The most hyped launch is coming to Base

Over 3700 users and $18M volume in guarded mainnet👀

Here is how you can make 100%+ APY in real yields on your ETH 🧵👇

Before I get into the juice, here the outline of the content:

Metrics

About

Fees/Rewards

Tokenomics

Roadmap

Conclusion

If you enjoyed the read, please RESTACK, LIKE and COMMENT on what you like to hear next. It will be super helpful

🔷 Metrics 🔷

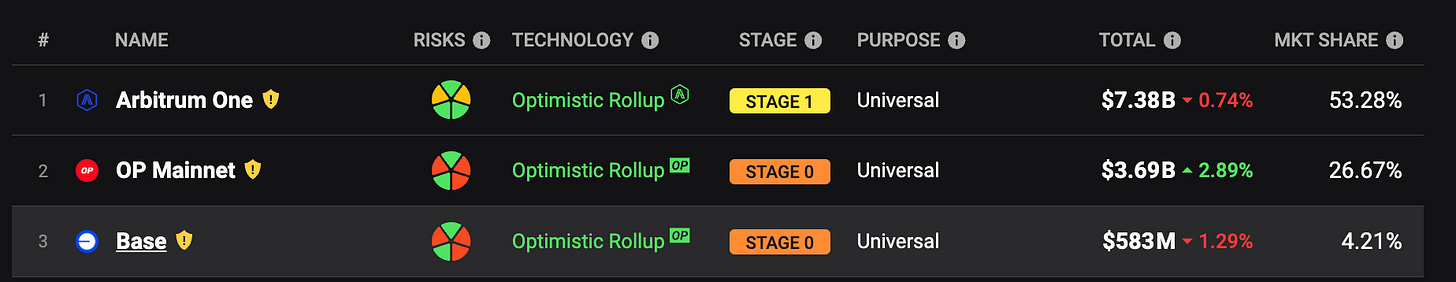

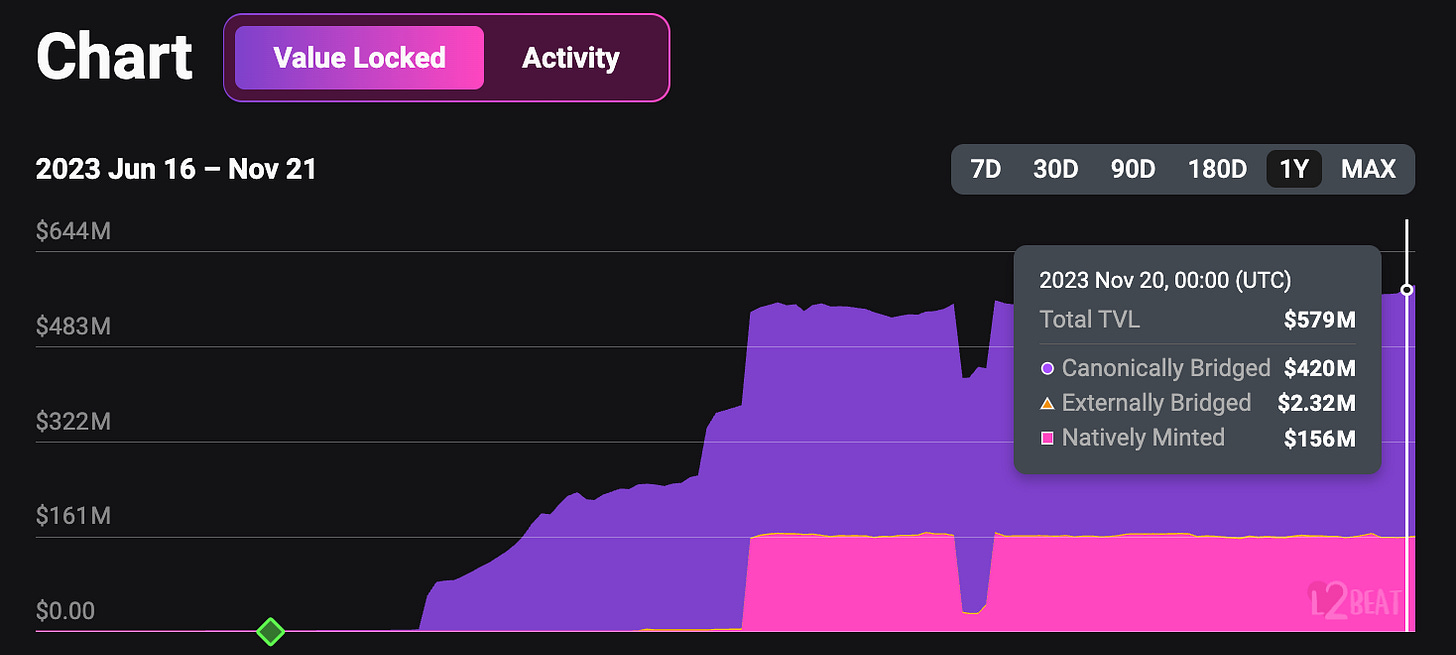

Base is the top 3 layer 2 and has seen a steady growth in TVL with $580M already.

And in my thesis for the bull run, I shared why I think that the run will be one that is fuelled by growth in the perpetuals market.

And @TradeVoodoo topped the charts for its 1-month increase in trading volume.

They are doing high trading volumes with low TVL.

To note, they do not even have a token yet and are already doing crazy numbers:

More than $18M in trading volume

Nearly $10k in total fees earned

More than 3700 users

@TradeVoodoo platform has been recording top 24-hour trading volumes even though they are still operating on only guarded mainnet.

This means only the project's capital is flowing through the platform.

And they are the top perp dex based on 7D volume on base.

🔷 About VooDoo 🔷

@TradeVoodoo is the first fair launch Perp DEX on Base that have the following features:

Unique set of incentives to create flywheel effect

up to 100x leverage on both long and short positions

0% slippage on all trades

I particularly like how they differentiate themselves from existing Perp DEXes:

Community-focused tokenomics, no private sale, no VCs

100%+ APY of real yield for ETH-USD

Already audited by @peckshield

🔷 Fees/Rewards 🔷

Voodoo follows a very similar token structure as $GMX with their 2 tokens: $VMX, $VLP.

They are also incentivising heavily the VMX-ETH LP holders.

$esVMX stakers

$VMX can be locked to get $esVMX, which can be staked to earn 3 kinds of rewards.

Multiplier Points (MP): An additional way to boost $ETH earnings

Staking $esVMX allows holder to receive additional $VMX

A share of the platform fees - paid in $ETH

$VLP stakers

Stake $VLP after depositing ETH or USDC and earn 2 types of rewards

esVMX tokens

A share of the platform fees distributed in ETH

$VMX-ETH LP stakers

VooDoo is clearly heavily incentivizing thier LP and this will create a very deep liquidity for their token. LP stakers will earn from 4 rewards:

Multiplier Points

esVMX

Platform fees

@aerodromefi trading fees

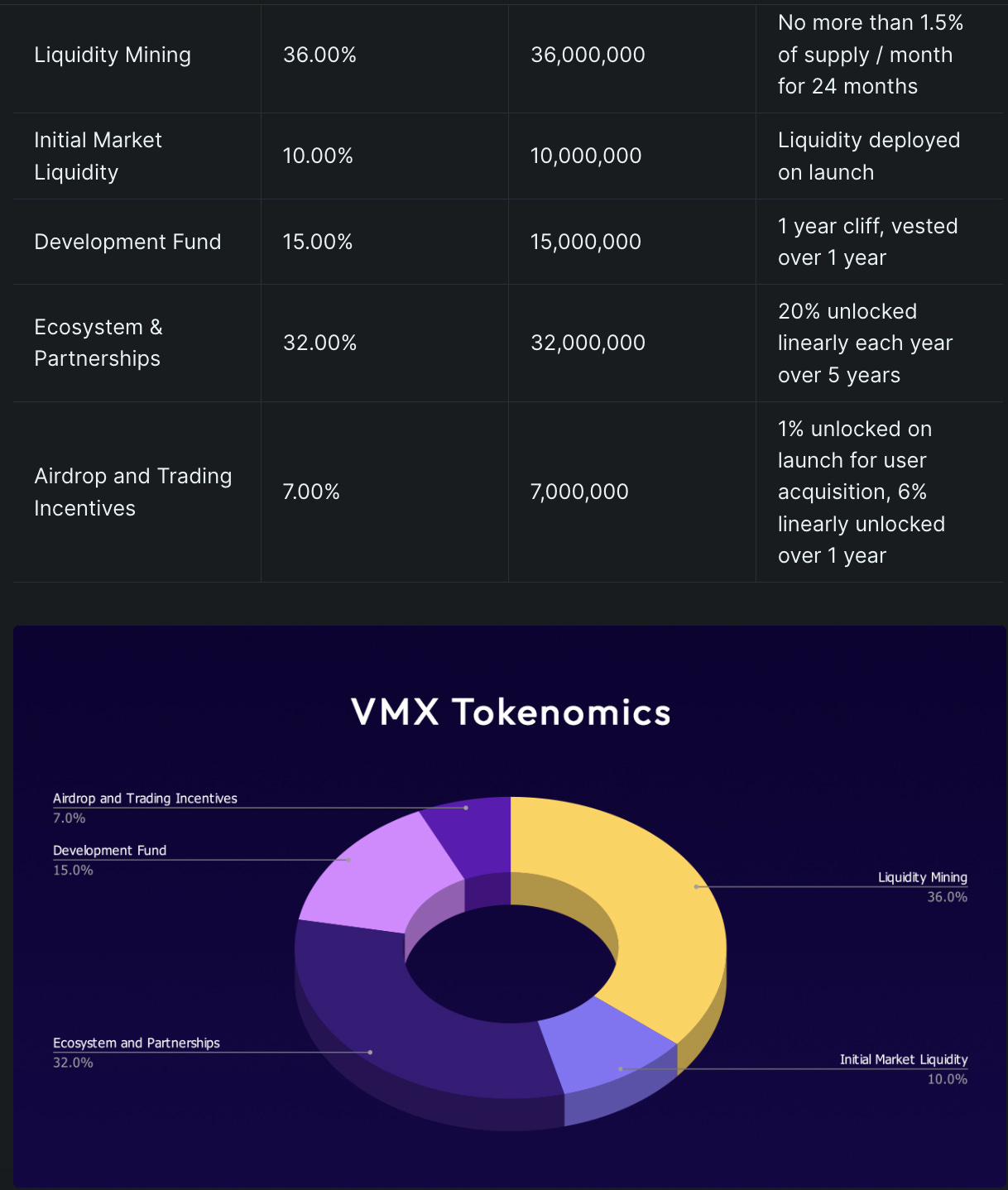

🔷 Tokenomics 🔷

They have a similar 2 token model as $GMX and here I noticed that they have a good flywheel tokenomics of buyback and burn + keeping up the buy pressure for the token

Here are some value accural features:

Buy Pressure - 5% of platform revenue used to purchase VMX from open market and add as liquidity for VMX-ETH trading pair. Removes supply while increasing liquidity.

Deflation - 5% of revenue goes to buy & burn VMX. Decreases circulating supply and offsets inflationary pressure.

Dynamic Emissions - VMX emissions adjusted periodically to target APY range. Helps maintain token value amid fluctuating crypto market conditions.

Platform Rewards - 10% of fees fund protocol operations and development. 90% of fees distributed as VMX emissions to users. Incentivizes providing value to platform.

Their tokenomics is also fairlaunch based with with 85% of the tokens for the community.

🔷 Roadmap 🔷

Just right after the IDO, they will be opening 100% APYs on ETH-USDC based on real yield alone.

This is a huge statement to put out to promise that kind of yield, and this gets even larger with more $VMX incentives.

They will also be heavily incentivizing the VMX-ETH trading pair, aiming to create lots of market depth for the token.

🔷 Conclusion 🔷

Voodoo aims to capture the growth in perpetuals on Base Layer 2 through strong incentives and tokenomics. The early traction is promising.

If the team delivers on the roadmap and sustainability of yields, adoption could be significant.

Twitter: https://twitter.com/arndxt_xo/status/1727282084707008701