This have been a big week! Big numbers dropped and market displayed continued resilience.

Jobs numbers were far more than estimates, displaying positive sentiments

NFT market going through transformation, betting and casino is trending, $MATIC as a hidden gem lagging behind the pump

20+ early protocols and juicy yield farming opportunities

Crypto tools are being shared by the gigabrains

Are Defi protocols plotting something in a (3,3) coordination way?

Before we dive into the weekly highlights, you might have noticed that the Twitter algo has changed. Here is what you can do to keep up with your engagement by @gregyounger

Hope you enjoy the content, and feel free to connect with me on Twitter here.

Segmenting the megathread of content into 5 parts:

Macro news

Trending narratives

Defi happenings

Educational resources and tools

Spicy crypto drama

1. Macro News

This week contained lots of impactful news that generated alot of market exuberance and we are seeing it as I am writing this.

Let’s walk through what my macro man @_FabianHD has for us throughout the week.

In the beginning of the week, @_FabianHD shares that he does not believe there is a soft landing and recession might be in for the coming months.

Markets typically de-risk ahead of uncertainty and are prone to exhibiting relief once the bandaid gets ripped off

@_FabianHD reviews the current market sentiment and shares his lastet view on macro.

Great share by @_FabianHD

@whospay_intern on BlackRock's 2023 Prediction

Let’s also look at the takes from other analyst

@CoinNotes_io shares the theory of “Echo Bubble” in 2019 and how we can play this out in 2021.

@0xCrypto_doctor on BTC outlook being affected by rates hike

@JasonYanowitz thinks that we are in stage 3 of market structure

@DataaRocks Strategy: Long into Thursday, then flip short

@QCPCapital shares Quick Market Update before FOMC update

Weekly roundup by @TheRRoundup

@tier10k on Powell’s restrictive stance and comments shared that pivot could come in Sept 2023.

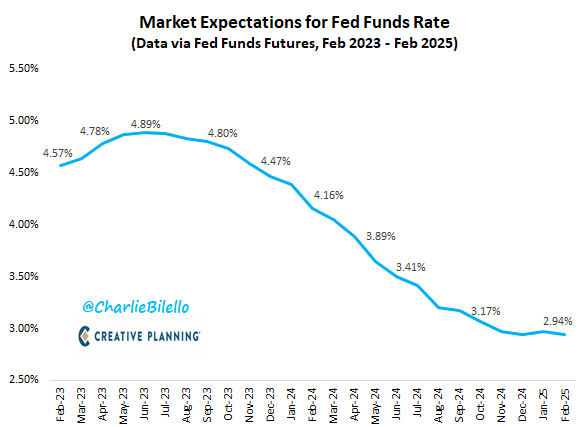

@charliebilello on current market expectation htat Mar 22, 2023: 25 bps hike to 4.75%-5.00%. Rate cuts start in Nov 2023.

@BobEUnlimited expects the pause to be most likely coming.

@AlemzadehC on markets in DENIAL

2. Trending Narratives

@CryptoShiro_ starts the month with alpha!

@TheDeFinvestor on the Appchain Thesis getting traction

@TheDeFinvestor on the latest developments in DeFi

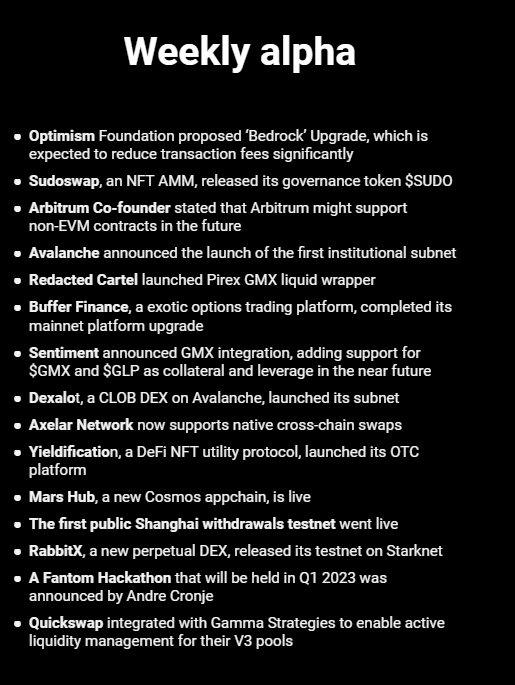

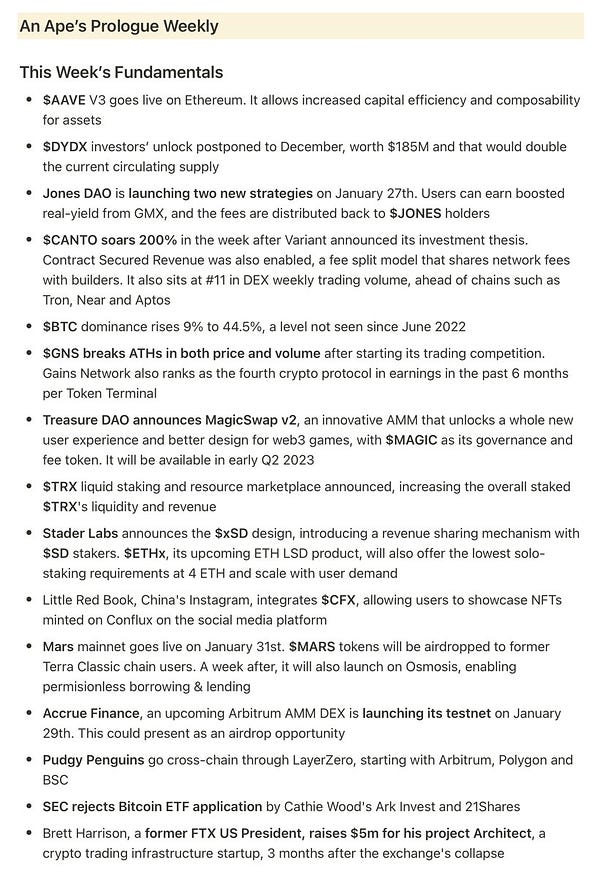

@apes_prologue Weekly alpha

@CaesarJulius0 on Avalanche Monthly Recap - January

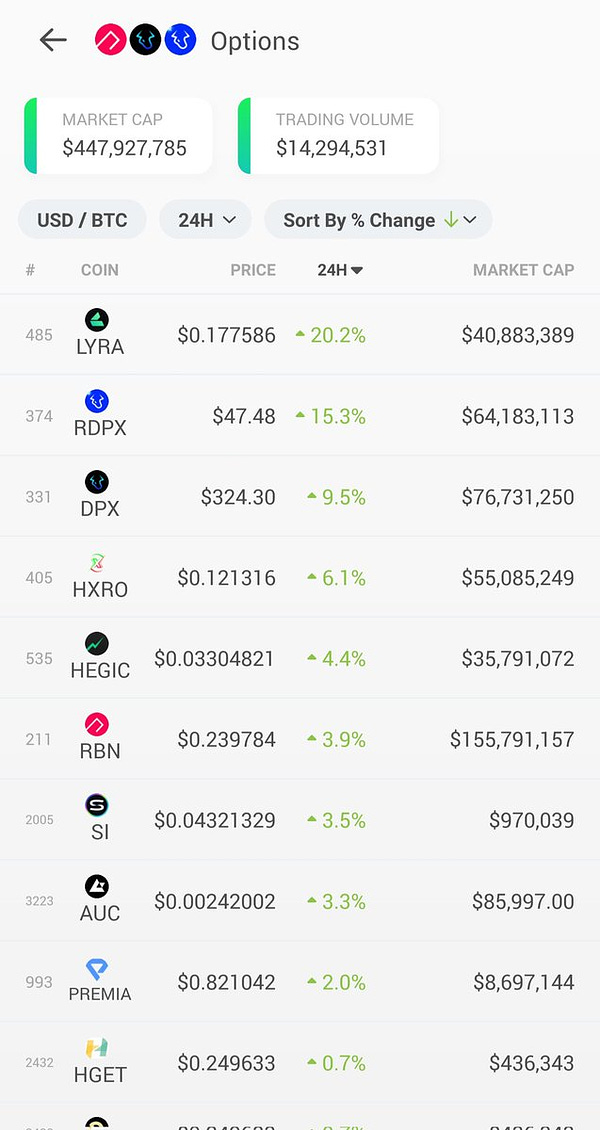

@hansolar21 believes that the next narrative is options

@remusofmars on NFT market looking like the American stock market 100 years ago and the NFT looks like it is going through a transformation

At the same time, @TheDaoMaker is having their own NFTs

@crypthoem share 15 threads to find untold amounts of crypto alpha

@DataaRocks is bullish on $ETH but why?

@SteveGoulden8 finds that $MATIC is lagging behind its L2 counterparts but boasts lots of potential with a strong BD team

@0xvanillacream sharing that #Web3 casino & betting platforms are the next crypto narratives.

3. Defi Happenings

@toffee248 shares new protocols that he finds intersting

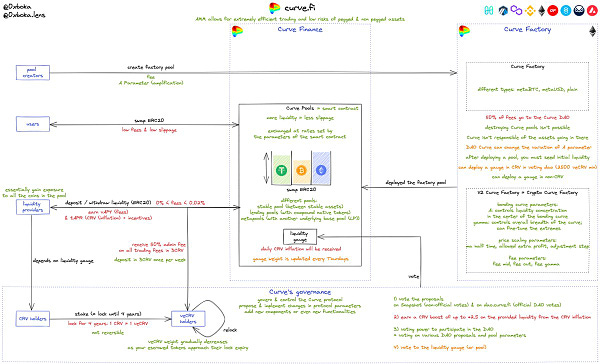

@WinterSoldierxz disagree with some points in @DeFi_Cheetah analysis of @CurveFinance V2 vs @Uniswap V3.

@ajnafi is a lending protocol with no governance, permissions or external price feeds (oracles). You can use it to borrow and lend against your entire portfolio, including NFTs.

@DoveProtocol unifies unified liquidity, accessible anywhere.

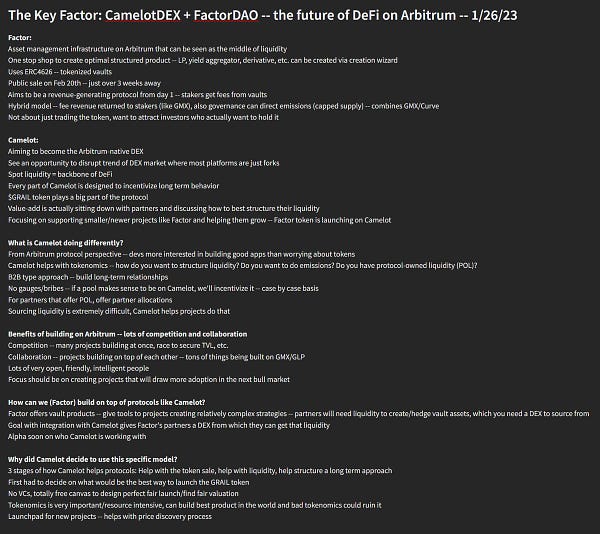

@VALh0lla did a @FactorDAO AMA with @CrossChainAlex @SirBootsOfIron @CamelotDEX!

@0xthade bullish on DigitsDAO selling $GRAIL

@InfPools is a decentralized exchange that offers unlimited leverage on any asset, with no liquidations, no counterparty risk & no oracles.

@CryptoTrendzN on @redactedcartel that started as an @OlympusDAO fork and now after the redesign, they have developed the most interesting Defi applications.

@JiraiyaReal shares that $Y2K (@y2kfinance) is underrated

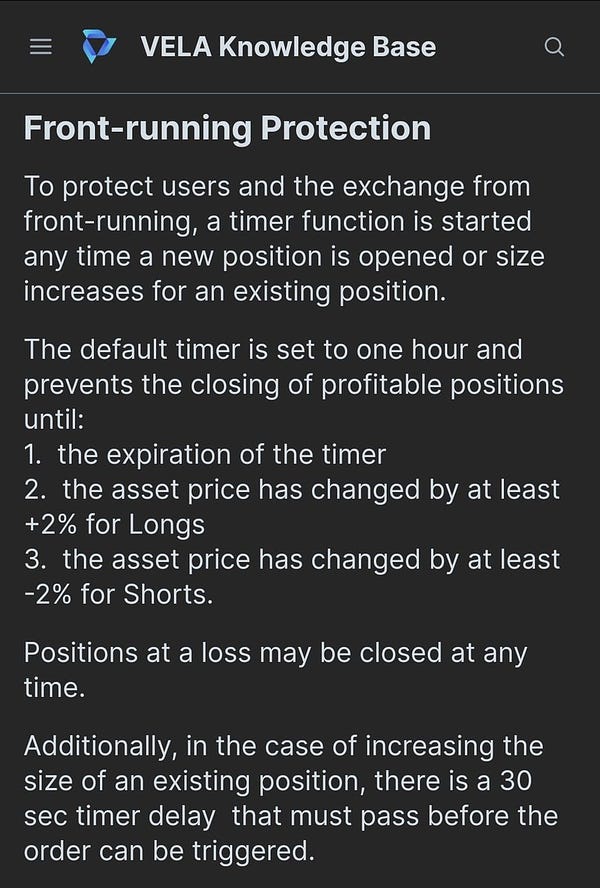

@derpaderpederp on $DXP / $VELA docs not allowing people to take profits immediately

Vest Exchange: A DEX backed by Jane Street, QCP Capital, and Big Brain Holdings.

@Nicknick2109 talks about @LexerMarkets - An upcoming decentralised perpetual trading platform on @arbitrum

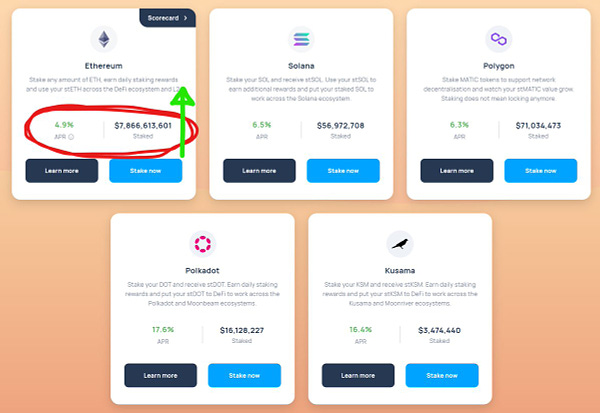

@0xboka breaks down the workings of the @CurveFinance protocol

@tokenterminal breaks down the cost to run a DAO: @MakerDAO, @LidoFinance, and @SushiSwap.

@CryptosWith on the best #StableCoin Yields Greater than 20% — the @optimismFND Edition (February 2023)

Byte Masons introducing Ethos Reserve

@smol_thots on $UMAMI @UmamiFinance destroyed after pausing treasury payout to stakers

@Slappjakke excitement for 10 unlaunched projects

@RyskyGeronimo shares about @PremiaFinance V3 moves from a Decentralized Options Vault (DOV) to a platform for building and executing custom options strategies.

@shufflecom is an all-new crypto casino built from the ground up to take on the best in the industry.

@arbisled WL mint will start soon.

@PerpyFinance public sale will take place at @CamelotDEX.

@Chinchillah_ on Delta neutral strategies

@ArkhamIntel shares a list of some of the most interesting wallets on Canto to document their yield farming strategies.

4. Educational resources and tools

@arndxt_xo shares the Yield Tokenisation concept used by @Timeless_Fi,

@alpha_pls on his 13 free crypto tools

@rektdiomedes on 10 More Gigabrains Very Much Worth Following

@w1nt3r_eth list of power tools (and their hidden features) that security researchers use to investigate hacks.

@coindar_ tool on Cryptocurrency Calendar. Top Events: Jan 30 - Feb 5, 2023

@0xCrypto_doctor shares a tool called Bitdiver

@officer_cia shares his tool list

https://github.com/OffcierCia/On-Chain-Investigations-Tools-List#i---tools-list

5. Spicy Crypto Drama

Solana Unveils App Store For Saga Phone by @DefiantNews

Wormhole Wins Vote to Be Uniswap’s Designated Bridge to BNB Chain. by @CoinDesk

@smol_thots caught that defi protocols could be plotting something.

Appreciate your donation or tipping if you liked this newsletter!

Nice write up :)