ETH going bonkers, Bald Jesse launched his own coin, SOL eco seeing $BONK winning, $HYPE saw $1.2B buybacks, $PUMP bought back $19M

This run will be revenue driven + a16z thesis on the blend of crypto and AI, $SPON is my next natural thesis.

I believe its TGE is coming, hence I am laying out my thoughts on why $SPON has me seriously intrigued👇

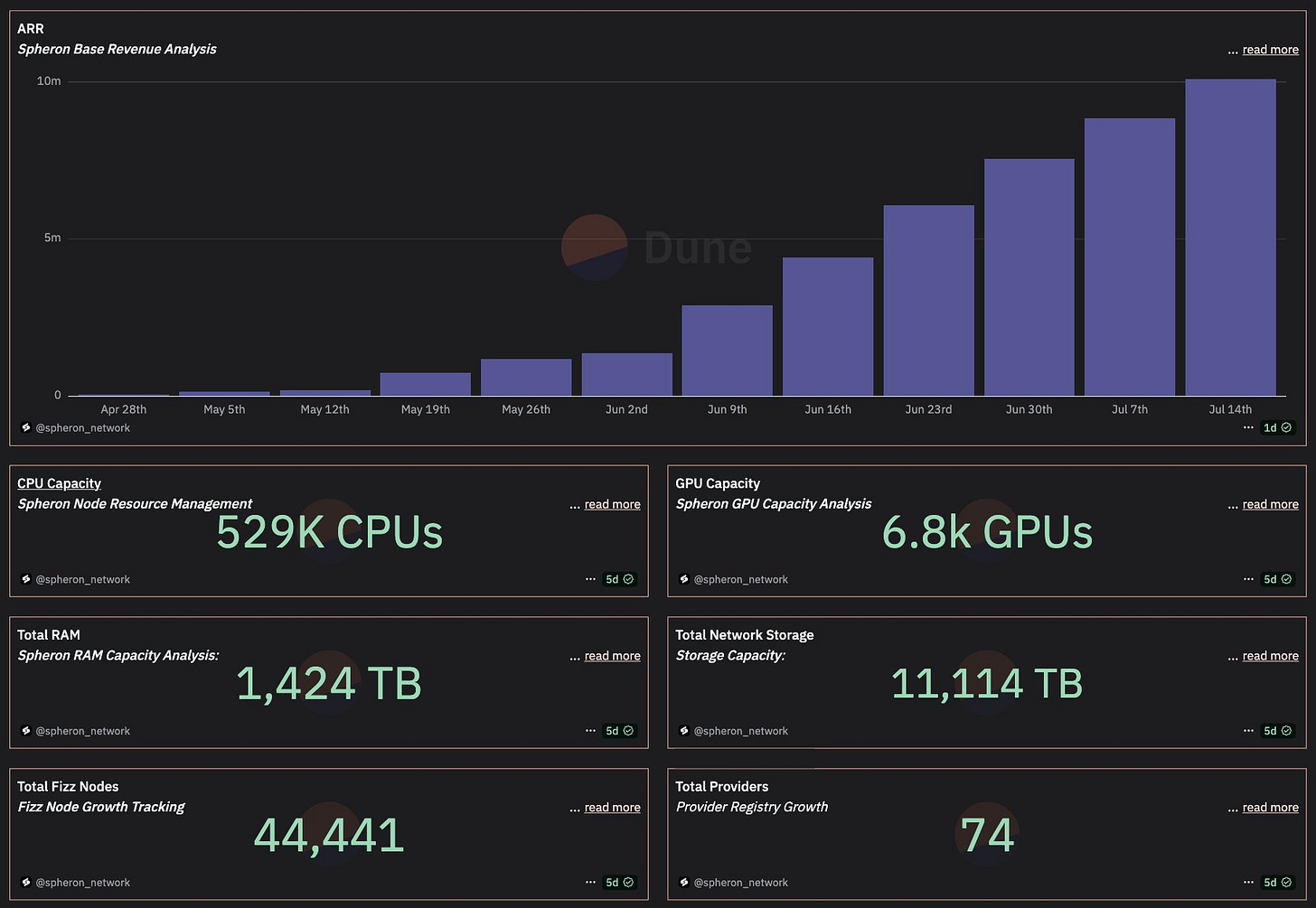

1.Revenue-first, token-second: This de-risks the TGE. You’re not betting on maybe someone will use this. People already are with $10M ARR, PRE-TGE!

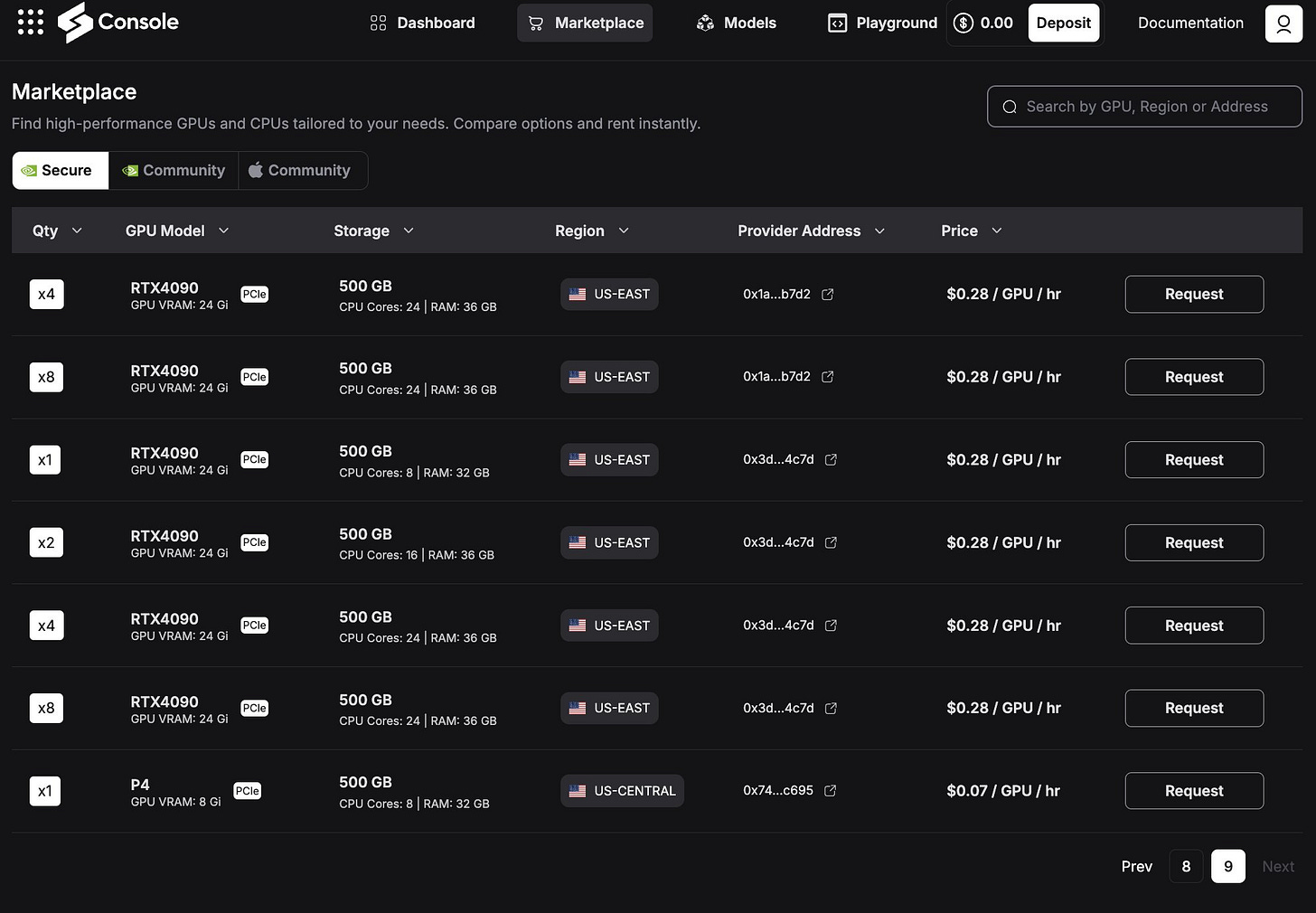

http://2.AI + Crypto is here to stay: GPU demand only accelerating faster. If Spheron keeps its pricing edge, I am confident it will become a liquidity hub for compute, its priced as low at $0.07. Here is @a16z AI x Crypto thesis: https://x.com/a16z/status/1932807889808220576

3.Product flywheel: From compute layer (Fizz, Supernoderz) to tooling layer (Skynet, Klippy), they cover both demand and supply.

4.Onboarding edge: Gmail sign-ins for node runners could be the bridge normies need to join decentralized infra.

5.Base ecosystem tailwind: Expansion to Base gives it L2-native exposure at a time when AI infra is going multi-chain.

What it is:

@SpheronFDN Network decentralizes hosting, storage, and compute, but the real alpha is in how they’re setting up an AI GPU/CPU marketplace that anyone can access or contribute to.

They’re shipping products:

• Fizz Nodes: Join the network via Gmail and monetize your idle compute

• Supernoderz: One-click infra for startups, no need to manage hardware

• KlippyAI: Text-to-video tool for Web3 marketing (already being used)

• Skynet AI: A no-code agent builder (TGE+ feature)

The console has 500+ live deployments.

Here are some numbers that is useful when evaluating traction:

• $9.7M in ARR pre-TGE

• $7.05M raised from Alpha Wave, Nexus, Zee Prime, ConsenSys Mesh, Protocol Labs, etc.

• 8,200+ GPUs, 598K+ CPUs active (claimed)

• ~$0.07/hr GPU rental cost (currently live)