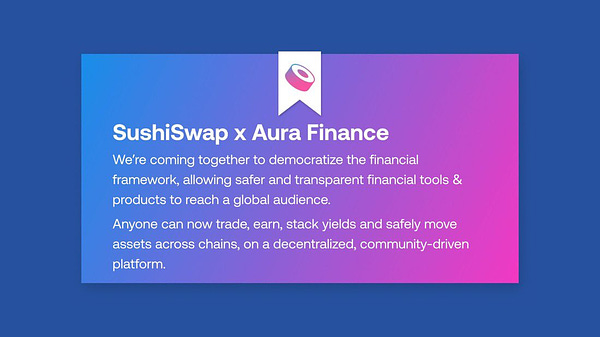

This week have been really exciting with much drama happening. Keep me super busy. Memecoins saw some pump while these other things were going on:

Macro events are becoming uncertain. GCR cautioned us. Jobless claims were higher than estimates. Market seem to be retracing right now

SEC bans on Cefi staking presents opportunities for the LSD protocols, on chain staking and RWA.

Trident DAO launched, $WILD revamped tokenomics caught Hayes’ eye, LSD, Hook’s NFT DN strat, $OATH flywheel

(3,3) marketing flashmob, Umami fell or not? Huobi lists $FUD, Uniswap forum drama

If you have not read the previous week’s highlight, here it is:

Hope you enjoy the content, and feel free to connect with me on Twitter here.

Segmenting the megathread of content into 5 parts:

Macro news

Trending narratives

Defi happenings

Educational resources and tools

Spicy crypto drama

1. Macro News

Macro had alot of uncertainty for the week. Mixed reactions.

Jay Powell says, “Effects of tightening not yet felt.” Alex says, “No shit, Jay.

@GCRClassic reminds all to extract as much yield from favorable conditions

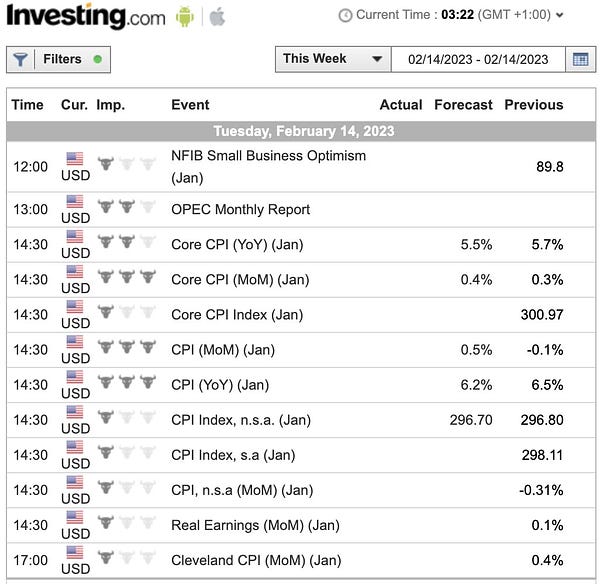

First CPI expectations came out and the MoM forecasts (YoY doesn't matter) on both headline and core are not pretty. Good dollar, not good risk assets @_FabianHD

@JJcycles shares Forecast CPI (YoY) at 6.5%. on the 14th Feb.

@_FabianHD shares Earnings season from Factset. It's a quick statistical roundup of the reported earnings as of last Friday.

@MacroAlf shares his view on the macro end game

@CryptoHayes believes that JP wont stop the bull market and he started to buy $BTC.

$300b of liquidity coming into the market over next month shared by @CC2Ventures

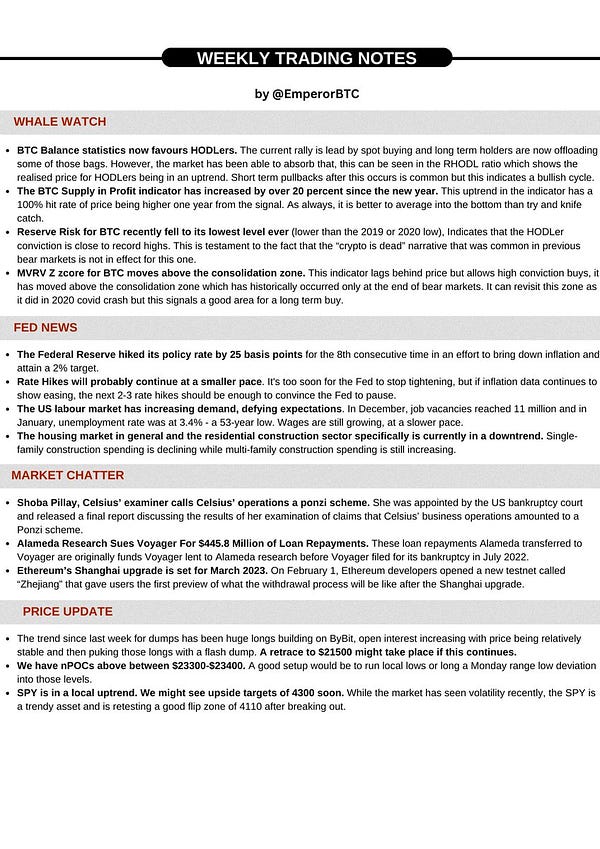

@EmperorBTC shares hie Crypto Trading Notes for the week

@StockMKTNewz shares U.S INITIAL JOBLESS CLAIMS ACTUAL: 196K VS 183K PREVIOUS; EST 190K

@_FabianHD shares that yield curve continues to steepen. Dollar decisively rejected off the 104 level. Major stock indices up with cyclicals leading.

@lookonchain shares that a mysterious fund started pouring money into the crypto market ahead of this year's small #BullMarket.

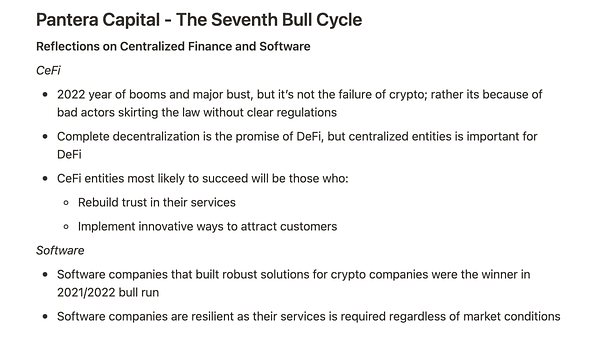

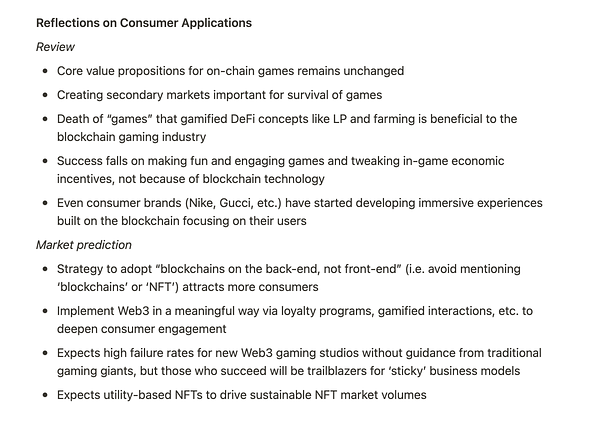

@apes_prologue takeaways for @PanteraCapital's February blockchain letter: "The Seventh Bull Cycle"

2. Trending Narratives

@TheDeFinvestor on Latest developments in DeFi

@lookonchain shares Arthur Hayes holdings

@0xYugiAI on 4 crypto trends of this year

@dymensionXYZ raised $6.7M to bring to life a network of easily deployable modular blockchains!

@rektfencer the new narrative is RWA

@gauntletnetwork shares thier view on the Shanghai update.

@cryptocrash420 shares taht $BTRFLY is the next major LSD coin that you can still be early to

@FungiAlpha’s Best of DeFi's alpha in 3 minutes

@0xkodi on Q1 Narrative cheatsheet

@dennis_qian on MDMA: Monday DeFi Market Alpha

@thedailydegenhq’s Thread: This Week's New Protocols! (Feb 6th, 2023 Edition)

3. Defi Happenings

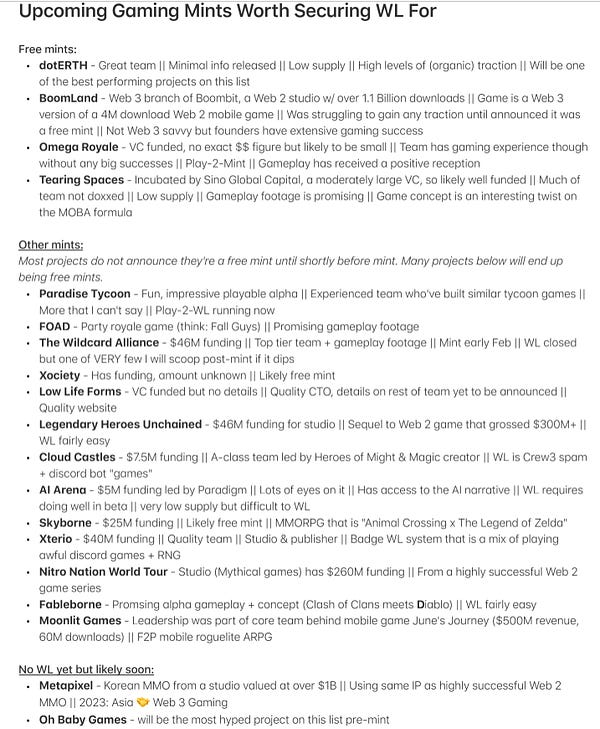

@sparkcsays shares his list of games worth trying for WL.

@TridentDAO PSI has launched its public token sale.

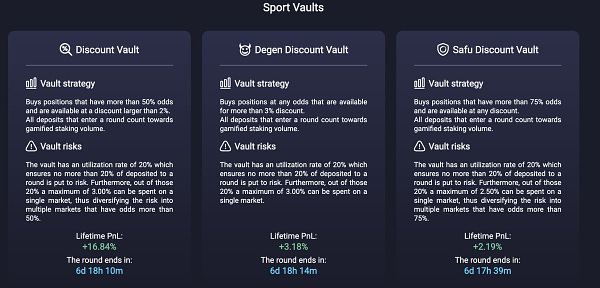

@OvertimeMarkets is a Sports market AMM built on @thalesmarket - $THALES

@nitrocartel launching on the 17th Feb

@huntingforalpha shares how DigitsDAO turns 100K INTO 2.5M

@real_n3o shares the revamped $WILD token utility and economics.

@Crypt0_Andrew on $BNC as the most undervalued LSD project

@MIM_Spell on how to use your $WBTC, $WETH and $USDT to earn north of 100% APY

@ViktorDefi on @SturdyFinance airdrop alpha

@HookProtocol introduces delta neutrality concept for NFT collections

@cryptodetweiler bullish on @ThenaFi_

@0xGeeGee catches interesting projects

@ripe_dao have been doxxed.

@ZacharyDash @FlidoFi launches on 15 Feb and allows you to earn an instant *upfront* yield on your $stETH

@0xsurferboy revisists Telegram's L1 @ton_blockchain

@2lambro on GearboxProtocol hidden gem of defi lending

@APP0D14L thread and comments about Arbitrum Blue Chips

@zhusu on his Open Exchange

@carbondefixyz #ETH strategy generated +24.15% in profits over the last few months.

@OasisSwapDEX is @TridentDAO native swap

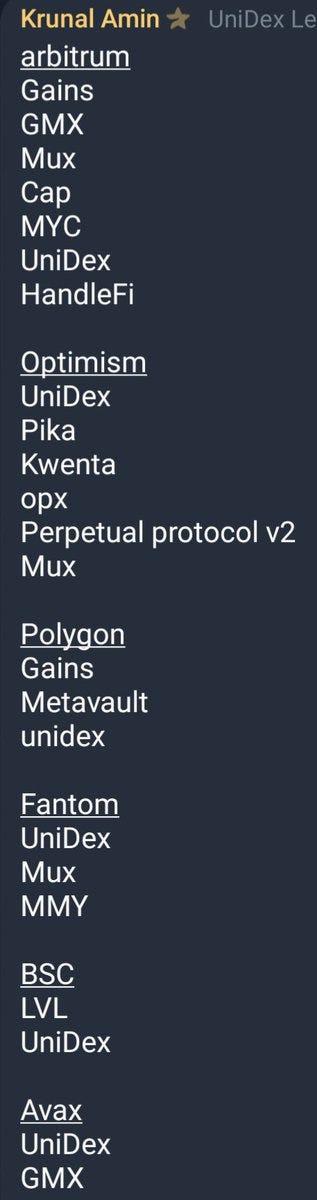

@0xChiRho shares @UniDexFinance aggregating the following perp dexes on launch.

@Only1temmy on Utopia -a project that will minimize the complexities of DeFi by making the process of yield farming as simple as possible.

@0xsurferboy on CaviarAMM (@caviarAMM)

4. Educational resources and tools

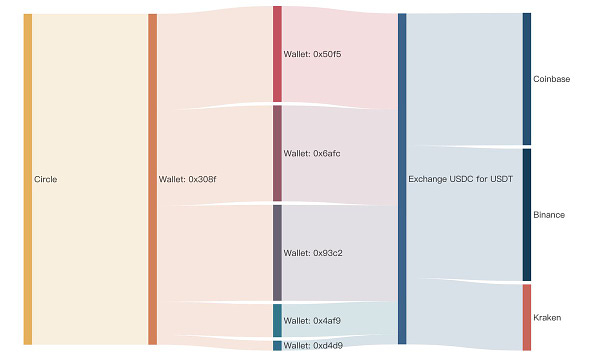

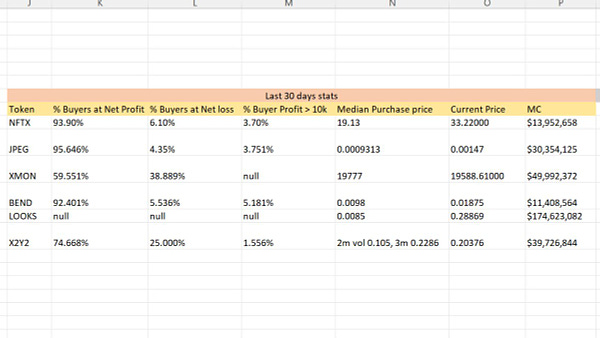

@defi_mochi shares his whale wallets finds

@FuelMap_xyz on his list of Upcoming Projects Ecosystem On @fuellabs_

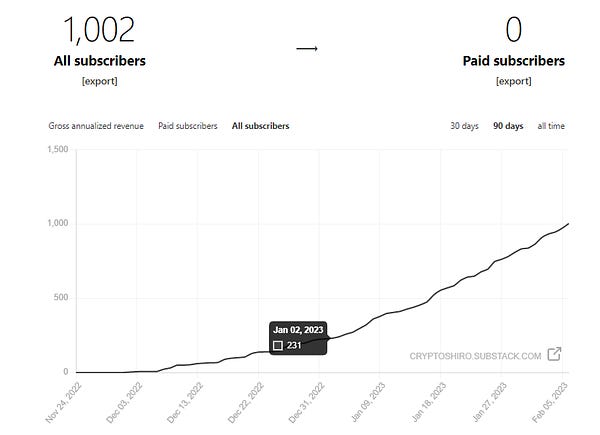

@CryptoShiro_ shares some his own newsletter + Other Newsletters you should subscribe to.

@Slappjakke on what @lyrafinance $LYRA Newport upgrade brings

@BillyBobBaghold on $OATH - The Next Big Flywheel

@WinterSoldierxz shares his 22pg research deck for @gammaswaplabs

@InverseFinance dropped their whitepaper FiRM. The Fixed Rate Money Market Protocol.

@0xdrun made a toold: @Uniswap V3 interactive desmos for visualizing the relationship between real and virtual reserves.

@TheDeFISaint shares @bubblemaps use case how to spot NFT wash trading

@Louround_ secrets to to improve by 300% your research efficiency with Tweetdeck

@OvrCldJonny on bridging 101

5. Spicy Crypto Drama

Super juicy week this time.

The week started with rumours about Arbitrum airdrop as several protocols appears to collude with partnership handshakes throughout at a defined timing. In fact it appears to be just a marketing feat. @veH0rny

Drama happened in Uniswap forums extreme political plays @abdullahbumar

@cameron shares that @Gemini reached an agreement in principle with Genesis Global Capital, LLC (Genesis), @DCGco, and other creditors on a plan that provides a path for Earn users to recover their assets.

Eisenberg waives bail, Munger calls for crypto ban, judge orders SBF to zip it

@justinsuntron shares that @HuobiGlobal has listed @FTX_Official Users' Debt Token (FUD).

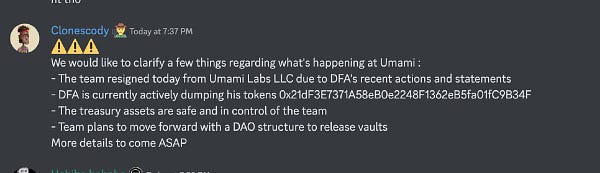

Drama ensues in the case of Umami. @DAdvisoor got timed out on the @UmamiFinance server.

@brian_armstrong shares rumours that the SEC would like to get rid of crypto staking in the U.S. for retail customers.

@0xJezza on Umami to zero

@DAdvisoor shares proposal #1 by @UmamiFinance DAO presented by @crypto_condom : Instatement of core contributors and Tokenomics Solidification

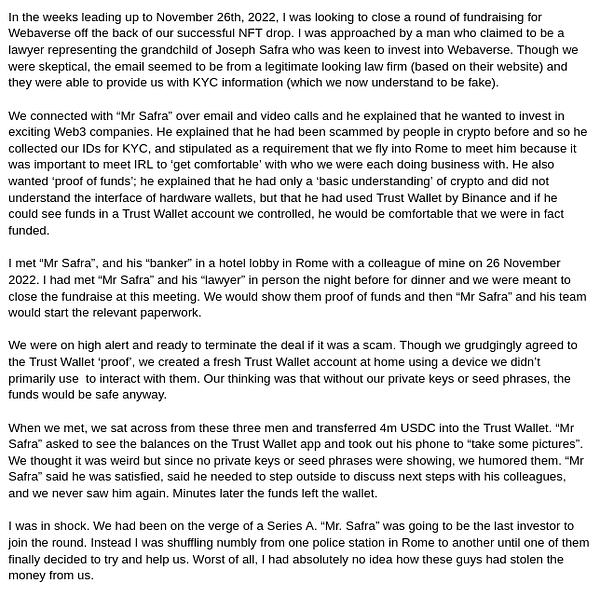

@0xngmi on a crypto scam stole 4m by just taking a photo of a trust wallet screen, with no seed phrases or any private info on sight

@w0000CE0 on $35k per month in marketing budget, 1 (ONE) tweet last month

Appreciate your donation or tipping if you liked this newsletter!