Crazy week. So much pumping is going on, and today is a happy market, so happy bags. Drama all over, with projects being hacked, lawsuits. Fret not, we have our threadoors sharing their tools on how you can make those money back and safeguard yourself from bad actors.

CPI print his week seems to have given market some hope. We have pumped abit with BTC heading towards 25k.

Narratives resurface again (reviving old narratives) with hypes in casino coins, LSD, Index funds,

Defi took a ride up. $GRAIL, $THE gone parabolic, Nitro Cartel launch raised $4mil in 5mins and many other promising protocols upcoming.

CT chads shares their research, whale hunting, anti-scam tool

Stablecoins vs SEC, Umami drama goes on, Do Kwon charged, USP hacked

More importantly, for you to take note: @NFT_GOD finds that twitter algo changes again. For optimum impressions, heres what he recommends.

If you have not read the previous week’s highlight, here it is:

Hope you enjoy the content, and feel free to connect with me on Twitter here.

Segmenting the megathread of content into 5 parts:

Macro news

Trending narratives

Defi happenings

Educational resources and tools

Spicy crypto drama

1. Macro News

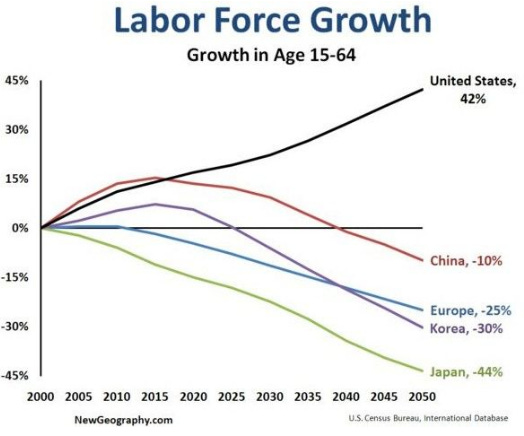

Discussion thread about Labour force growth US vs other markets.

@MacroAlf shares that US labor growth is widening from the other markets. The comments then goes on to share about various figures about population and employment

@p_tzelepis then mentions that it comes down to immigration policies. The US can handle a larger population economically and given the available space should they wish. The others not so much.

@GCRClassic noted an interesting dislocation between retail and options traders (for you gigabrains to decode, because I don’t fully comprehend despite re-reading many times.

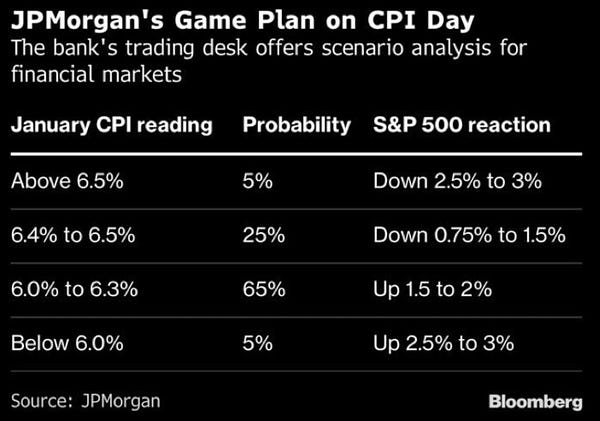

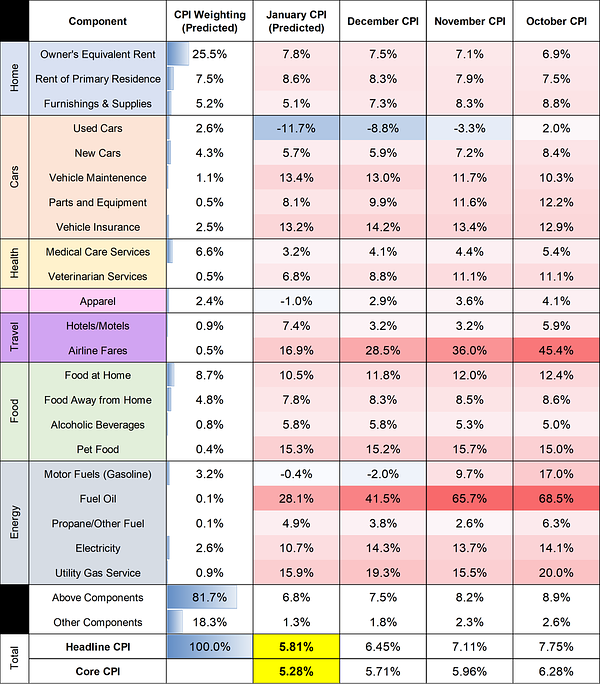

@MortensenBach on JPMorgan game plan for CPI release, predictng 5.9% YoY

@ThHappyHawaiian quite accurately predicts 5.8% for CPI

@_FabianHD shares that CPI was already priced into bond markets last week.

🌐 14 Feb - Weekly update - https://t.me/jukovcalls

The past week was relatively harmless on the market and not super exciting imo. We saw some blood as the pricing-in of a Fed-pivot was first partially revised again. Reasons for this were the significantly stronger labor market and various Fed speakers who seem to have suddenly realized that inflation is still high (or could possibly even rise again) - I talked about this for weeks now, while the market started wanking to the thought of a new bullrun.

My personal highlight was Kashkari, from the Fed Minneapolis who had a rant about the prizes of his frozen lasagna which now costs 21$ instead of 16$ and that this is a sign to him that inflation remains way too high.... Yeah I know. This reads like a joke but in fact has happened: Kashkari, who is considered one of the dovishest members of the fed, wants a weaker labor market because his lasagna is too expensive for his taste. But yeah, that's the world we live in and the market we are moving in - very much fed & fed-talk driven price action across the board. We just have to deal with it.

Now let's take a look what this week waits for us:

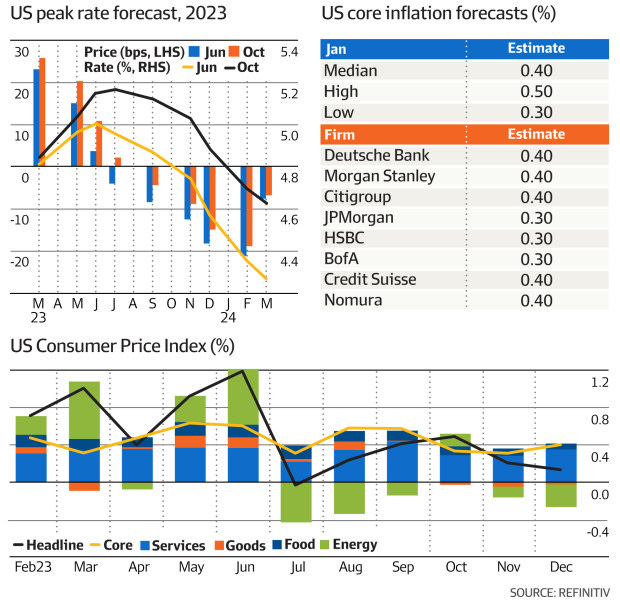

▫️ CPI USA - On tuesday we will get the new inflation numbers from the US. The Headline inflation is expected to be risen to 0.4% MoM while the YoY CPI is expected to be at 5.5% (the smallest annual gain since 2021).

Each CPI reading is important as we know, as it's the fundamental base for any directional decision of the Feds money policy. This weeks CPI however, is especially important as it will be 100% seen as a crossroads between disinflation theory (the market was pricing in for the whole january) and the sticky-inflation/waves thesis (I was talking about this during the last months as I was seeing the potential risk of it based on services-inflation - this potential risk a few weeks ago became a real risk now

So this weeks CPI will either confirm or falsify each thesis, painting a clearer picture for directional price action).

The market is purely driven by the hope of a Fed-Pivot (and options), so this event will be by far the most important for the week and can be summarized as: higher than expected = blood; lower than (or same as) expected value = pump.

▫️ More earnings, more balloons, more aliens? - Well a few more corporate results this week from Palantir, Coca Cola, AirBnB, Shopify and Deere (possibly forgot one or two not-so-interesting ones). Most earnings are over (70%+ of the S&P500 have already reported) and over 70% of the reports have beaten the expectations from analysts. As good as this sounds, its ironically pretty bad. If you look at historic data, normally 80%+ of earning reports beat expecations, so we are below average performance actually. That's it from the Earnings-Front.

Well, we also have some Balloons flying over the US, Canada, Taiwan and China apparently. And a general who cannot out-rule aliens, when asked in a presser. But I don't really think any of this theatre has any immediate influence on the market, so I dont really care and you shouldn't either probably.

Have a good week frens and don't get rekt leverage trading this bullshit bingo week.

@CoinNotes_io shares his TA views

2. Trending Narratives

@whospay_intern shares 5 crypto insights by Ark Invest

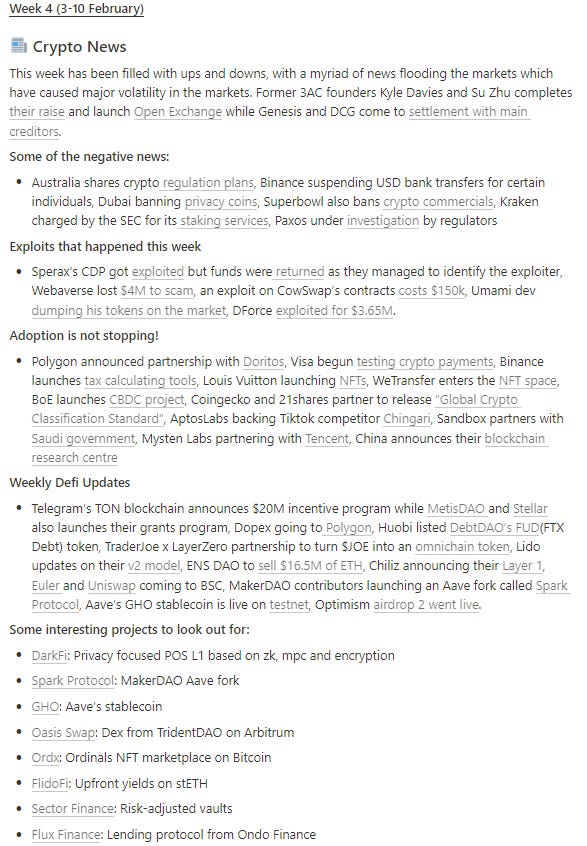

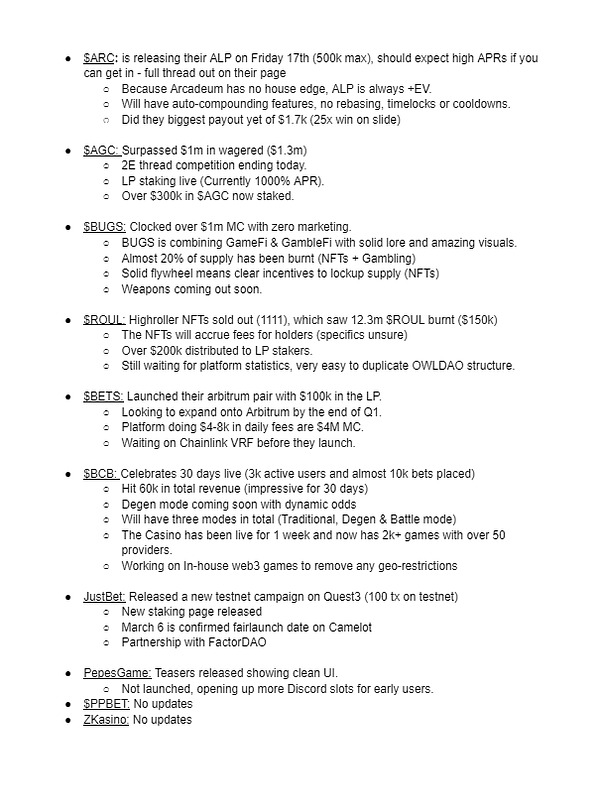

@FungiAlpha The Fungi Alpha Weekly DeFi Update

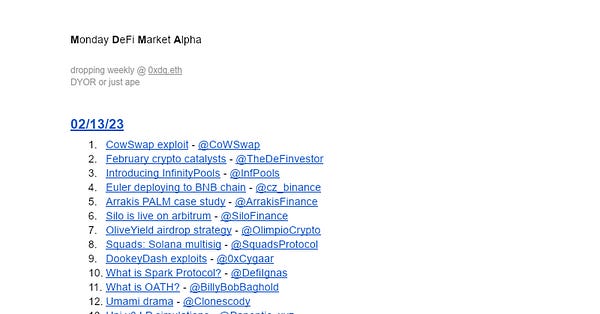

@dennis_qian MDMA: Monday DeFi Market Alpha

@insomniac_ac on #CrossChain 6 - 12 February 2023

@CJCJCJCJ_ on Weekly Updates (3rd-10th Feb 2023)

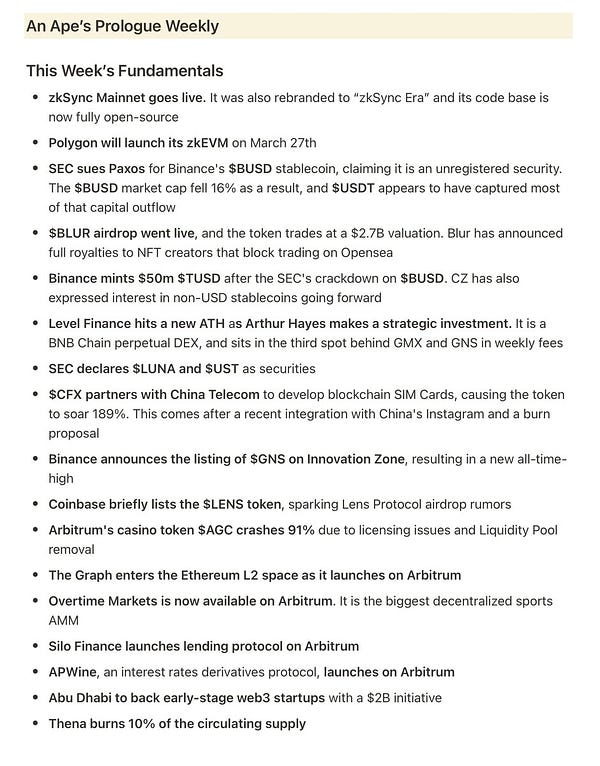

@apes_prologue Weekly Alpha

@OnChainWizard shares February Narratives & Catalysts to Watch

@satoshibulletin on Top 10 alpha, narratives

@a16z on the biggest ideas in tech in 2023

@nftgoio shares 182 pages of insights, 50+ graphs, expert analysis from 11 industry leaders, 10 chapters, and 8 future predictions.

@karl_0x on not fading LSDs but will be fuelled by SEC crackdown

@DefiIgnas feels bullish for decentralised stablecoins

@TheDeFinvestor also on decentralised alternatives

@dirty_digs on @y2kfinance probably the solution to safeguard your decentralised stablecoin pegs

@DegenSpartan feels like its 2017 all over again (casino narrative)

@LouisCooper_ loving GambleFi projects.

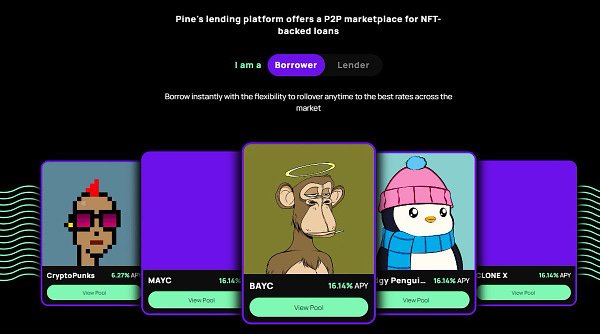

@DeFiMinty on NFTfi narrative with $BLUR airdrop

3. Defi Happenings

shares what bunni is building and together with Timeless finance, it creates a flywheel ecosystem

@TheDeFISaint on @ClipFinance being the gamechanger

@Slappjakke on the flywheel bribe economy @fBombOpera $fBOMB

@keoneHD on @InfPools design and where the leverage comes from

@InfPools is a decentralized exchange that offers unlimited leverage on any asset, with no liquidations, no counterparty risk & no oracles

@0xTindorr on @InfPools, you can trade with UNLIMITED leverage on any asset, with no liquidation, no oracle.

@0xFitz on MetaReset - @metareset harnessing the power of #AI, #Web3 and #NFT

@0xsurferboy on Hegic options

@OlympusDAO never dies introducing OHM Lending Markets to borrow OHM

@CryptoGirlNova on FactorDAO

@Nicknick2109 on @UniDexFinance - DeFi platform that aims to be the Nasdaq of DeFi

@WinterSoldierxz on @0xConcentrator & @0xC_Lever flywheel

@martin100x on weekly $GRAIL tokenomics analysis of @CamelotDEX

@defi_naly on $OATH

@ZacharyDash on $FLASH and @FlidoFi

@Rancune_eth bags for the medium-term

@PhilippInvest on @FinanceLiquid and their $LIQD wants to pop.

@crypto_linn on @ede_finance 's Trade-To-Earn

@0xShual on @ParallelTCG's $prime and $pdt

@DefiDegenL2 on $PINE $fxPINE Open Architecture @PineProtocol

@MrCustomSuit shares alpha on Ticker/name change

@doomsdart speculates its $bnx $gft $STG $KPL

@Nicknick2109 on @Overlord_xyz - why will it explode in year 2023

@HyacinthAudits is making audits accessible & transparent for everyone

@radius_xyz Introducing 360° The first MEV-resistant Sequencing DEX protecting trades against front-running and sandwich attacks. Live on @0xPolygonZK

4. Educational resources and tools

@sovereignsignal on this amazing compilation of Staking, Yield Farming & LP tools

@Slappjakke shares his crypto tools

@DeFiMinty digs through the codes on how you can protect yourself against bad actors

@danblocmates on alpha in newsletters

@ardizor on alpha in newsletters

@rektfencer finds influencers' wallets without any coding

@2lambro on this research tools

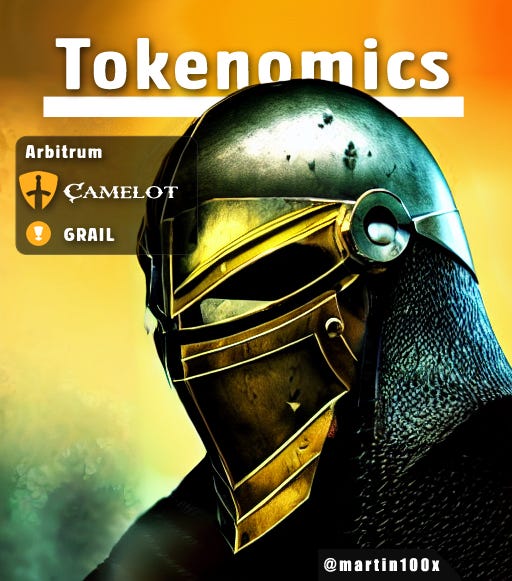

@tokenterminal has **weekly** financials and key KPIs of @Uniswap

@0xCrypto_doctor shares how to can trade with the herd (technical thread)

@defi_mochi on @Blockpour allows you to check for largest trades to see huge purchases from whales. just 8hrs ago there was a huge txn for $100k worth of

@CryptoSnooper_ on @InsightsFlow, a blockchain data tool that lets you query ANYTHING in the blockchain's history.

@0xsurferboy shares his secret to maximise research efficiency

@parallaxfin Alpha Testing Registration and 200 USDC rewards for applicants

5. Spicy Crypto Drama

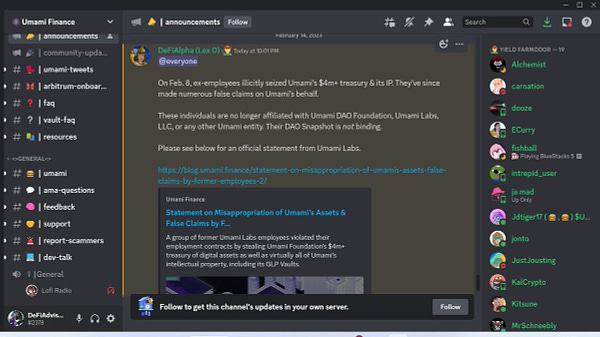

@jimmybluebags on @UmamiFinance drama

@DAdvisoor on @UmamiFinance, where plot thickens

@DLNewsInfo notes on the happnenings between SEC vs Crypto

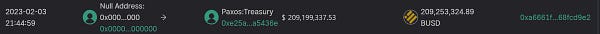

@ScopeProtocol on news that #Paxos will stop issuing new $BUSD

@WuBlockchain cautions against staking products

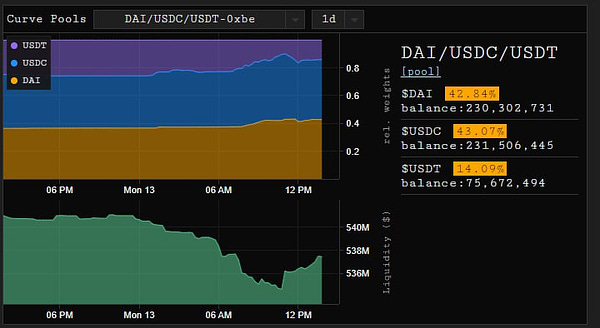

As a result of the ban, @AviFelman shares that USDT getting drained from 3CRV right now.

@CoinDesk on FTX’s Sam Bankman-Fried’s $250 million bail bond drama

@WSJ on Celsius reaching a deal to sell its retail platform to NovaWulf

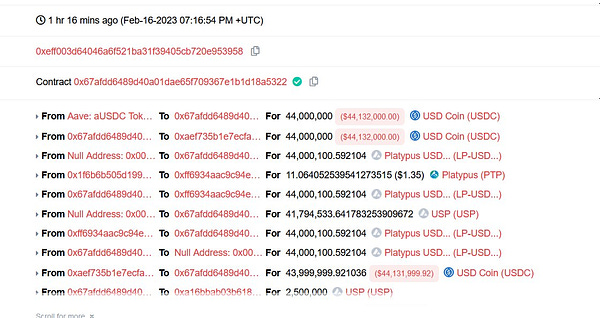

@spreekaway on @Platypusdefi new stablecoin has been exploited for approximately 8m

@zachxbt sleuthing around and found hacker @retlqw. But unlikely law enforcements could do anything because hacker is from Bulgaria as crypto laws dont work there. And if it does hacker can bribe his way around.

@SECGov charged Terraform Labs PTE Ltd and Do Hyeong Kwon (like finally)

Appreciate your donation or tipping if you liked this newsletter!