previous alternatives.

Dynamic is attacking friction at the wallet layer. With 20M users and 500+ supported wallets, their infrastructure removes the need for wallet switching or onboarding friction, unlocking payment composability across apps.

These trends are creating a new form of middleware monetization—selling low-latency, chain-agnostic access to composable data. As this becomes the norm, expect AWS-style pricing models and latency-based developer tiers to emerge.

5. Institutional Credit Infrastructure & RWA Integration

Lending is going institutional, with auto-renewing credit lines, fallback variable rates, and leveraged RWA strategies now taking center stage.

@TenorFinance integration with @MorphoLabs V2 showcases the maturation of onchain credit. Their new fixed-rate loan products come with auto-renewals and fallback logic, giving institutions the tooling they’re used to in TradFi. Morpho’s teaser of a levered RWA strategy using @apolloglobal ACRED fund hints at where this is going, high-yield, compliant vaults structured for institutional flows.

Euler Prime’s move to boost stablecoin liquidity with targeted incentives adds another layer, yield optimization for market makers and treasuries seeking predictable returns.

We’re inching closer to onchain prime brokerage, with compliance-ready, fixed-income structured products leading the way. But RWA strategies require high-fidelity oracles and robust redemption logic. Any offchain mismatch can trigger large-scale depegging or margin calls.

6. Airdrop Economy & Incentivized Farming

Airdrops remain a dominant user acquisition tactic, even as retention metrics decline. @sparkdotfi SNAPS campaign, @AethirCloud Cloud Drop 2.0, and @KiiChainio ORO testnet all reflect a familiar pattern: points, quests, and gamified engagement to bootstrap attention.

Yet data shows that only ~15% of total value remains post-airdrop after the first two weeks. This reality forces protocols to offer higher point multipliers (e.g., 30x on LPs) or bundle additional benefits (governance access, boosted yields) just to stand out.

Cookie.fun and similar platforms are starting to reduce Sybil exposure by gating wallet claims through social or behavioral verification, but farming whales continue to fragment wallets or use multi-sig structures to game campaigns.

Projects that want long-term liquidity need to shift toward retention-based incentives—e.g., veNFT locks, time-weighted boosts, or restaking access—not just speculative points.

Narrative Overview

Geopolitical tremors can still yank the market, but structural buyers absorb dips. Altcoins will not enjoy a 2021-style everything rally; instead, narratives with tangible catalysts (ETF wrappers, real revenues, exchange distribution) will cannibalize attention from memetic punts.

1. The Macro Backdrop: Volatility Anchored to Headlines

Bitcoin’s slip from $105 k to just under $99 k during the Iran-Israel flare-up proved, once again, that 2025’s market is headline-driven. Within 36 hours the U.S. confirmed strikes on Iranian nuclear sites, the Iranian parliament threatened to choke the Strait of Hormuz, Tehran lobbed symbolic missiles at U.S. bases, and Donald Trump brokered a cease-fire. The entire arc compressed into a single weekend, yet it erased and immediately restored $14 k of BTC’s price.

My read: leveraged shorts were already crowding the tape after three months of sideways action; the geopolitical scare simply supplied the catalyst for a liquidity grab that flushed weak hands and transferred coins to longer-term balance sheets. Spot ETFs continue to hoover up inventory; every geopolitical shakeout accelerates that transfer. BTC now oscillates around $107 k, about 25 % below the cycle high yet still above the “BUY!” band of the Rainbow valuation model, which flags sub-$94 k as historical value territory .

2. Summer Lull or Springboard?

Seasonality argues for a sleepy Q3, but two forces mute the usual summer malaise:

ETF bid stability. 2024’s lesson, that steady ETF inflows create a structural floor, remains intact. If supply continues migrating from OG miners to corporate treasuries, a swift push to $130 k becomes plausible once volatility sellers relax.

U.S. equities leadership. The S&P 500 printed fresh highs on 27 June while BTC lagged. Historically those gaps resolve in BTC’s favor after 4-to-8 weeks; if risk sentiment stays buoyant, crypto may simply be late rather than broken.

3. The Only Alt-Narrative That Matters Right Now: a Solana ETF

In a market starved of “next big thing” stories, the pending Solana spot ETF is the lone theme with institutional heft. The SEC’s review window for four filings (VanEck, 21Shares, Canary, Bitwise) formally opened in January; final rulings must land by late September at the latest .

Thesis: The day a SOL ETF includes staking rewards, it reframes SOL from “high-beta L1 trade” to “quasi-yielding digital equity,” compressing the staking derivative trade (JTO, MNDE) into the ETF narrative. Accumulation under $150 looks less like speculation and more like positioning for an inevitable wrapper trade.

4. DeFi’s Fundamental Bid

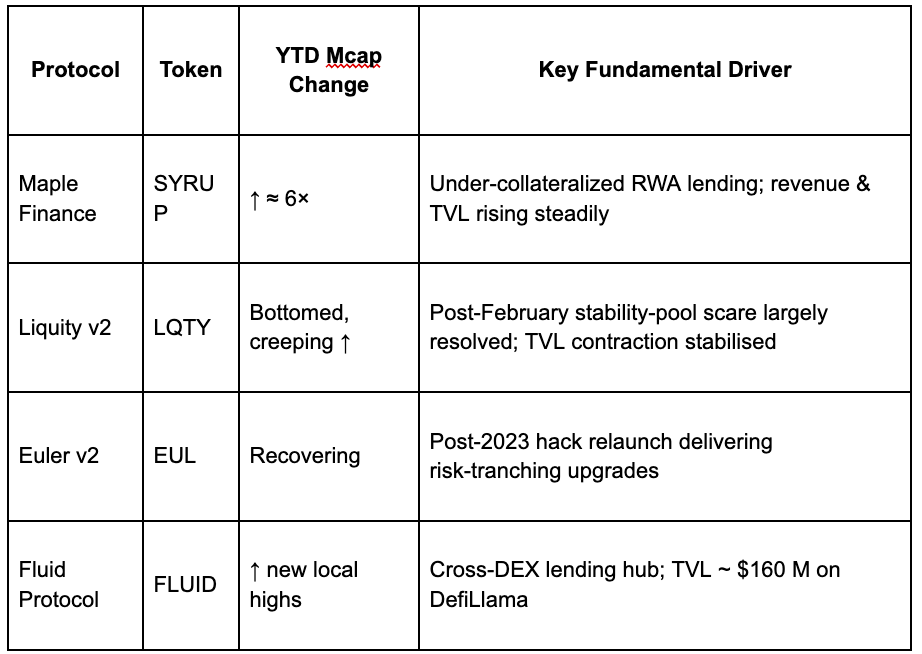

While meme-coins and narrative rotations dominate X, on-chain cash-flow protocols are winning quietly:

5. Memes & The Banana Syndrome

Binance perp listings like $BANANAS31, $TUT, and $SIREN highlight a pump-and-dump meta: thin-liquidity assets with perpetuals run, funding flips deeply negative, and marketers frame it as “rotation.” In reality these trades are extractive. My approach: either embrace the full Ponzi risk with tight invalidation or ignore entirely. The same caution applies to Base meme rockets ($USELESS, $AURA) which can produce 10× moves but also 70 % daily drawdowns.

6. New Issuances & Structural Tailwinds

@RobinhoodApp Orbit L2. Robinhood’s choice of @arbitrum Orbit for its L2 and tokenized equities push strengthens the “Exchange-chain” thesis already pioneered by Coinbase’s Base. A retail brokerage onboarding millions into seamless on-chain assets may revive activity on ETH L2s sooner than typical summer doldrums.

$H @Humanityprot and $SAHARA @SaharaLabsAI showed that even with brutal initial dumps, credible teams with verifiable road-maps are bought aggressively on second prints, suggesting that primary auctions remain fertile hunting grounds if one waits for post-listing capitulation.

7. Investment Framework for Q3 2025

Core: Keep a structural overweight in BTC until ETF outflows meaningfully exceed inflows (not yet visible).

Rotational Beta: Accumulate SOL beneath $160 as an ETF option. Pair with $JTO / $MNDE for yield-amplified upside.

Fundamental DeFi Basket: Equal-weight $SYRUP, $LQTY, $EUL, $FLUID; recycle into laggards whenever Maple extends >3× relative outperformance.

Speculative Bucket: Cap memecoin exposure at 5 % NAV; treat every Binance-perp meme as a weekly options trade—cheap gamma, strict stops.

Event-Driven: Track Robinhood L2 milestones; front-run user-onboarding catalysts in Arbitrum ecosystem tokens.