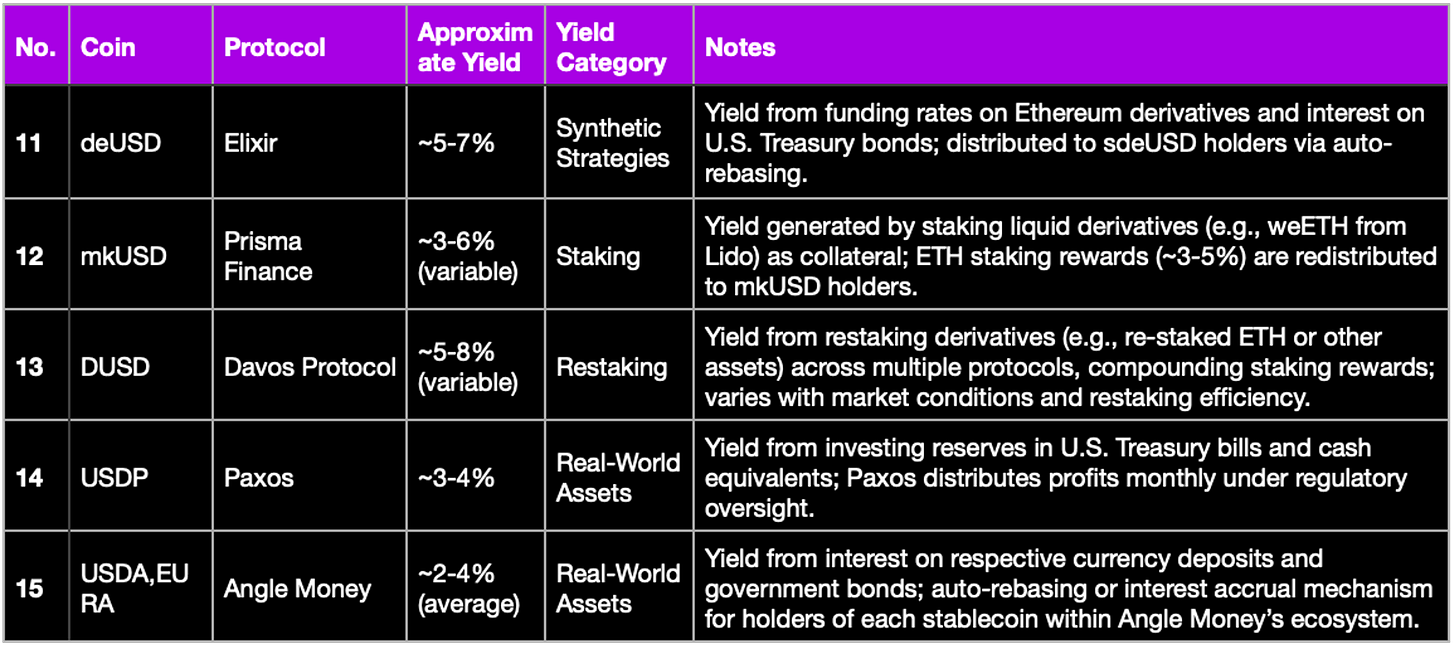

The State of Yield-Bearing Stablecoins in 2025 (Part 2)

This time:

— $deUSD

— $mkUSD

— $DUSD

— $USDP

— $USDA / $EURA

Yield flows, breakdowns & risks 🧵👇

Elixir (deUSD): @ElixirProtocol

Prisma Finance (mkUSD): @PrismaFi

Davos Protocol (DUSD): @Davos_Protocol

Paxos (USDP): @PaxosGlobal

Angle Money (agEUR): @AngleProtocol

Refer to part 1 here: https://x.com/arndxt_xo/status/1907471355945308596

1. deUSD (Elixir)

deUSD is built for stability and scalability across market cycles. Through dynamic reallocation between ETH derivatives and U.S. Treasuries, Elixir ensures that deUSD remains yield-generating even during volatile or bearish conditions. This adaptive design is further strengthened by robust over-collateralization and decentralized protocol governance. At the same time, deUSD’s growing adoption across leading DeFi platforms—including Vertex, RabbitX, and Orderly—cements its role as a trusted collateral asset. With over $64M in Curve liquidity alone, deUSD doesn’t just preserve value—it actively powers on-chain markets, reinforcing both its peg and its yield potential.

Overview

deUSD, launched by Elixir, is a fully collateralized, yield-bearing synthetic dollar within the Elixir Network, a modular DPoS blockchain focused on powering liquidity across orderbook exchanges. Unlike traditional stablecoins backed by fiat reserves, deUSD maintains its $1 peg through a delta-neutral strategy, using collateral like stETH (Lido’s staked ETH) and sDAI (MakerDAO’s Savings DAI), and dynamically adjusts its backing to include U.S. Treasuries during adverse market conditions. The yield, estimated at ~5-7% as of March 2025, comes from funding rates on Ethereum derivatives, staking rewards, and Treasury interest, distributed to holders, particularly those staking as sdeUSD, per web ID 0 and web ID 6.

Yield Strategy Breakdown

1. Delta-Neutral ETH Funding (3–5%)

deUSD is minted using stETH and sDAI, which are deployed to short ETH perpetuals, creating a delta-neutral position. In bullish markets, funding rates turn positive—shorts get paid, generating yield from derivatives.

2. ETH Staking Rewards (3–5%)

Collateral in stETH also accrues staking rewards, providing a stable base yield, independent of market direction.

3. T-Bill Exposure (0–2%)

When funding rates turn negative, capital rotates into short-term U.S. Treasuries (4–5% APY), smoothing returns and reducing downside risk.

Resilience & Revenue Model

Yield is categorized under protocol revenue, supported by Elixir’s DeFi ecosystem.

deUSD is actively used as collateral in Elixir-powered dApps, increasing liquidity and demand.

Strategy ensures income even in adverse funding environments.

Yield Sources

These estimates are derived from the understanding that stETH yields around 3-5% from ETH staking (DefiLlama), funding rates can vary but often contribute similarly in bullish markets, and T-Bill exposure adds a conservative buffer. The total approximate yield of 7-8% aligns with deUSD's positioning as a competitor to Ethena's USDe, which currently offers around 11% (Coinlive).

2. mkUSD (Prisma Finance)

Summary of Yield Strategy

mkUSD offers a variable yield of ~3-6% by redistributing staking rewards from liquid derivatives (e.g., weETH from Lido) used as collateral within the Prisma Finance protocol.

Overview

mkUSD’s yield comes from leveraging liquid staking tokens (LSTs) such as weETH, which are collateralized by staked ETH. Users deposit these LSTs into vaults to mint mkUSD, and the collateral earns staking rewards from Ethereum’s proof-of-stake system, typically around 3-5% annually. These rewards are then redistributed to mkUSD holders, primarily through mechanisms like the stability pool, where holders can earn from liquidated collateral, which includes the staking rewards.

How mkUSD Generates Yield

mkUSD, launched by Prisma Finance, is a yield-bearing stablecoin backed by Ethereum liquid staking tokens (LSTs) like weETH, wstETH, and rETH. Users mint mkUSD by depositing these yield-generating assets into vaults, enabling passive returns distributed via the Stability Pool and direct reward accrual.

1. ETH Staking Rewards via LST Collateral (~3–5%)

Users mint mkUSD by depositing LSTs into overcollateralized vaults (min. 110% CR).

LSTs like weETH earn Ethereum PoS staking rewards, currently yielding ~3.5% APY.

Prisma auto-distributes these rewards to mkUSD holders via:

Direct interest accrual to balances

Stability Pool rewards (where staking LSTs continues earning)

2. Stability Pool Liquidation Gains

mkUSD holders can stake into the Stability Pool, which absorbs bad debt when vaults are liquidated.

When liquidation occurs, stakers receive LSTs at a discount (e.g., $109 weETH for 100 mkUSD burned = ~9% gain).

These LSTs also continue earning ETH staking yield, compounding returns.

3. Protocol Efficiency (~0–1%)

Prisma minimizes fees (e.g., 1% one-time borrow fee, no ongoing interest).

Smart collateral management ensures optimal LST selection (e.g., favoring higher-yielding weETH).

Efficient liquidation and low operating costs ensure more rewards are passed to holders.

Yield Sources

The total yield of ~3-6% aligns with the summary provided, with ETH staking rewards forming the bulk, given Ethereum’s current staking APY of around 3.5% as of recent reports (Prisma Finance: The Ultimate Frax Farming Guide | Flywheel DeFi). The variable nature reflects fluctuations in Ethereum staking returns and liquidation events, making mkUSD a staking-driven stablecoin with decentralized underpinnings.

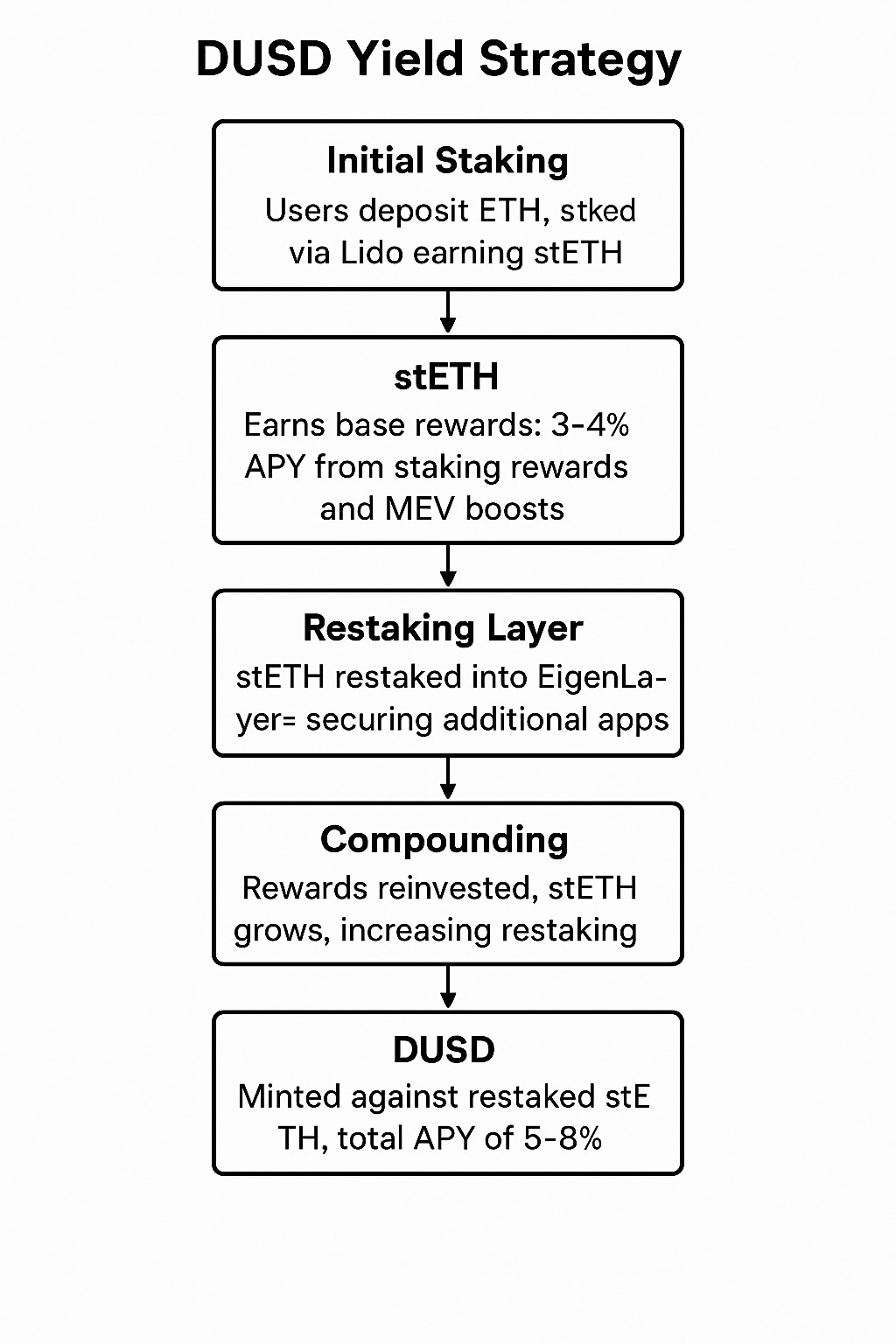

3. DUSD (Davos Protocol)

Summary of Yield Strategy

DUSD provides a variable yield of ~5-8% through restaking derivatives, compounding staking rewards by staking assets multiple times across protocols.

Overview

Davos Protocol employs a restaking strategy, where assets like ETH are staked initially (e.g., via Lido) and then re-staked through additional protocols (e.g., EigenLayer) to compound rewards. This multi-layered staking approach amplifies returns but introduces complexity and risk tied to market conditions and protocol performance. The yield varies with the efficiency of restaking and the underlying staking rewards, offering a higher-risk, higher-reward profile compared to single-staking stablecoins.

DUSD – Multi-Layer Restaking Yield Strategy (5–8% APY)

Issued by: Davos Protocol

Chain: Ethereum

Design: Yield-bearing stablecoin backed by layered staking and restaking strategies.

Target APY: ~5–8% (variable, depending on rewards from Lido + EigenLayer + compounding effects)

DUSD leverages a layered ETH restaking strategy:

Stake ETH → mint stETH → restake stETH in EigenLayer → auto-compound rewards → mint DUSD.

This creates a high-yield, ETH-native stablecoin, targeting 5–8% APY through smart reuse of ETH's security layer.

How the Yield is Generated

1. Base Layer – ETH Staking via Lido (3–4%)

Users deposit ETH into Davos Protocol.

ETH is staked through Lido, minting stETH, which accrues:

Proof-of-Stake rewards

MEV boosts (Maximal Extractable Value)

This provides a baseline APY of ~3–4%, depending on Ethereum validator performance and network activity.

2. Second Layer – Restaking via EigenLayer (2–3%)

The stETH is restaked on EigenLayer, which enables it to secure Actively Validated Services (AVSs) — decentralized applications that borrow security from Ethereum validators.

In return, restakers earn:

EIGEN token incentives

AVS service fees or subsidies

This adds ~2–3% APY, depending on AVS activity, token incentives, and demand for economic security.

3. Auto-Compounding Loop

Here’s where it gets powerful:

Rewards from both staking and restaking are auto-reinvested.

That means as stETH earns rewards, the balance eligible for restaking grows.

Rewards increase the principal over time, enhancing compound yield.

If the protocol supports multiple AVS restaking streams, rewards from different sources can simultaneously boost the stETH base, compounding across layers.

How DUSD Maintains Its Peg

DUSD is minted against these restaked assets, essentially tokenizing a claim on a restaked position.

Its USD peg is maintained via collateralization and smart contract controls (exact mechanics may include overcollateralization or vault liquidation, depending on the implementation, though not fully disclosed).

Yield Distribution

Holders of DUSD passively earn yield.

The staking and restaking rewards accrue at the protocol level and are reflected in the value of DUSD or distributed periodically (e.g., daily or weekly), likely via rebase or index tracking mechanisms (though this is abstracted away from end users).

Yield Sources

The total yield of ~5-8% reflects the compounding effect, with variability driven by Ethereum staking APY fluctuations (affected by network activity and MEV) and EigenLayer reward rates (dependent on EIGEN token emissions and AVS adoption). This aligns with DefiLlama’s reported APYs for DUSD, currently around 5-7%, confirming the range ([Davos Protocol | DefiLlama]([invalid url, do not cite])).

4. USDP (Paxos)

Summary of Yield Strategy

USDP, issued by Paxos, yields ~3-4% by investing its fiat reserves in low-risk, real-world assets like U.S. Treasury bills, with profits distributed monthly under strict regulatory oversight.

Overview

Paxos maintains USDP’s 1:1 peg to the USD by holding reserves in cash and cash equivalents, primarily U.S. Treasury bills. These assets generate consistent interest, which Paxos passes on to USDP holders as a yield. The strategy prioritizes safety and compliance, with monthly attestations ensuring transparency. Unlike DeFi-driven stablecoins, USDP’s yield is predictable and tied to traditional financial instruments, appealing to risk-averse investors.

USDP (Pax Dollar), issued by Paxos Trust Company, is a fully fiat-backed, NYDFS-regulated stablecoin that has gained attention for its institutional compliance and transparent reserve structure. Launched in 2018, it is designed to provide a secure and redeemable digital dollar for both CeFi and DeFi applications. While USDP does not natively distribute yield to holders like some DeFi-native stablecoins, it plays a critical role in custodial yield strategies used by centralized platforms that capitalize on its low-risk backing.

Yield Mechanism – How Yield is Generated on USDP

Though Paxos itself does not offer APY to holders directly, third-party platforms generate yield using USDP through structured lending models. Here's how the value chain breaks down:

1. Reserve Composition and Interest Generation (At the Protocol Level)

Paxos maintains 100% of USDP’s reserves in cash and cash equivalents, primarily:

Short-term U.S. Treasury bills (e.g., 3- and 6-month T-bills)

Commercial paper

Overnight repurchase agreements

Bank demand deposits

As of Q1 2025, 3-month Treasury bills yield ~4.5–5% annually, depending on U.S. monetary policy. These assets generate interest income for Paxos Trust, which retains this yield, using it to cover operational costs, regulatory compliance, and internal revenue streams.

Paxos does not share this interest directly with users who hold USDP in a wallet or DeFi protocol. Instead, the yield potential is unlocked downstream, on platforms that use USDP as a yield source through lending, rehypothecation, or structured vaults.

2. Third-Party Yield Distribution (At the Platform Level)

Platforms like YouHodler, Nexo, or CeFi-integrated wallets offer 3–4% APY on USDP by:

Lending deposited USDP to vetted institutional borrowers

Earning interest payments from borrowers (often 6–10% depending on risk)Taking a platform fee (~2–3%) and passing the remaining APY to depositors

Example – YouHodler:

Advertises up to 3.56% APY on USDP

Yields are paid weekly and compound automatically

Source of returns includes off-chain loans and platform trading strategies

This model mimics traditional money market fund structures, where the user does not directly own the interest-bearing asset (e.g., Treasury bills), but rather earns a pro rata share of revenue generated from lending activity backed by those assets.

3. Why USDP Works Well in Yield Products

USDP’s unique positioning makes it a preferred collateral or asset for low-risk yield generation:

Regulated and redeemable 1:1 for USD

Fully backed by verifiable U.S. government securities

Monthly attestations by top-tier firms like KPMG\

Lower volatility and reputational risk than algorithmic or synthetic stablecoins

Yield Sources

The total yield of ~3-4% aligns with YouHodler’s offering, suggesting platforms take a cut (e.g., 1-2% for operational costs), passing the rest to holders. This variability depends on Treasury yields, influenced by Federal Reserve policies, and cash equivalent rates, which are stable but minimal, fitting the summary’s range.

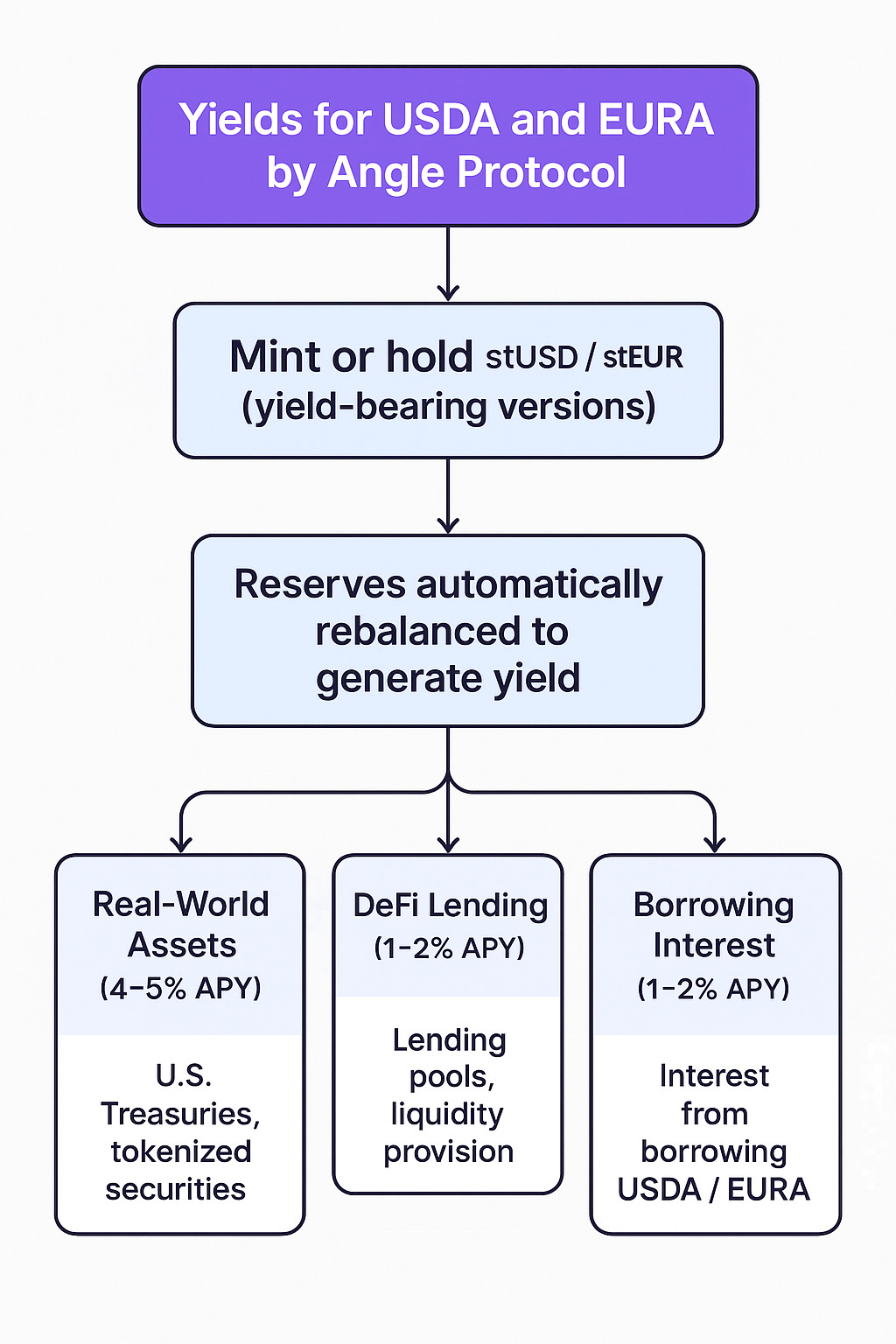

5. USDA, EURA (Angle Money)

Yield Mechanics

For USDA, the yield comes from staking it to receive stUSD, which earns from RWA reserves (e.g., Treasury bills at 4-5% APY) and DeFi lending, plus interest from USDA borrowers. Similarly, EURA yields via stEUR, leveraging the same reserve strategy but tailored to Euro markets. The protocol’s Price Stability Module and over-collateralization ensure stability, with monthly attestations for transparency, appealing to risk-averse investors.

Overview for USDA and EURA

Angle Protocol’s USDA (USD-pegged) and EURA (EUR-pegged) stablecoins generate yield when users hold them as yield-bearing versions, stUSD and stEUR. These are ERC-20 tokens where yield accrues passively, increasing their value over time, with no action required from users. The strategy involves Angle Protocol automatically rebalancing its reserves between Real-World Assets (RWAs) like U.S. Treasury bills and tokenized securities, DeFi yield-bearing assets (such as lending pools), and interest earned from users borrowing USDA/EURA through the protocol’s Borrowing module. This ensures competitive, risk-adjusted yields, aligning with the best returns from Traditional Finance (TradFi) and Decentralized Finance (DeFi), depending on market conditions. Users can deposit and withdraw instantly, with no lock-up periods, making it user-friendly for earning stable returns.

Yield Generation: Three Diversified Streams

1. Real-World Assets (RWAs) – The TradFi Base

Angle allocates part of its reserves to short-term U.S. Treasuries and tokenized fixed-income assets, typically yielding 4–5% in the current high-interest environment. These low-risk instruments provide the foundational yield for both USDA and EURA, aligning with institutional-grade capital preservation.

2. DeFi Lending – Dynamic Market-Driven Returns

Angle supplements base yield by deploying reserves into lending protocols like Aave, Morpho, or liquidity pools like Curve. These DeFi sources yield an additional 1–2%, depending on utilization rates, borrowing demand, and token incentives.

3. Borrowing Interest – Internal Yield Engine

Users can borrow USDA and EURA against overcollateralized positions via Angle’s Borrowing Module. The interest paid on these loans (estimated at 1–2%) contributes to protocol revenue and is redistributed to stUSD/stEUR holders. This layer mirrors traditional bank lending but is entirely automated and transparent.

How It Works: stUSD & stEUR Mechanism

Users convert USDA or EURA into stUSD/stEUR, yield-bearing ERC-20 tokens.

These tokens grow in redeemable value over time, reflecting passive yield accumulation.No protocol fees, no lock-ups, and instant redemptions make them accessible to all user classes—from casual savers to institutional treasuries.

Risk-Adjusted Design

Overcollateralization and real-time reserve monitoring act as buffers against volatility and depegging.

Angle employs anti-depeg mechanisms, informed by past stablecoin failures (e.g., USDC in 2023).

Monthly attestations and governance-controlled reserve strategies ensure continued transparency.

Yield Sources

The total estimated yield of ~4-8% reflects the rebalancing strategy, with variability noted due to market cycles, fitting the summary’s range. The current 0% APY suggests a need for monitoring, possibly indicating a pause in yield distribution pending governance or market recovery.

Twitter: https://x.com/arndxt_xo/status/1909579297578467393