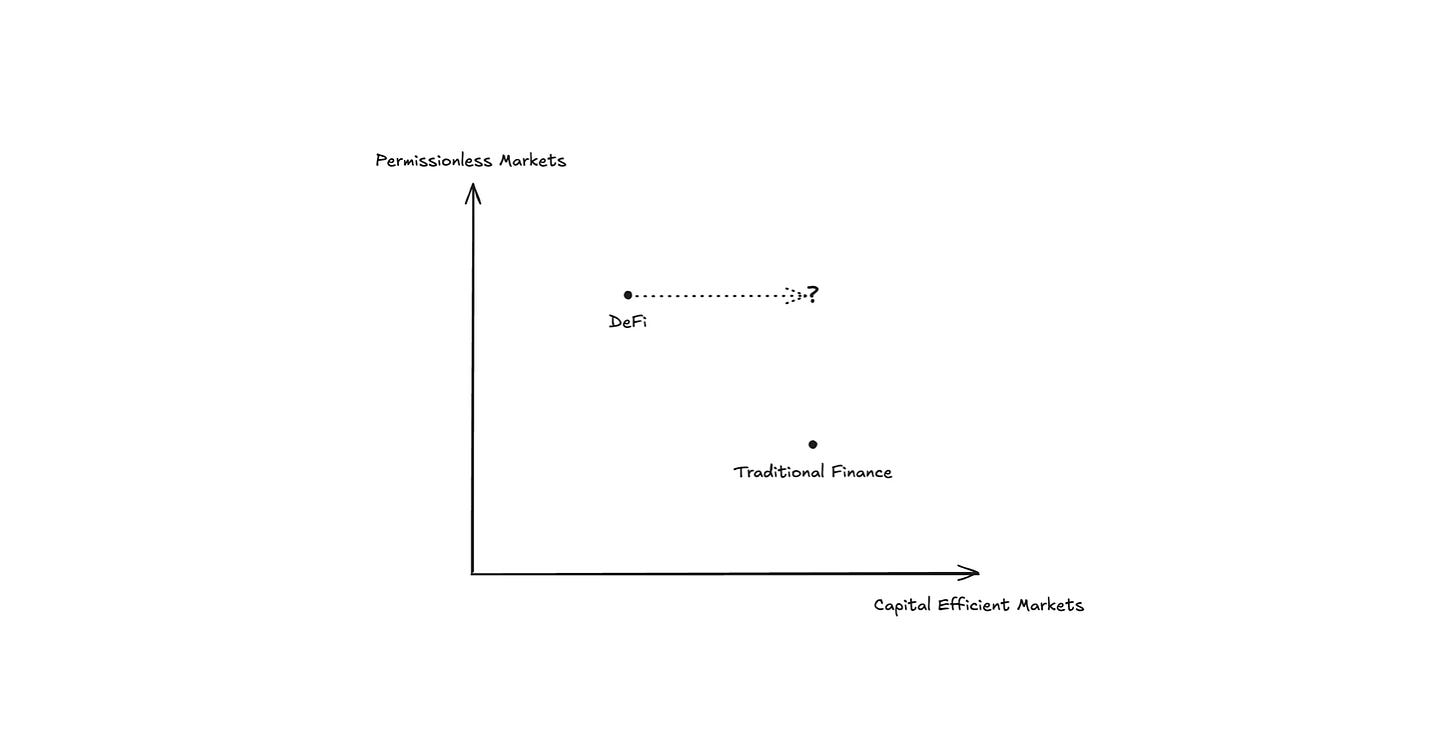

Core view: We’re entering a new phase where yield becomes a primitive, tokenized, portable, and risk‑parcelled, while liquidity concentrates around stablecoins and RWAs.

Infra is racing to deliver CeFi‑grade UX and throughput; institutions are quietly wiring in custody and treasury rails.

The investable edge lies in platforms that (1) manufacture programmatic yield, (2) route it efficiently across chains, and (3) sell it to new buyer classes (institutions, apps, and RWA users).

Banner image credits to @Decentralisedco

1) Yield Goes Portable: Funding-as-a-Token

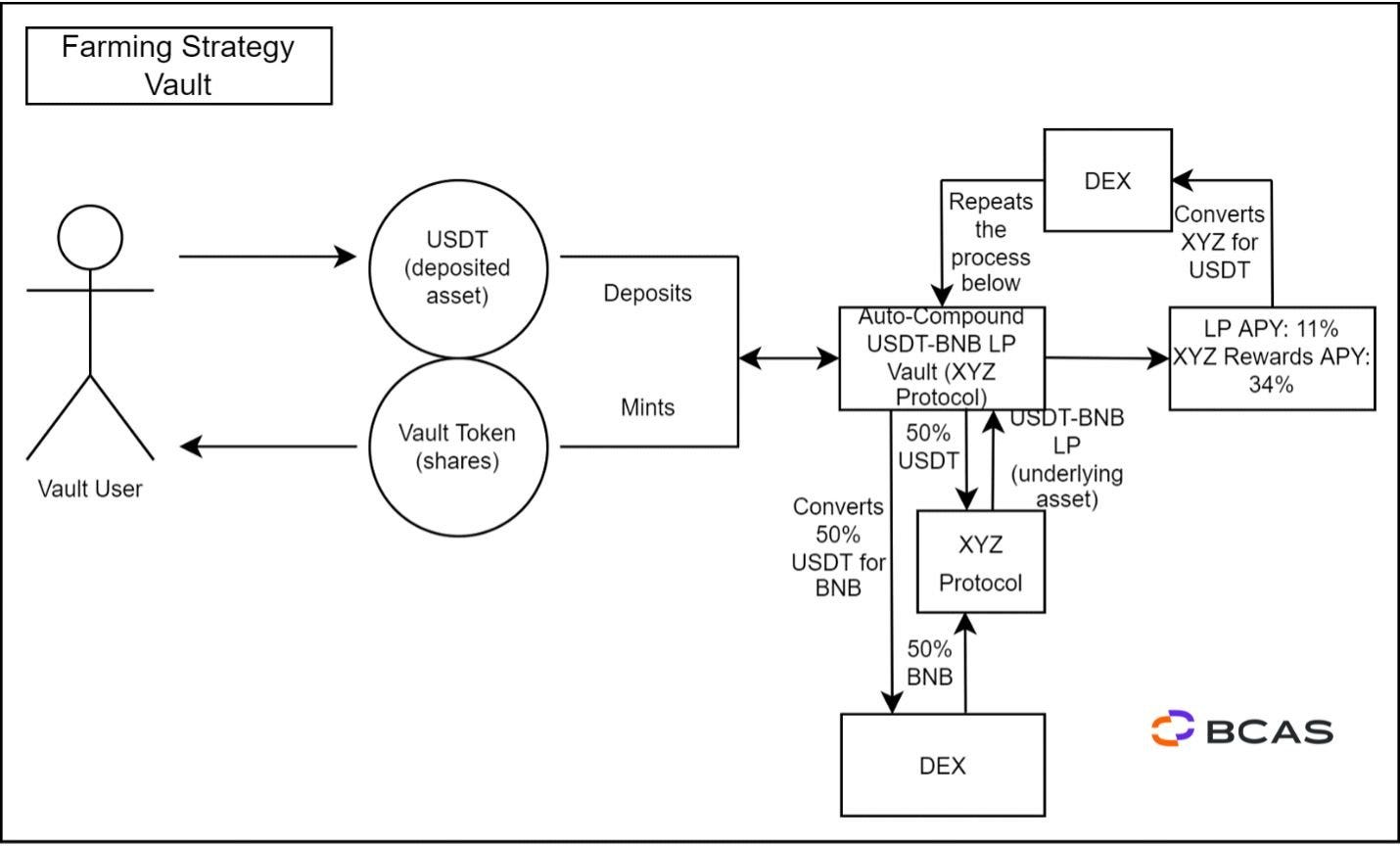

What happened: @liminalmoney (with @hyperunit + @HyperliquidX) is launching xTokens (xHYPE, xBTC, xETH)—ERC‑20 wrappers for delta‑neutral strategies that long spot and short perps to capture funding yield. These tokens are designed to be collateral, AMM inventory, or Pendle‑style yield-leg assets across HyperEVM and EVMs.

The bigger story is about distribution. When “native exchange yield” is tokenized, it stops being siloed in perps venues and starts moving like stablecoins do today—portable, integrated, and infinitely reusable. This unlocks an entirely new layer of financialization, where developers can design products on top of yield as easily as they do on top of USDC.

But this also demands a new risk framework. Yield portability only works if the market can quantify and price the fragility underneath: what happens when funding flips? When liquidity thins? That’s where onchain risk engines, feeding in oracle data, volatility regimes, and inventory buffers, become central.

In other words: yield is becoming infrastructure. Liminal’s xTokens mark the shift from earning yield to routing yield, and the protocols that master this portability will shape the next cycle of DeFi composability.

Why it matters:

Financialization unlock: Packaging basis/funding into transferrable ERC‑20s turns ephemeral trading PnL into composable collateral.

Distribution unlock: Once “native exchange yield” is portable, it can flow into lending markets, structured products, and RWAs.

Risk model: Funding flips, liquidity depth, and execution quality become quantifiable inputs to onchain risk engines (think: oracle + vol regime + inventory buffers).

2) Stablecoin Liquidity Wars 2.0

What happened: @coinbase announced a Stablecoin Bootstrap Fund to deepen USDC liquidity across @aave, @MorphoLabs, @KaminoFinance, @JupiterExchange, etc. At the same time, new vaults and tranching products spotlight stablecoin carry (e.g., @yearnfi USDS up to ~14%; @Dolomite_io srUSD with stacked incentives >27%; @pendle_fi routes for syrupUSDC ~27%+ with boosts).

The narrative here is about distribution as a moat. Just as exchanges fought over order flow in TradFi, DeFi protocols are now competing to become the default “savings account” for stablecoin capital. The stakes are high: whoever owns that parking spot owns the downstream flows, routing, spreads, fee capture, and governance leverage.

And critically, the buyer base is expanding. Conservative yields in the 8–14% band, especially when transparent and programmatically enforced, will keep pulling capital off the sidelines, not just from crypto natives, but from a new class of allocators who want predictable, auditable income without full exposure to token volatility.

This sets up a composability flywheel: as stablecoin liquidity deepens, AMMs and perps tighten, which strengthens funding and vault strategies, which then produces more attractive carry products to market. The loop reinforces itself, and the protocols with the deepest hooks into stablecoin liquidity will emerge as systemic winners.

Stablecoins have always been the quiet backbone of crypto, but now they’re becoming the arena where distribution, yield, and user trust converge. The “liquidity wars” aren’t just about yield—they’re about building the default savings rail for onchain capital.

Why it matters:

Distribution as a moat: Whoever controls where stablecoin liquidity parks controls order routing, spreads, and fee capture.

New buyer class: Conservative yields (8–14%) with transparent mechanics will keep pulling capital off the sidelines.

Composability flywheel: Stablecoin liquidity begets better AMMs and perps depth, which begets better funding and vault economics.

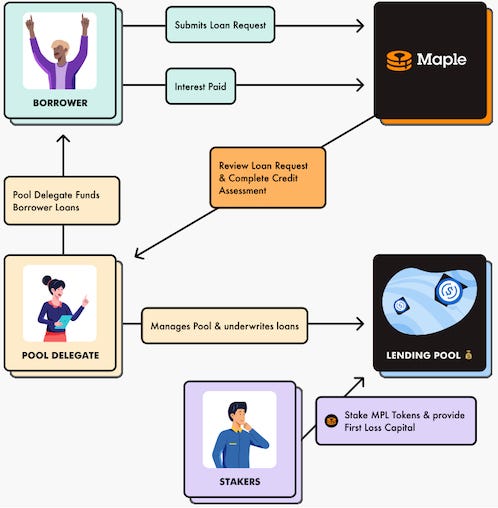

3) RWA: From Wrapped T‑Bills to Tradable Exposures

What happened: @OpenEden_X introduced $EDEN (governance, staking, incentives, buybacks) with a 7.5% fully unlocked Bills Campaign airdrop and a HODLer bonus (details due Sept 15). @GMX_IO‑Solana rolled out RWA perps (SPY, QQQ, AAPL, NVDA, etc.). @DinariGlobal announced a regulated equities L1 on Avalanche for issuance, settlement, and transfers, governed by institutions (@Gemini, @BitGo, @vaneck_us). Dinari is aiming to be the clearinghouse, an issuance and settlement backbone for tokenized equities across chains

The bigger story: RWAs are evolving from isolated products into a stacked ecosystem:

Issuance (Dinari providing compliant rails),

Yield wrappers (OpenEden turning treasuries into programmable collateral), and

Derivatives & distribution (GMX packaging RWAs into perpetual markets).

This matters because RWAs are finally aligning token design with real revenue streams. Buybacks, staking flows, and fee redirection can now be priced against actual economic activity, not just speculative narrative. And with institutional custody and governance layered in, these aren’t just experiments—they’re becoming repeatable, trusted distribution channels.

Where this goes next: expect builders to design basis trades between spot RWA yield and synthetic RWA derivatives, or structured vaults that tranche U.S. equities for different risk appetites. The investable angle it’s in the clearing layers that unify multi-chain liquidity, compliance, and distribution into a repeatable standard.

RWAs are no longer “tokenized T-bills.” They’re on the verge of becoming an entire parallel capital market, regulated, composable.

Why it matters:

Full stack moment: RWAs now span issuance (Dinari), yield wrappers (OpenEden), and derivative distribution (GMX perps).

Revenue design: Tokens that direct cashflow (buybacks/fees) can price real activity, not just narrative.

Compliance rails: Institutional governance and custody transform RWAs from point solutions into repeatable distribution channels.

4) Hyperliquid/HyperEVM: From DeFi Playground to Institutional Rail

What happened: @Anchorage Digital will custody HYPE on HyperEVM. @kinetiq_xyz partnered with Anchorage for kHYPE deposit safeguards. @squidrouter added HyperEVM bridging + swaps across HYPE/PURR/USDT0. PT‑kHYPE is collateral on @hyperlendx; @Balancer announced expansion to HyperEVM.

The narrative here is about venue graduation. HyperEVM is building the pillars that transform it into a settlement venue where both traders and institutions can confidently park, route, and grow capital. With xTokens, liquid staking tokens, and perps all reinforcing each other, the ecosystem is architected for a self-reinforcing yield loop: liquidity generates yield, yield is tokenized into new assets, and those assets deepen liquidity further.

Why it matters:

Institution‑ready: Qualified custody is the unlock for treasuries, funds, and listed entities.

Liquidity depth: Blue‑chip AMMs (Balancer) + bridge liquidity (Squid) signal a venue graduation.

Yield stack: With xTokens + LSTs + perps, HyperEVM is set up for a self‑reinforcing yield loop.

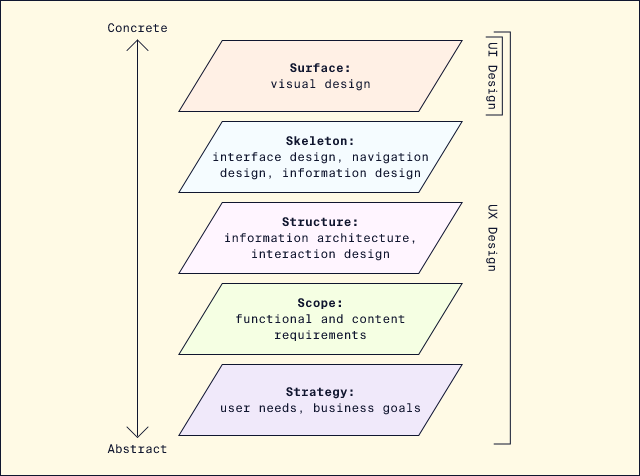

5) UX and Speed: CeFi‑grade Experiences Onchain

What happened: Coinbase integrated @AerodromeFi (Base) for direct DEX exposure. @SkyEcosystem added bundled transactions (multi‑action, one confirmation). @unichain Flashblocks (200 ms sub‑blocks via TEEs) and @puffer_finance UniFi V2 (sub‑10 ms confirmations, atomic exits) push latency down. @SunriseLayer launched as an “Interliquidity” L1.

But the deeper impact is on market quality. Faster execution, prioritized sequencing, and atomic exits mean tighter spreads, less slippage, and more stable LP returns. That directly improves the economics of market-making and lending strategies, attracting larger capital allocators who were previously priced out by inefficiency.

And then there’s the design space this opens: application-specific market structures. With sub-second confirmations and modular rollups, games can settle instantly, RWAs can trade without daylight lag, and structured products can build new forms of conditional execution. What used to be a limiting factor—latency—is now becoming a differentiator.

The takeaway: DeFi isn’t just competing on yield anymore; it’s competing on experience. And the winners will be the protocols and chains that collapse the UX gap while retaining the composability that CeFi can’t match.

Why it matters:

Conversion uplift: One‑tap, one‑screen flows reduce retail drop‑off and expand TAM.

Market quality: Lower latency + prioritized sequencing = tighter spreads, more stable pricing, better LP economics.

Design space: Faster finality plus plug‑and‑play rollups invite application‑specific market structure (e.g., games, RWAs).

6) Governance‑Free Safety and Structured Risk

What happened: Aave Umbrella staking is live in DeFi Saver with indicative yields (e.g., ~3.2% ETH, ~8–12% on stables), a 20‑day cooldown, and a 2‑day withdrawal window. @Strata_BTC launched risk‑tranching on Ethena assets. @Bedrock_DeFi keeps shipping BTC LST liquidity (e.g., brBTC/uniBTC with OP incentives).

The narrative here is about maturing risk architecture. DeFi is moving away from informal, patchwork protection and toward structured, scalable systems:

Safety modules that act as insurance rails with transparent economics.

Tranching mechanisms that let protocols diversify their depositor base.

Collateral depth from BTC and ETH LSTs to support structured yield products.

The net result: portfolios that once looked binary (safe until they aren’t) can now be engineered with graduated risk layers. Conservative allocators can take the senior slice, crypto-natives can lever the junior, and protocols benefit from broader participation.

It’s risk-priced yield, and that’s what makes it investable at scale.

Why it matters:

Credible backstops: Governance‑light safety modules are becoming insurance rails that actually pay depositors.

Portfolio construction: Tranching makes it easier to sell senior paper to conservative buyers and lever junior paper for crypto‑native carry.

7) Programmable Liquidity as Policy

What happened: @limitbreak launched LBAMM (programmable hooks for fees, access, and liquidity rules). @usualmoney used @bunni_xyz on Uniswap v4 to concentrate liquidity efficiently. @Rabby_io now fully decodes LP txs; @ShadowOnSonic added decentralized limit orders with TWAP.

The narrative here is protocol-as-policy. This unlocks a new governance model: one where teams can pre-define how capital interacts with their protocol, who can access it, how it’s priced, and how fees adapt in real time.

The second-order effect is capital efficiency at scale. When $5M can replicate the slippage of a $60M pool, returns improve dramatically. That changes how LPs think about capital allocation and how protocols can bootstrap deep liquidity without overpaying in incentives. Efficiency becomes the moat.

What this signals: AMMs are evolving from markets into institutions. They regulate it, protect it, and direct it. And in doing so, they become the de facto monetary policy of their ecosystems.

The takeaway: programmable liquidity blurs the line between code and governance, turning AMMs into self-governing policy engines that set the rules of capital onchain.

Image credits to @MitosisOrg

Why it matters:

Protocol‑as‑policy: Hooks let teams enforce fee schedules, access controls, and liquidity protections at the AMM layer.

Capital efficiency: Concentrated liquidity that matches slippage of a $60M pool with ~$5M is a design win for returns.

Closing Thoughts

The market is rotating from yield discovery to yield distribution. The winners will look less like single‑venue dapps and more like supply chains: sources of yield → packaging → routing → end‑buyers.

Back the rails that make this chain efficient and the tokens that accrue the fees along the way.